Market Briefing For Tuesday, July 14

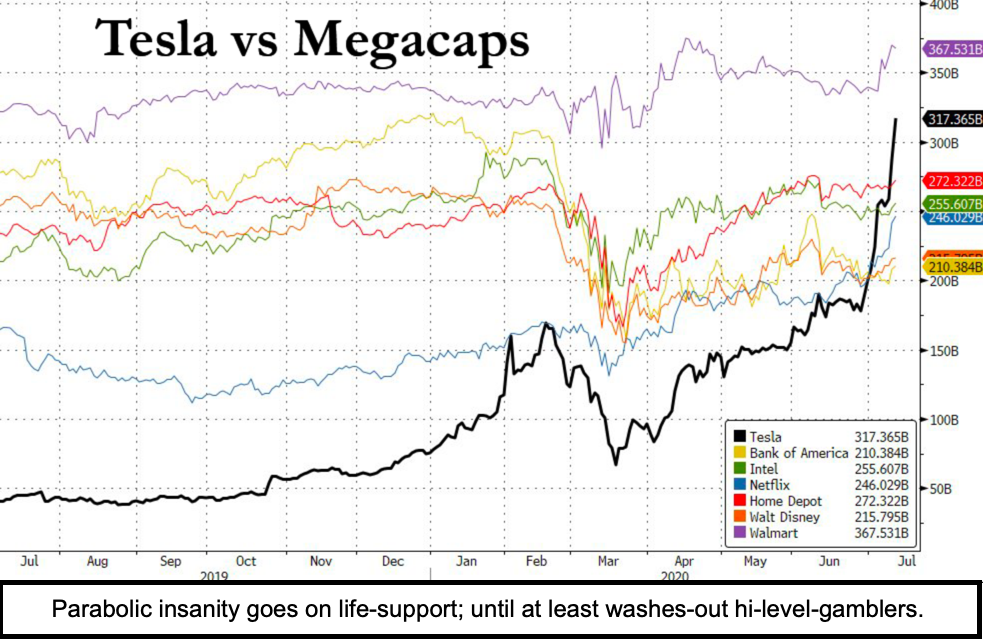

A huge speculative crescendo - raged for weeks in 'super-cap' FANG types, then it became pretty much loony tunes in what some refer to as the 'Robinhood' crowds of traders, who hopefully made money, but often chase rather than fade breakouts, even if it's perfectly common for stocks to pullback after breakouts, then advance.

It was this persistence of upward pressure (and often a stable or firm VIX concurrent with a strong S&P in the past couple weeks) that pointed to excess optimism both in the super-caps and lots of smaller stocks, even if perceived benefiting during COVID-19.

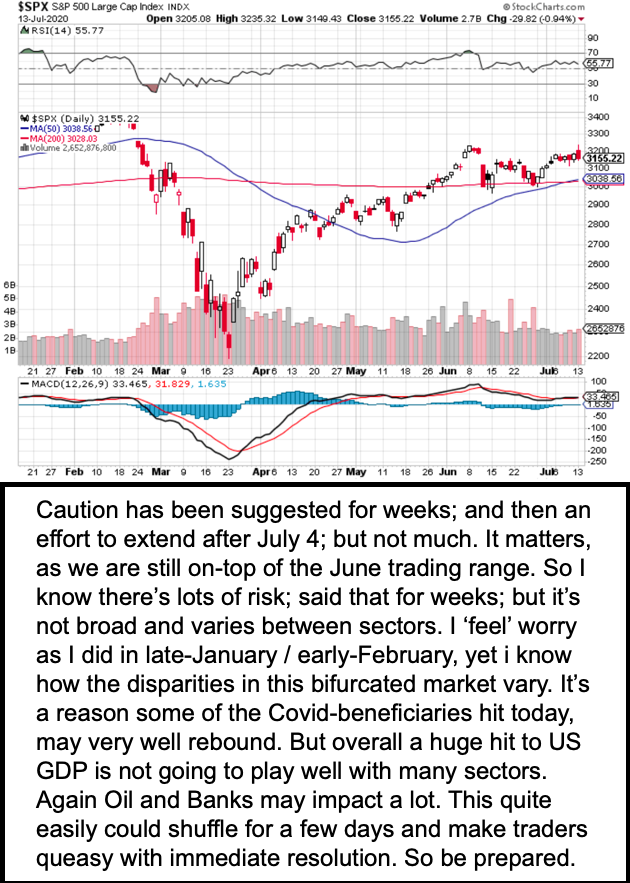

What we saw Monday was likely a preview of coming attractions, part of a process.

At the same time, Monday's initial upside was not going to be sustainable, as out-of-the-box Monday rallies, especially in already extended -technically stretched- markets, most often retreat to allow intraweek traders an entry opportunity, sometimes coming during ensuing weakness, a Tuesday turnaround.

