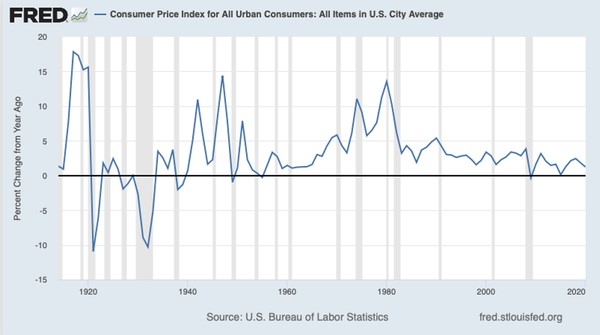

Inflation – A Spike Is Coming. Should We Worry?

“Spikes in inflation aren’t a new thing…..It wasn’t until the 1970s that we got an extended period of high inflation. And unlike previous bouts of inflation, the 70s inflation was sticky… In the months ahead the numbers won’t speak for themselves. Headline inflation will surely be a poor guide to what’s really happening, even worse than it was in 2011-12. Even core inflation as usually measured may be misleading. (Paul Krugman, NYT, April 16, 2021)

There is a growing consensus that the US economy will quickly recover this year and in 2022 because of the concurrence of a series of favorable stimulus factors. They include a somewhat successful vaccine rollout, the enormously large fiscal stimulus, and the incredibly easy monetary policy.

That is, the Biden administration is successfully injecting $1.9 trillion of new spending into the struggling economy and the Federal Reserve is promising to maintain near-zero policy interest rates well into 2023.

Even as the economic outlook brightens, some economists and investors are warning about the threat of rising inflation, even though America’s economy is still struggling to recover from its deepest recession on record.

For example, former Treasury Secretary Lawrence Summers has warned that the Biden stimulus could “set off inflationary pressures of a kind we have not seen in a generation.” As noted above, Nobel Laureate Paul Krugman clearly differs from Summers perspective.

In this economist’s view, context is everything, and the context is different this time around. In plain words, inflation in the western world has been tame over the past decade and has mostly fallen short of the 2% target that the Fed thinks is optimal for the US economy.

Moreover, because of the structural problems associated with the steep pandemic recession, the Fed has indicated on multiple occasions that it is prepared for a burst of inflation once the economy is mostly healed. As well, the Fed has also indicated that it expects an increase in inflation to be mild and temporary.

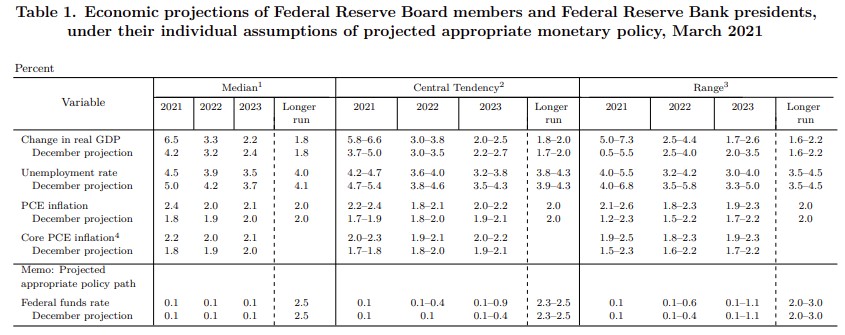

For example, at its recent March FOMC meeting, the median projections of Fed officials for core PCE inflation was 2% for 2022 and 2.1% for 2023. (See the table at the end of this article.)

The projections for the other commonly accepted PCE indicator were virtually identical. As well, a renewed commitment for near-zero policy interest rates were also in the Fed projections. That is, Fed officials still expect the federal fund's interest rate at year-end 2021, 2022, and 2023 would continue to be fixed at 0.1%.

Clearly, the Fed’s and the Biden’s Administration’s main policy priority is undoing the damage to the labor market caused by the pandemic. The Fed’s projections recognize that it could take several years for unemployment to fall close to the pre-pandemic low level of 3.5%.

Still, what seems to worry a lot of professionals is that a huge inflation burst could emerge and then become deeply embedded in the economy, as was the case in the 1970s.

In the 1970s the combination of OPEC-generated oil price shocks and related wage spirals produced the longest bout of high inflation in recent American history.

The 1970s experience confirms that it is very difficult to extricate from a steep inflation cycle without a deep recession.

However, the current economic environment is vastly different from the 1970s.

Unlike the 1970s, high and rising inflation is not currently embedded in wages and salaries. Oil is also a much smaller part of the US economy today than in the 1970s, and wage-push inflation sparked by union pressure is almost nonexistent.

As well despite the possibility of post-pandemic supply shortages, deflationary pressures from abroad will still exist. Even now, global competition based on price is extremely fierce, and it will not be much different post-pandemic.

In conclusion, despite the large-scale expansionary policies in place, it is rather unlikely that a temporary new bout of higher inflation will become embedded, as was the case in the 1970s.

Krugman is right when he argues that we should not let the inflation bogey scare us again.

(Click on image to enlarge)

The constant, driving, inflation as constantly pushed on u by the federal reserve people, is constantly reducing the quantity of what my dollar will buy. And I am certain that it reduces the amount that other fol dollars will buy as well. And the unfortunate part of the problem is tha I do not have a magic button to press thatraises my income to compensate for that. And the terrible news is that for some reason my investments do not suddenly become more valuable because the dollars to buy a share have increased.So I am caught beneath a rock sitting on top of a hard place. And the fact i that each time previously that there has been a sudden increase of available money there has been inflation as a result.

Money printing o far is at $13 trillion, which is more than the cost of our largest wars. Classic inflation is too much money chasing too few goods. Cngress is poking the inflation bear. How much paper will it take?