Inhibikase Therapeutics: A Novel And Promising Approach To Neurodegeneration And Oncology

Image Source: Inhibikase.com

Inhibikase Therapeutics (IKT) is a small capitalization company working in both neurology and oncology. Their principal focus is a small molecule inhibitor of c-Abl for the treatment of a number of neurodegenerative disorders with an initial focus on Parkinson’s Disease. The lead asset (IkT-148009) is a selective, brain penetrant inhibitor of c-Abl1 and Abl2/ARG. The drug is designed to minimize the toxicity commonly associated with the cancer drugs of this class, while maximizing efficacy against neurological diseases.

Neurodegeneration has multiple causes, but the aggregation of misfolded proteins is often associated with these diseases and in the case of Parkinson’s Disease it is the aggregation of alpha-synuclein. Given that these aggregates are clearly associated with the disease, a common tactic to drug development is to find treatments that eliminate the protein bundles, but these approaches have generally had quite modest effects.

Inhibikase approaches the disease from a different perspective in that the core issue is when those aggregates become internalized in neurons (in the case of PD). When this occurs, c-Abl triggers a cascade of responses that ultimately leads to neurodegeneration. Inhibiting c-Abl stops these reactions and saves the neurons. (The details of this approach can be seen in the recent article in Neurodegenerative Disease).

One of the difficulties of inhibiting c-Abl in neurodegenerative diseases, however, is the potential toxicity. Gleevec is a commonly used inhibitor of c-Abl in oncology, where it has an acceptable toxicity profile, but it would be too toxic for neurological indications. Developing a drug that can inhibit c-Abl in the brain but without the common toxicities is the fundamental breakthrough of IkT-148009.

It is the selectivity of the inhibition that is key. The corporate presentation clearly shows a differentiated inhibition profile (source).

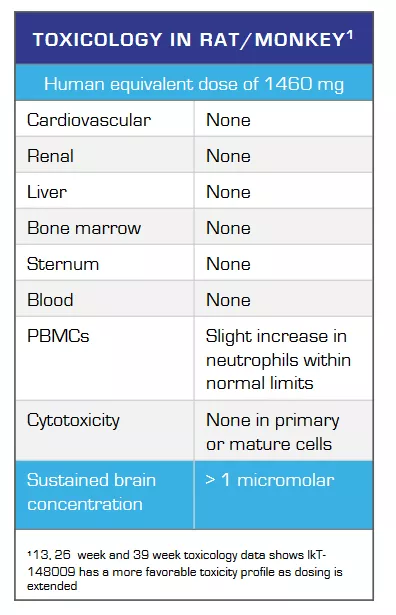

This selective inhibition of IkT-148009leads to a very clean toxicity profile.

This safety is not simply theoretical as their phase I, Ib, and 2a trials confirm the lack of significant toxicity. There was a grand total of 14 reported adverse events among 113 treated patients and only one was moderate (the rest were mild).

It cannot be stressed enough that safety is absolutely crucial in neurological indications, and it seems that the design of the drug, the preclinical and early clinical results all point to low toxicity, which is exactly what you want to see from these early looks.

Inhibikase currently has an ongoing double-blind enrollment trial across three doses for the treatment of Parkinson’s disease. The trial includes a 3-month treatment period followed by a 12-month open label extension. The primary endpoint is safety, which is appropriate for a dose ranging phase II trial and expectations should be a clear confirmation of the established safety profile.

That being said, there is a robust set of secondary endpoints that will provide important information as to the efficacy profile. The preclinical work in a Parkinson disease animal model demonstrated a consistent efficacy where treatment lowered alpha-synuclein back to baseline levels, preserved as much as 85% of neurons, restored as much as 90% of motor function, and suppressed neuroinflammation back to near baseline levels.

Obviously, a replication of those results in the phase II trial would be spectacular but a clear win would also be a confirmation of the safety profile, a strong signal of efficacy, and a clear move forward dosing level. Given that the PK profile seen in the animal models is similar to the PK shown in the phase I trials, the chosen dosing levels in the phase II trial should lead to a go forward dosing as well as a demonstration of efficacy.

The company has guided to a robust set of progress in 2023, where the continued enrollment of the phase II trial is perhaps the most important.

I noted earlier that Inhibikase Therapeutics is both a neurology and oncology company. In terms of oncology, the company has an improved version of Gleevec that is designed to minimize GI toxicity. This asset is undergoing a bioequivalence trial, which could accelerate the pathway to approval, but I think the key valuation inflection point will be the 201 trial in Parkinson’s disease.

The 201 trial has the potential to confirm the safety profile, identify a go-forward dose, and establish efficacy. The current valuation of the company does not reflect any of that potential. It does not even properly reflect the safety profile seen in the phase I trials let alone a potential success in the 201 trial. The heavily discounted valuation provides a compelling risk/reward given the ability to establish both safety and efficacy in Parkinson’s disease let alone any progress in oncology.

Related Articles:

Inhibikase Targets A Substantial Market Following Results Presented At The Barcelona Conference

Inhibikase Therapeutics: Targeted Therapies That Can Improve Quality Of Life

More By This Author:

The FTC, Amgen, And Horizon: A New Hurdle For Biotech Deal Making Or Regulatory Overreach?

Coya Therapeutics: Another Success

Sarepta: The AdCom Documents Enter The Discussion

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their ...

more

Bio Deep Dives, very thorough piece on #Inhibikase. But could you go into more depth about the competative landscape? Intersted in $IKT but wondering how the competition measures up.

Bullish on $IKT

Sounds very promising!

Good analysis.

This certainly does sound like an opportunity. And a good ESG opportuinty as well.