Market Briefing For Monday, April 14

The Administration finally figured out, finally, that iPhones are not assembled largely robotically; FoxConn probably enlightened them, plus Trump needs to appease 'Tim Apple' (as he usually calls CEO Cook) whose investment very notably for U.S. manufacturing relates to data-center servers, not iPhones as I have noted even Lutnick repeatedly misspoke as intended to be made here.

Clearly the US has no workforce sufficient (400,000 for example) or interested in assembling phones. Anyway here's the details: U.S. Customs and Border Protection (CBP) issued an updated guidance late Friday night on product exclusions from President Trump's reciprocal tariffs, imposed under Executive Order 14257 and its amendments (EO 14259). The exclusions cover a wide range of electronic devices, including smartphones, laptops, and related components. (And I will add, equipment 'for making' semiconductors.)

So, the whole tariff schtick is disintegrating before our eyes. Two days ago it was "pausing" tariffs and exempting farm workers from deportation; now it's "exempting" large categories of electronics. Next week it will be other favors for particular segments (pharmaceuticals?) and we'll see. But it is a 'blink' to curry favor with Beijing; and that may be a good thing.

The United States cannot leave such heave-and-ho economic politics at this high level, not for the market's sake, but for average people's confidence that as you know slid lower. Anyway this should help Apple and maybe BestBuy at least temporarily bounce come Monday. Apple is nearly biggest-cap so there is that; and of course combine Apple and Nvidia rallying and we can push the 200-DMA for S&P, and then we'll see. It's a big deal if While House shifts toward achieving their goals without unnecessary chaotic dislocations.

Alternating whipsaws throughout the week just past, clearly do not resolve matters, and actually increase erratic as well as emotional market behavior. It is primarily based on the idea that in a 'stagflationary' trade war environment, CEO guidance is largely impossible, but S&P multiple contraction is likely too.

However, everyone knows this; including the Administration; and Beijing that has reason to curb the hubris, put egos aside if possible, and work something out. 'If' a deal with China emerges, the extreme jitters will briefly 'pass over'.

And that's where things stand. Many fretting the downside; but notice markets aren't extremely jostled 'as if' Armageddon nuclear market winter was coming. There's no assurance how ramifications unfold; but consider you're dealing of course with Trump; and Xi knows how to handle it. Perhaps they compromise.

However, facing an increase in 'yields' while the Dollar eases is not optimal of course. I have believed that we were already in quasi-recession; so we'll see if the currency and bond 'juggling acts' get enough attention and even reverse if the Treasury Secretary (and Trump) manage to cajole satisfactory deals.

The erosion of confidence is a given; there was somewhat of a 'buyer's strike' of U.S. investments (aside Friday's 'save the chart pattern' S&P rebound); but the context may actually evolve favorably beyond big-caps, in the wake of the 'shock & awe' (and earlier poorly handled) series of moves, which damaged the United States standing, but isn't irretrievable. That's the challenge now.

In that regard, I emphasize Scott Bessent is now in-charge of sorting this out or possibly achieving the President's goals without the bludgeoning start that had laudable goals, but with somewhat moronic insults and tone with leaders of other countries, with constituents who also insist they command respect. I'd mentioned that days ago; and subsequently China used the world respect and I know President Trump 'gets it now', since he mentioned Xi and 'respect'.

So, a face-saving China agreement, negotiated behind the scenes rather than on camera, would catapult S&P to far higher levels, with much angina passing over, as I mentioned, even though certainly some enduring 'trust' is damaged.

I add, you never know for sure what China will do: today's Foreign Ministry spokeswoman had the courage or gall to show Mao speaking against Dwight Eisenhower in 1953. Mao was an evil communist and murderer of millions of his own people. So now the CCP glorifies a terrorist dictator who forced China to heed him, even as he brutalized and bamboozled the Chinese people.

The obviously political message 'now' from Xi, about not being intimidated; is troubling given the current police state shows that respect to Mao ... and might be more than showing resilience to Trump: aka imperialist designs on Taiwan.

The numbers are not bad, plus clearly investors and traders are sensitive to a POTUS who is working with the architect of Soros' move against Britain in a prior life, and they are afraid of shorting this market with any confidence, as bears should have anxiety relating to out-of-the-blue rescues or deals.

The remarks from the Boston Fed President was useful too. Not that she's a voting member; but just stating that the Fed is 'ready to act if needed', says all traders need to keep them shy of pressing downside too heavily for now. In fact, even the mega-caps we warned of, were overpriced last year before the ill-fated Trump Honeymoon rally, and got hammered so much one should not be in negative or short position; because that's likely downside greed for now.

