Macro Briefing - Friday, Nov. 14

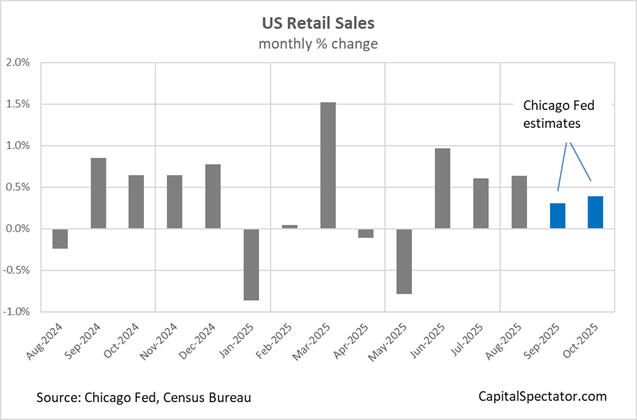

US retail spending rose for a fifth straight month in October, according to data published by the Chicago Federal Reserve. The estimate tracks retail and food services sales excluding motor vehicles & parts and indicates a 0.4% rise last month, up slightly from a 0.3% gain in September, according to the regional Fed bank. The last two monthly advances also mark softer gains vs. the official retail sales data from the Census Bureau, which published numbers through August before the government shutdown paused updates.

Suspected Chinese operators used Anthropic’s AI coding tool to target about 30 global organizations — and had success in several cases, the company said Thursday. Anthropic said the campaign relied on Claude’s agentic capabilities, or the model’s ability to take autonomous action across multiple steps with minimal human direction.

The delayed jobs data for last month will be partially released, said National Economic Council Director Kevin Hassett. The report, originally scheduled for release on Nov. 7, will include data on the number of jobs added in the month, but will not include the unemployment rate because a household survey was not conducted during the government shutdown. Hassett’s comments dispelled concerns the report would not be released, after White House press secretary Karoline Leavitt said Wednesday that economic data for October would “likely never” be published and could be “permanently impaired.”

China’s factory output and retail sales grew at their weakest pace in over a year in October. The news adds pressure on policymakers to revamp the $19 trillion export-driven economy as a trade war with the US and weak domestic demand heighten risks to growth.

The US on Thursday said it will remove tariffs on some foods and other imports from Argentina, Ecuador, Guatemala and El Salvador under framework agreements that will give U.S. firms greater access to those markets. The agreements are expected to help lower prices for coffee, bananas and other foodstuffs, a senior Trump administration official told reporters, adding the administration expected U.S. retailers to pass on the positive effects to American consumers.

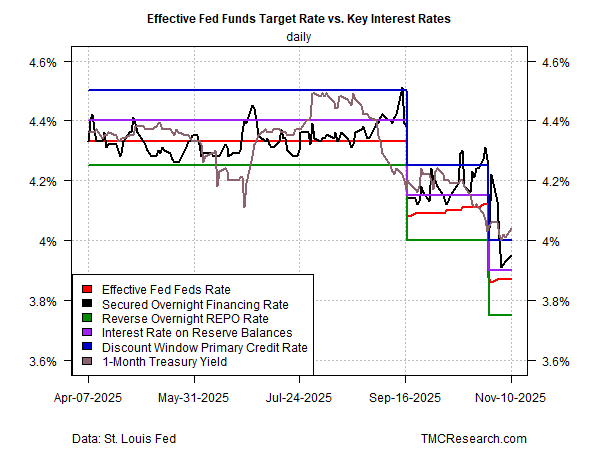

Markets have turned mixed on the rate-cut outlook as the Fed struggles to parse inflation and payrolls data, according to analysis by TMC Research, a unit of The Milwaukee Company, a wealth manager. The market may be starting to price in, if not a rate hike, a rate pause, based on the recent increase in the 1-month Treasury yield, which is now defining the highest rate for the channel.

More By This Author:

Macro Briefing - Thursday, Nov. 13

Weak Jobs Data Favors Another Rate Cut In December… Maybe

Macro Briefing - Wednesday, Nov. 12