Inflation Is Eating Up Your Wage Increases

You’re making more money. But you can’t buy as much stuff.

Why?

Because inflation continues to eat away at your wages.

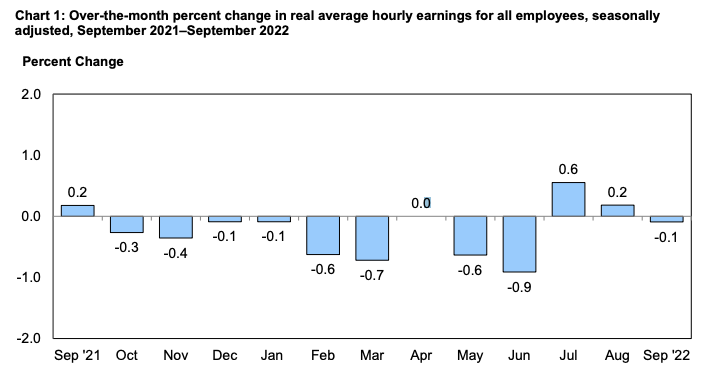

According to the most recent Bureau of Labor Statistics (BLS) data, real average hourly earnings for all employees decreased by 0.1% from August to September. This reversed two months of month-on-month wage gains.

Average hourly earnings rose by 0.3% in absolute terms from August to September, but the month-on-month CPI increase of 0.4% in the same period ate up all of that increase and then some.

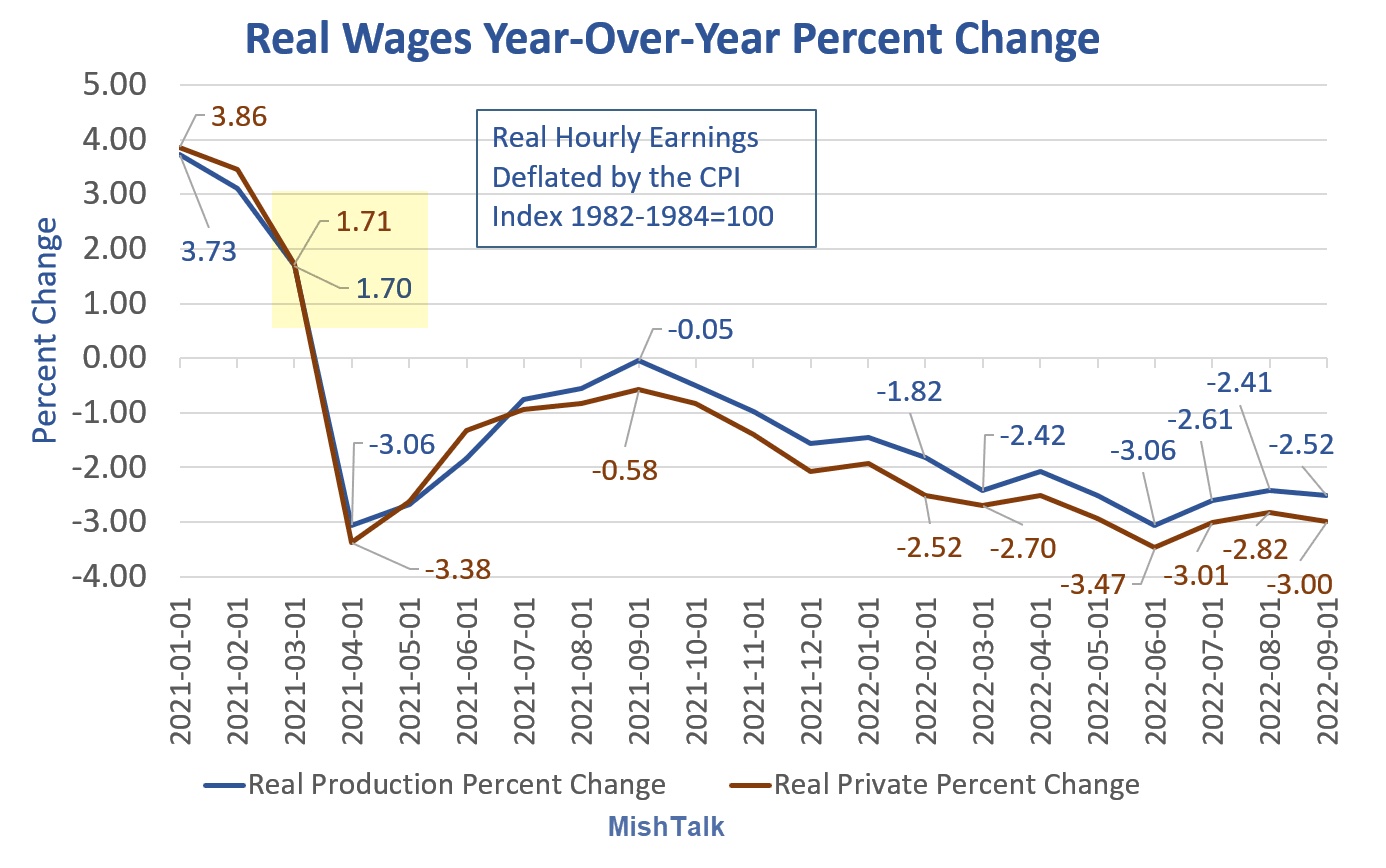

On an annual basis, real average hourly earnings decreased by 3.0% from September 2021 to September 2022 (seasonally adjusted). It was the 18th consecutive month of declining real wages on an annual basis.

This means while you got a 5.2% raise over the last year, your purchasing power dropped 3%. In other words, you have more dollars in your pocket, but you can’t buy as much with them. In effect, you got a 3% pay cut this year.

And the reality is even worse. These numbers are based on a government-rigged Consumer Price Index. Using an honest CPI, total real income is down somewhere in the neighborhood of 10% from last year.

In a nutshell, Americans can’t seem to outrun the inflation monster.

Economists and pundits talk about inflation as an academic exercise. They rarely reflect on the fact that rising prices have real impacts on real people. And if you happen to be somebody living on a fixed income or savings, you’re really screwed as inflation is rapidly eating away your purchasing power and your income streams aren’t increasing at all. Inflation always causes the most pain for the poor and elderly.

Many pundits in the mainstream blow off inflation by pointing out that wages rise along with prices. But as this data shows, wages rarely rise at the same pace as prices. That means inflation puts a significant squeeze on the pocketbook, at least in the short term.

You’re undoubtedly feeling that squeeze today.

But despite 18 months of declining real wages, economists keep telling us that American consumers are “healthy.” After all, they continue to spend. Retail sales have generally increased. How is this possible?

Americans are burning up their plastic in order to make ends meet in these inflationary times. Revolving credit, primarily reflecting credit card debt, rose by another $17.1 billion in August. To put the 18.1% increase into perspective, the annual increase in 2019, prior to the pandemic, was 3.6%. It’s pretty clear that with stimulus money long gone, Americans have turned to plastic in order to make ends meet as prices continue to skyrocket.

More By This Author:

Federal Tax Receipts Near Record-High Share Of GDP

Comex Inventory: 17.4 Paper Ounces Of Silver For Each Registered Ounce

A Reason For Bullishness: Robust Demand For Physical Gold