Below is a summary of prior spending and DOGE claims achieved thus far:

Market X-ray: I got a kick from a reporter noting at noon that the market was meandering and rallied on the words 'Breaking News' appearing on screen, before any news was reported. Hah... that's the sensitivity of this neurosis of investing environment. It's mostly a Bond market 'kerfuffle' that's worrisome.

The Fed has liquidity programs out there; and they haven't pulled triggers; so if they do it would be via swap lines, repo's and so on, not rate cuts; which for sure they resist in inflationary times. Powell wants to be a Volcker, not Burns. If Asian countries (sometimes indirectly via Europe) stop buying Treasuries, of course everything changes. However there's a broad awareness of that risk.

Again as they say in medicine: the acute phase is behind; this 'may' be going into a chronic state, out of the ER and into the ICU; when further treatment or recovery, pending. However the patient is not back to the normal population, as too much is pending, but with realization Government is moderating while sometimes talking tough concurrently. 'Art of The Deal' edited by ... Bessent.

(Oh.. I'm in 'physical recovery mode' after this week, and thoroughly described the current status.. range-bound and still trying to reassert strength.. fearful of tariff revisions (to wit deal with China despite both sides intransigence). Being bearish here is perilous risk; as so many stocks (even big-caps) could stand a further rebound, regardless of how it sorts-out over time. April rally still the call by me, so no need to expound via video beyond what's already reviewed.)