Besides suspecting the market Monday would reverse somewhat due to worries just ahead of the 'big bank' earnings (even dividend jitters on those which aren't resolved by temporary cash flow from Federal stimulus fees they get paid to administrate). Another problem is, especially for the expensive overpriced big-caps, and some that have benefited since the (partially-failed) economic re-openings, is a fairly draconian (almost all-encompassing) shutdown of California's economy announced in the noon hour. It's impact was gradually felt, and apparently grasped as the session evolved.

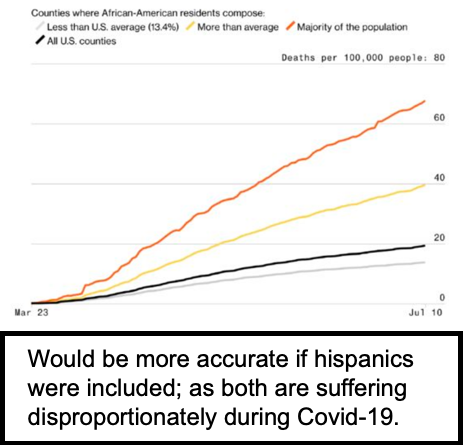

Daily action - 'shock & awe' from California was telegraphed as other states hinted, from elsewhere, including here in Florida where we have the highest of all daily cases, while (this may have pulled the trigger) California (Los Angeles I believe) had the 'highest positivity' rate of COVID-19 tests, which is horribly ominous.

So that's not an undertone, that's the sober reality that apparently Washington (some aspects) ignores, whether they are sane or not when it comes to separating disease from politics and realizing that only another round of 'tough-love' would actually be a better-perceived response by citizens, who generally are not like the crowds of 1918 who (after re-opening) demanded the right not to wear a mask, held open gatherings and so on, and woe-and-behold, found more cases and deaths in the 2nd wave.

Monday also had a little noticed comment from the Dallas Fed President, noting that the Fed won't have these expansive policies in-effect forever (my take on that), but not being withdrawn anytime soon given the COVID-19 fiasco is still expanding.

Indeed we hope that these shutdowns will see less COVID-19 cases, muddle through the series of bank and other earnings, but perhaps not a flat-out renewed crash. If this week's rebounds are mediocre, it may be partially earnings-related, so difficult for a trader to presume too much regarding the range of outcomes that are possible here.

So more medical progress, not so much whether schools mostly don't reopen, that's all out there to contemplate. And you can add U.S.- Chinese relations. Meanwhile a series of badgering media politics are really frustrating Americans, as we all have to deal with the risks, and perhaps the real concern, if it's even even worse than reports as contrasted to the idea that somehow it's less severe (aside a few places). There are other issues; including as I touched on last week again, China and fleet moves.

One rumor is that the U.S., with its little-noticed 3 Carrier Battle Group Fleet sailing in the South China Sea right now, is about to issue a 'formal' protest statement to China, about illegal claims of sovereignty over 'disputed' islands, which clearly aren't Chinese territory. There is risk in sniping at the Dragon's tail (it can get whippy and threaten fire), and some may say it's political, but the reality is China had previously pushed the issue with an also-ongoing naval sorties (once around Taiwan's East), with its carrier), and perhaps thought the U.S. off-its-game (that was in PLA press) due to the number of COVID-19 cases in the US Navy.

Conclusion: There a breakaway S&P gap from February that bulls were looking at, I thought it unlikely we would get through that, although it was a visible target. Now it should be noted a one-day reversal has not 'yet' broken the S&P (SPY) ascending wedge pattern, though that looms, possibly after we get rebound washout and rebound tries that may be tainted by hourly or daily responses to upcoming bank earnings.

This is a COVID-19, Fed, and globally news-sensitive equity market, and remains not for the faint-of-heart, with a continuing view that chasing the big-caps was nuts, with a slew of institutional traders who missed our bottom in March chasing big caps, likely as those were the only issues with sufficient daily volume to absorb their action.

Hints (then partially retracted by investment banker Goldman Sachs) that Softbank was (SFTBY)contemplating sale of it's ARMS Holdings is further evidence that's concerning as far as companies building liquidity. But also, though expensive, if I had to ponder who might be a buyer (over 30 Billion), let's watch Apple (AAPL), as they do have a license to design and make their own version of ARMS processors, and they are moving to 'Apple Silicon' as they call it, based on their proprietary variations.

Tuesday could be rocky to start or just jam the short-sellers again. Highly doubtful a crash occurs spot-on here, without a process of alternating moves, again sensitive to bank earnings as discussed. On the other hand, there is no change in the correction expectations overall, or belief that there's minuscule upside potential against lots of downside risk, especially for stocks that would suffer economically as this drags on.

Thank you for this article- how do you see the rest of the week playing out and not just today?