Macro Briefing - Wednesday, Nov. 12

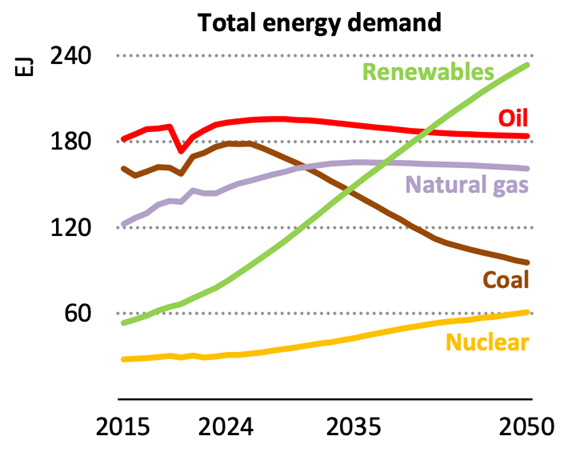

Global oil and gas demand could rise through 2050, according to a new forecast by the International Energy Agency. The revised outlook contrasts with IEA’s previous estimate of a speedy transition to cleaner fuels. The report notes: “Total global energy demand continues to increase, rising by 2% in 2024 to more than 650 exajoules (EJ). Fossil fuels accounted for nearly four-fifths of total energy demand – a share that has decreased only marginally since 2000.”

The House is set to vote on legislation to end government shutdown. The bill is expected to clear the House today and President Trump said he will sign it into law.

Reopening the government will avert a recession that may have come to pass in the event of a prolonged shutdown lasting weeks or months longer, according to economic analysts. “If the government opens up and people get back to work, this will prevent what might otherwise have been a pretty serious downturn in the economy,” Gerald Epstein, a professor of economics at the University of Massachusetts, told ABC News. “Come January, we could be in this same mess again.”

A US aircraft carrier moved into the Caribbean on Tuesday, raising fears that a military strike on Venezuela is near. The ship’s prescence in the region “will bolster US capacity to detect, monitor, and disrupt illicit actors and activities that compromise the safety and prosperity of the United States homeland and our security in the Western Hemisphere,” Pentagon spokesman Sean Parnell said.

Warren Buffett said that he will be “going quiet” after he steps down at the end of this year. He is being replaced by Greg Abel next year. Abel, 63, is the vice chairman of non-insurance operations of Berkshire and was designated as Buffett’s successor in 2021. He said that “Berkshire has less chance of a devastating disaster than any business I know.”

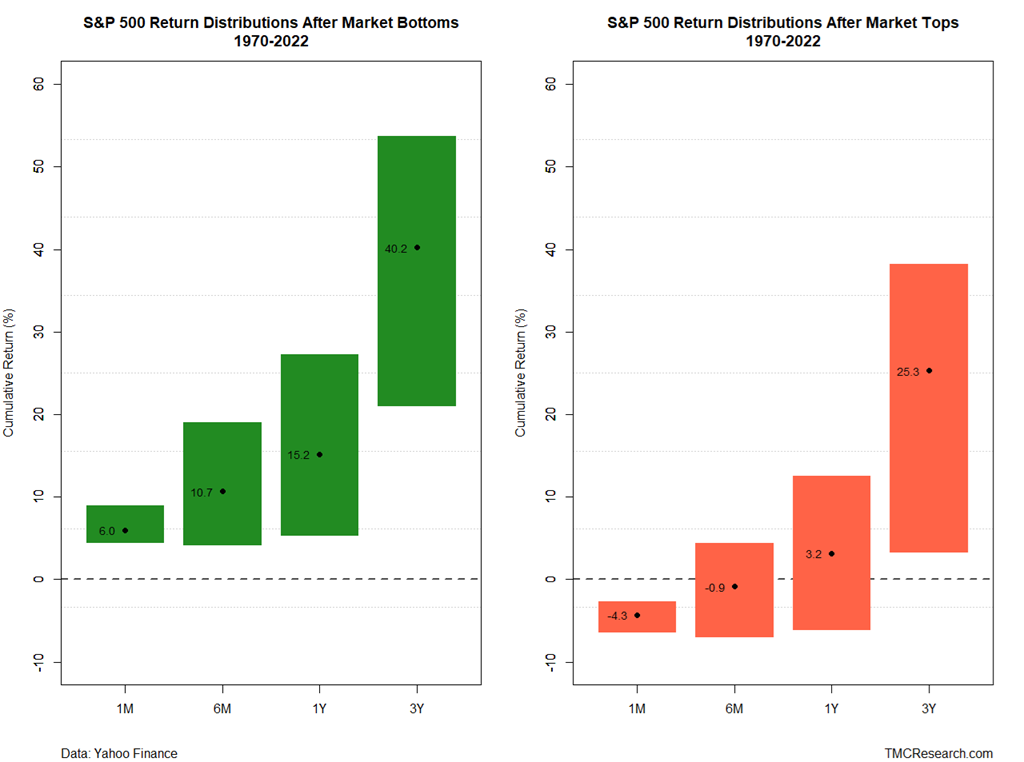

Stock market troughs offer a return premium, but timing precision is elusive and rarely repeatable, advises TMC Research, a unit of The Milwaukee Company, a wealth manager: “We calculated 1-month, 6-month, 1-year and 3-year returns following market tops and bottoms for the S&P 500 starting in 1970 and ending in 2022 (the last year available for subsequent 3-year data through today). The results, shown in the charts below, align with expectations, namely: It’s generally preferable to buy around market corrections.”

(Click on image to enlarge)

More By This Author:

High-Beta Stocks Continue Leading Equity Risk Factors In 2025

Macro Briefing - Tuesday, Nov. 11

The Bond Market’s Having A Very Good Year