If Earnings Matter, Equity Valuation Looks Attractive

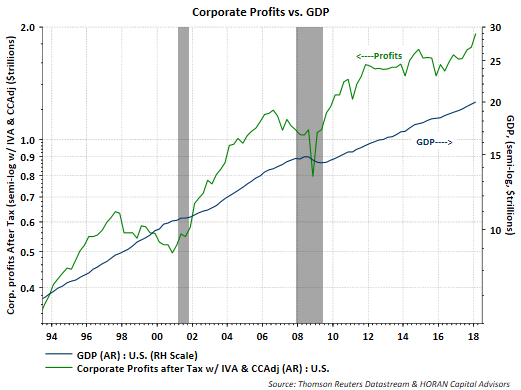

With last week's final reading on first quarter GDP, the Bureau of Economic Analysis provides a final review of the National Income and Product Accounts (NIPA). One category worth evaluating is the corporate profits figures. Corporate profits from the NIPA tables are true economic profits from IRS data and not simply profits based on GAAP. In the final GDP report last week, corporate profits with IVA & CCAdj totaled $1.92 trillion at a seasonally adjusted annual rate versus $1.64 trillion in the same period a year earlier. This represents a nearly 17% increase in profits from a year earlier.

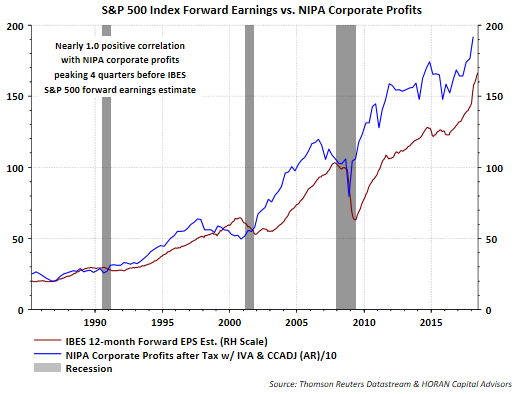

One aspect of the NIPA profit numbers is they tend to peak about four quarters before the I/B/E/S 12-month forward earnings estimates. With the strong growth in NIPA corporate profit it can be anticipated that I/B/E/S earnings growth will be favorable for the 12-months ahead, all else being equal.

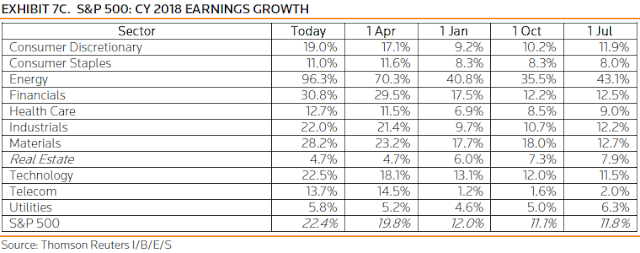

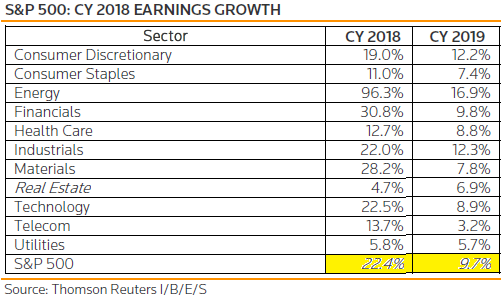

By now many have heard or read about the strong earnings growth in the first quarter of this year, up 26.6%. Certainly tax reform is having a favorable impact on corporate profits, but companies are reporting top line revenue growth as well. First quarter revenue growth is estimated to equal 8.4% versus the same period a year earlier. The below table outlines the progression of the higher earnings revisions for the calendar year 2018. On January 1, 2018 earnings growth estimates were anticipated to equal 12.0% for all of 2018. As of Friday's close though, earnings growth has been revised higher to 22.4% for 2018.

One would expect the market to react favorably to this rate of earnings growth. What may be occurring though is a market that is adjusting to a more normal level of earnings increases. The below table shows that earnings growth expectations for calendar year 2019 equals 9.7%, down from the strong 22.4% expected for all of 2018. Our belief at HORAN is the equity market may be correcting over time versus price as it adjusts to this more normal, but lower rate of growth for corporate earnings.

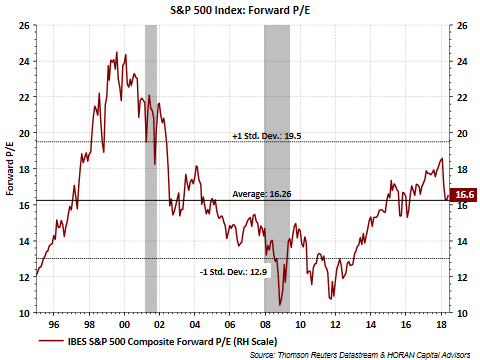

And lastly, the Tax Cuts and Jobs Act is not a one time event in that earnings will remain at this higher level during the term of the Act. Many of the provisions in the Act do sunset January 1, 2026. This higher earnings level has brought the market valuation or price to earnings ratio (P/E) back to its longer term average of around 16 times earnings. So the other benefit to the tax cuts has been the reset on the valuation.

Certainly the headline risk associated with the discussions around tariffs and trade wars is adding to the market's volatility. From an earnings and top line revenue growth perspective though, companies appear to be operating at a high level. With the year ahead earnings expectations looking favorable, this should translate into decent equity returns, but of course, not in a straight line higher.

Disclosure: None.

Great article, very clear. I was wondering- What is the underlying basis for the 9.7% predicted growth for 2019? It seems like a very specific value difference from both the 12% predicted for this year, as well as the updated prediction of 22.4% now expected. The update of 22.4% indicates corporate expansion (presumably spurred by the tax breaks, among other factors, as you pointed out), but that trend will probably take some time to contract. 9.7% seems like a pretty sharp difference. If it is an underestimate, that would imply that the equity index is even cheaper. Any thoughts?

The 9.7% does seem like a sharp reversal lower, but the YOY comparison in 2019 back to 2018 is going to difficult to to the larger 2018 result, i.e., 'base effects'. Also, the 9ish percent growth rate is near where earnings estimates stood in December 2017, prior to the tax cut benefits. Certainly, if reinvestment translates to higher sales, earnings growth could be quite a bit higher than the 9.7% anticipated at this point in time.

Thanks for the comment Zev.

David