Another Bitcoin Bottom Comes With An Important Signal

Now this is getting really interesting.

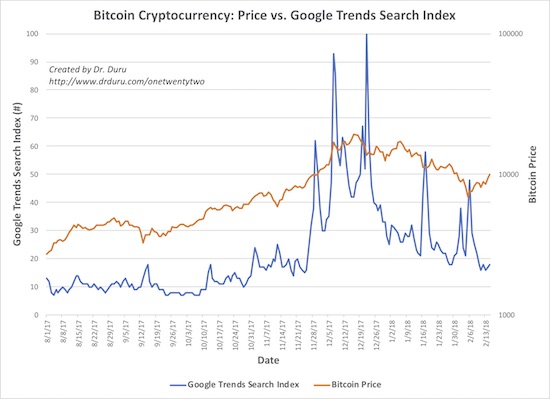

I am still in learning mode on cryptocurrencies. Every twist and turn is like a new flower patch around the bend. When I last wrote about the price patterns in Bitcoin a week and a half ago, I gave a qualified call for a bottom in the price of Bitcoin. The cryptocurrency was clinging to the $6000 level, so I just happened to write that piece at THE current short-term bottom. I did not quite feel comfortable calling a bottom because the data were incomplete. A few days later, the Google Search trend data did indeed show a spike in activity just as Bitcoin hit its latest attempt to bottom.

Source: Google Search Trends. Price data from Yahoo Finance

Extremes in Bitcoin price activity have typically generated spikes in Google Search Trends. The extremes have marked tops and bottoms.

As a reminder, I use Google Search trends to determine a change in direction for the underlying price of the search target. In this case, the search target is “Bitcoin.” The change in direction typically comes when extremes occur in both the recent price change and the search index. The term “extreme” is a bit subjective here, but it generally refers to a large percentage move in a short amount of time.

Going from right to left in the above chart, I examine the most recent episode of extremes. After Bitcoin started plunging from $10,000 on February 1, the search index spiked. The price stopped going down but for only about 2 days. After price plunged toward $6000 (intraday), the search index spiked well above the previous spike. That bottom has held ever since. Yet, the immediate drop of the index to what I have to assume is a kind baseline worries me about the sustainability of the bounce. It is as if new interest quickly evaporated. At this stage of the Bitcoin run-up, new interest and new money are key ingredients for upward momentum.

The next episode to the left on the chart was a single spike immediately following news from China of additional regulatory tightening on Bitcon trading on January 15th. Price bottomed out and recovered a bit, but this action preceded the eventual breakdown below $10,000.

Moving to the left again, the three prior spikes in the search index were about price reversing to the downside. Taken together, the three index spikes from November 28, 2017 to December 22, 2017 clearly display a growing frenzy that could not sustain itself. The first spike of the three did not occur alongside any price spike. The second of the three occurred as price soared from just under $12,000 to $16,000 in just two days. The third and largest index spike of all came along after Bitcoin’s price peaked out at $20,000. Along the way, search interest stayed at a high level. However, going into 2018, the sharp drop back to earth for the search index confirmed that sentiment hit a significant peak and with it the price of Bitcoin

Finally, before the final run-up of price, two index spikes occurred alongside sharp price drops. Bitcoin’s short-term price bottomed exactly at those points.

These spikes are sufficient but not necessary conditions for price reversals. In other words, extremes work together on both sides to set up the reversal, but price reversals can occur without a response from search interest. Note that price dropped sharply on December 30, 2017 without generating a spike in search interest. From my estimating, this was the ONLY price extreme which failed to generate an index spike since at least last August. There were at least two index spikes, on November 2nd and 12th, that did not accompany major changes in price.

So the evidence continues to build in favor of using Google Search trends as a tool for anticipating the reversal of price extremes. Going forward, if search interest fails to pick up in the next few weeks, I will assume that the fresh breakout above $10,000 will come to an end as well.

Indeed the interest in #bitcoin has died down considerably, although there is still a lot going on in #blockchain technology. One should look at the technology evolution not the quick concept of making some digital code and calling it money. If it were that easy everyone would be doing it. And that's what they were doing. That's why there are over 100 digital currencies and growing. The issue is why buy yours and who wants them when there are more popping out like weeds every day.

What is the difference between digital currency and crpto currency?

I guess you could call cryptocurrency one type of digital currency. Cryptocurreny relies on a blockchain which is a distributed (digital) ledger for tracking transactions using that cryptocurrency. A digital currency could be any form of money with an existence in computers.

I know new ones pop up every day, but is there some place that actually tallies all the different digital currencies? And have any already gone under?

There are indeed dead Virtual Currencies. Just no one wants to talk about them, especially the ones who lost money in them. http://deadcoins.com/ Digital Currency List https://coinmarketcap.com/all/views/all/

Thanks for the list! I have also been curious about the dead currencies. I have heard there are as many as 2000 of these things lurking around. Yahoo Finance tracks the most actively traded ones here: https://finance.yahoo.com/cryptocurrencies

Personally, I don't know how one sifts through it all. These cryptocurrencies have become very easy to create...out of thin air.