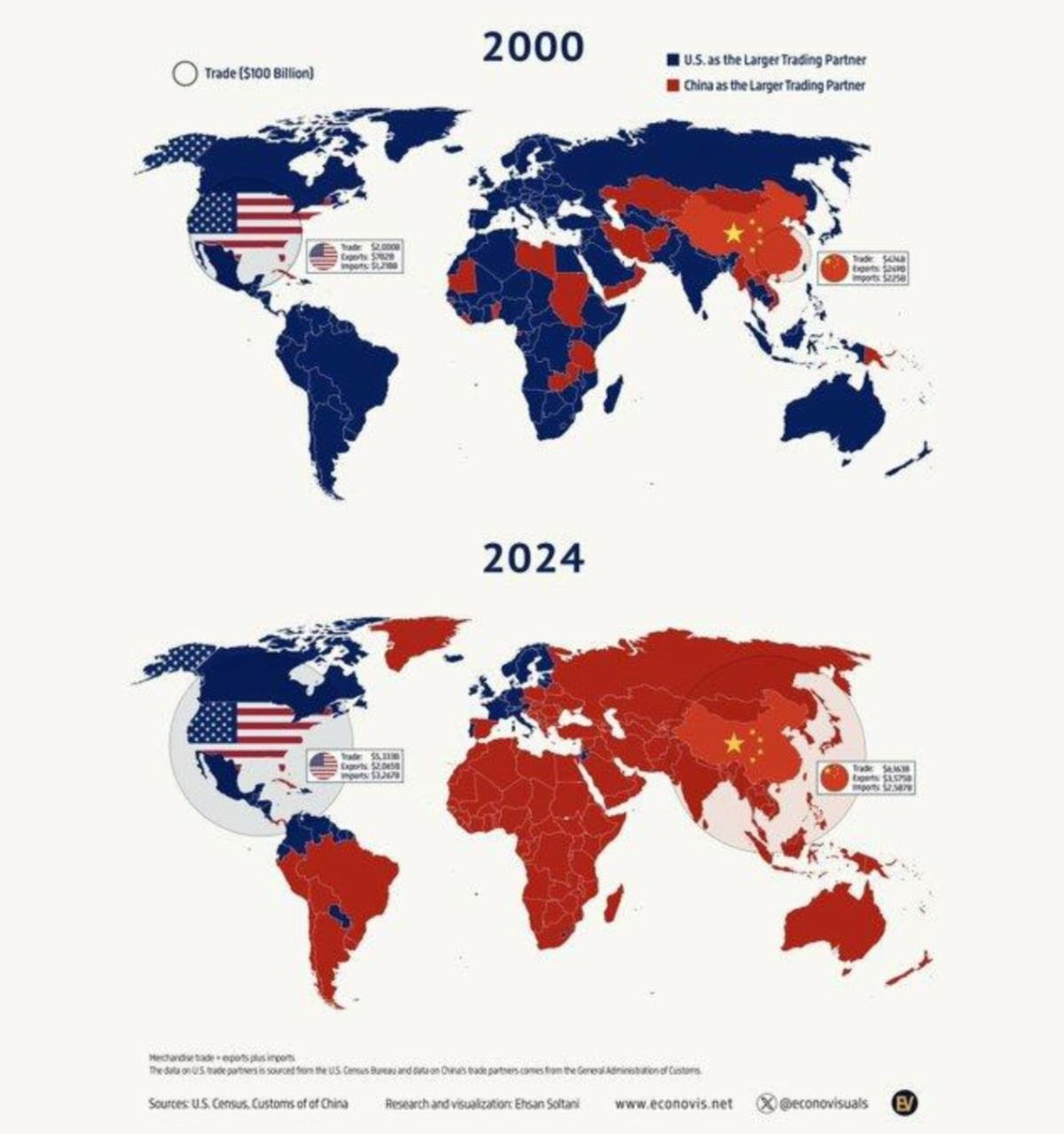

For a moment, let's consider the goals, whether one agrees or not with Trump or the re-industrialization plan. It's about rebuilding our heartland in America. It's about shrinking trade deficits among many countries, not just China; and I am thinking by exporting LNG and some Oil, as noted the other day. Also the National Debt becomes more manageable; ahead of enormous refundings for which the U.S. Treasury likely is more worried about 'demand' than sales.

Notice that politicians are 'not' chastising the Treasury Secretary. Bessent is a point man on this; and the critics might recall (as much as they hate George Soros); that Bessent is the guy who worked for Soros and was very pivotal in the Billion Dollar win by betting against the British Pound back in 1992. So, notice that Donald Trump brought him aboard for clever moves; not failure. It's tougher because of the tone initiating these efforts, but give this a bit of rope.

Earlier Friday, JP Morgan said this:

"De-leveraging and deterioration of macro sentiment has morphed into a situation in which liquidity dynamics are now meaningfully impaired in liquid markets."

Well yes; but lots of big stocks got cut-down pretty heavily; and hence 'if' we are not heading into a 1930's kind of morass, and the Administration is well aware of what happened then (Trump has said he could accept recession, but not at all be willing to risk Depression), the strategy is to attempt to restore the U.S. economy; not just fraud and abuse reduction; but regulation reduction as well as unfair-trade reduction; and that latter is what got big market attention.

I said for weeks that the mercurial draconian approach was based on 'logical thinking and goals', at the same time it was a big policy error by virtue of the methodology and disrespect for foreign leaders too (by doing it openly rather than behind-the-scenes); something I've been alluding to for a couple weeks.

So, there is no question as to whether JP Morgan's 'statement of condition' is correct, it is. So I think the negotiating 'handover' to Treasury Sec'y. Bessent, rather urgently, reflects a recognition of this situation; and suspect he now has been charged with responsibility to both make deals, or mitigate this situation.

I hear chatter of an 'Apple' exemption as relates to the tariffs, and this 'is' up to Washington, not Beijing. However at this point, even if so, that might not alleviate the multiple valuation questions. I also believe China cares about this; given the number of jobs involved..well of course if President Xi doesn't behave like Mao and consider them disposable. Perhaps old iPhones are disposable, but not half a million assembly workers (although globalism outsourcing cost a few million US autoworker jobs..).

Bottom line: 'if' markets show they're not functioning well, the Fed tends to step in. Otherwise not likely, and not based on the S&P price level. It's not a time for complacency, that's for sure; but I see the trade 'talks' as finally in a back-channel mode to a greater degree, with possible favorable surprises.

Geopolitically I don't like that Iran (after threatening to attack our base with the RAF at Diego Garcia) comes to Saturday's Oman discussion, after parading their nuclear capabilities to an audience yesterday. That's not how the Persian demagogues impress our Government, and suggests they don't get Trump.

Of course all the variables persist going into next week below the 200-DMA. It's been a wild week of frenetic moves; as the whiplash theatrics made for a dramatic reminder that Trump’s trade policy can change swiftly. That leaves unpredictability, but you know his goals; a fairer trade regimen and less debt.

The Friday rally was not to suggest 'big-caps' are particularly valuable, or in fact don't justify multiple contractions. It does means political shock gravitated to leadership adjustments, and it means the economic impact isn't sorted yet.

But, it was necessary to lift the S&P big market-cap components to hold this range together, with further moves held in abeyance pending trade talks as well as perhaps the Dollar's behavior. That would indicate structural changes, or not, as this may fundamentally go forward. Technicals will reflect the facts later; they already went through the anticipation and realization of chaos.

More By This Author:

Market Briefing For Monday, April 7

Market Briefing For Monday, March 24

Market Briefing For Monday, March 17