"Nasty Squeeze" On Deck: Last Week's Shorting By Hedge Funds Was "The Second Largest Ever"

Image Source: Pexels

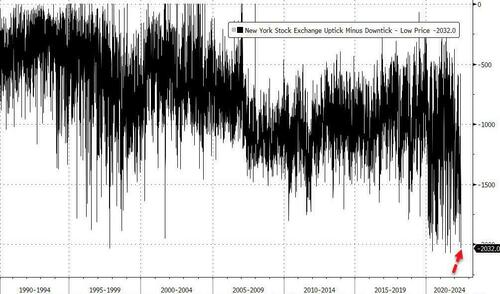

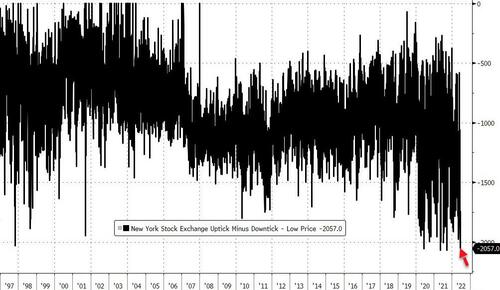

Last week, we observed that Monday, the day the S&P finally tumbled into a bear market, saw the the fifth largest 'sell program' in history.

This was promptly surpassed by even more furious selling on Thursday, when the TICK hit -2,057, the fourth biggest selling program on record.

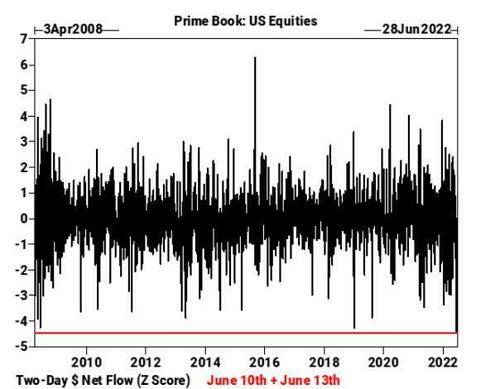

We quoted Goldman's Prime Brokerage, which stated that hedge funds not only sold US stocks for a seventh straight day on Monday, but the dollar amount of selling over the last two sessions (Friday and Monday) exploded to levels never before seen by Goldman.

That is remarkable because the bank's records go back to April 2008, which means they captured the chaos from the Global Financial Crisis. In other words, we just saw a more frenzied liquidation than what took place in the immediate aftermath of Lehman.

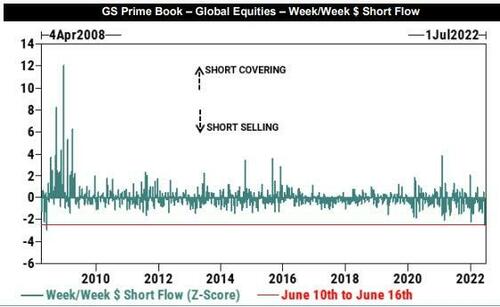

The data also prompted us to question how much of this was actual normal selling (i.e., closing out existing positions) vs. short selling (betting on more downside).

We now have the answer: according to Friday's note by Goldman trader John Flood, "in notional terms, this week’s shorting activity on our PB book was the second largest ever on our record (second only to the week ending June 12, 2008)."

Here are some more details on recent hedge fund performance from Goldman's Prime Brokerage, courtesy of Flood:

- The Goldman Sachs Equity Fundamental L/S Performance Estimate fell -4.61% between June 10 and June 16 (vs. MSCI World TR -8.47%), the worst weekly returns since January 2021, driven by beta of -3.99% (from market exposure combined with market sensitivity) and, to a lesser extent, alpha of -0.62%. L/S Equity HF is now down 19.02% on the year.

- Fundamental L/S Gross leverage declined by -3.6 to 166.1% (3rd percentile one-year) and Net leverage declined to 46% (lowest since October 2019).

But here is the punchline: "In $ terms, this week’s shorting activity was the second largest ever on our record (behind week ending June 12, 2008). Single Stocks/Macro Products were both shorted and made up 83%/17% of the $ short sales."

For perspective, 9 of the 10 largest stock shorting weeks in Goldman's record occurred in 2008 (weeks ending June 12, May 8, and June 5), 2020 (weeks ending April 5, March 5, and March 12), and 2022 year-to-date (weeks ending June 16, Jan. 6, June 9); the week ending Feb. 25, 2021 was the other one.

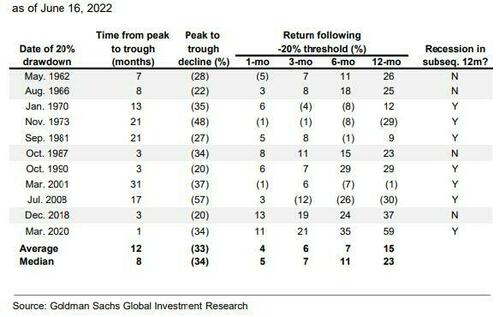

And predictably, following such massive shorting episodes, what follows traditionally has been a major squeeze. As Goldman's table below shows, returns following 20% S&P 500 declines have typically been positive

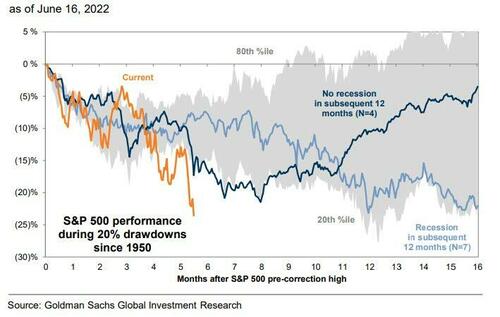

And while a squeeze now appears inevitable, the market will need much more than just technicals and positioning to recover, as the following chart shows. The current bear-market selloff has been the most violent and vicious ever.

As Flood concludes, "while it certainly feels like we are primed for a nasty squeeze early next week, I think the play book remains to sell the low quality bear market squeezes whenever they appear, and I think we will see more than our fair share of them."

John Flood's full note is available to subscribers here.

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All ...

more

ROTFLMAO, Fraud St and cronies unregulated manipulation stock markets fell last week and more for valid reasons. Rest assured we ain't seen nothing yet 🐻❤🤑😈✔ $F $SYF $TSLA $AAPL $AMZN and more... enjoy the Armageddon Depression.