Inhibikase Targets A Substantial Market Following Results Presented At The Barcelona Conference

Inhibikase Therapeutics (Nasdaq: IKT) is trading well off its IPO value and saw a substantial drop in value in June 2021 after it completed a $45 million follow-on offering at $3.00/share. The company is currently trading at a market cap of $35 million which is well below its cash value of $45 million and has a major catalyst in the coming days. Dr. Milton Werner, Ph.D., President & Chief Executive Officer of Inhibikase, will give an oral presentation at the AD/PD™, Alzheimer's & Parkinson's Diseases Conference being held in Barcelona, Spain from March 15-20, 2022. The presentation occurred Friday, March 18th, 2022. IKT is expected to review Phase 1a/b trial results of its lead candidate IkT-148009. If the trial results are good it could represent a serious value inflection point and set the stage for a Phase 2 study in Parkinsons.

While it is uncertain what causes PD, what is certain is that there are effective treatment options that can control the side effects of the disease for periods of time. Without getting into a complete science lecture, the Substantia Nigra, which is a small portion of the brain where the brain meets the spinal cord, is responsible for controlling motor function. The neurons in this area create a brain chemical called dopamine that ensures neurons fire quickly and efficiently. If dopamine levels drop then loss of motor control ensues and typically manifests itself as a shaking of the hands or shuffling of the feet. A drop in dopamine levels produced by the neurons located in the Substantia Nigra is a sign that the neurons are starting to degenerate.

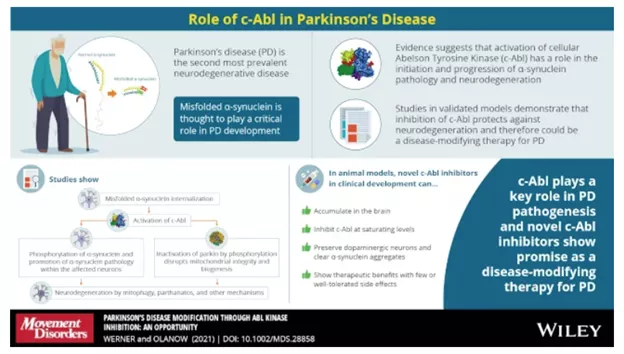

This infographic shows how cellular Abelson Tyrosine Kinase (c-Abl) is responsible for the production of the toxic form of alpha-synuclein which is theorized to be a possible cause of PD. Blocking c-Abl is expected to restore balance within these neurons and stop the degeneration along with the disease.

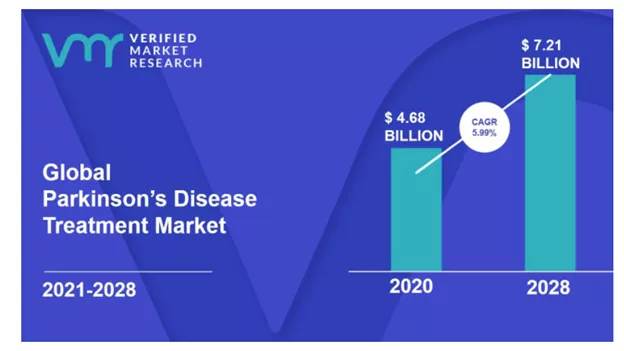

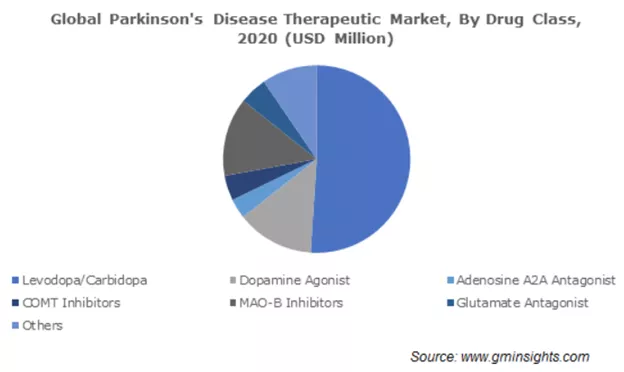

The market for Parkinson's Disease (PD) drugs is $4.68B. The primary drug used to treat PD is ledopa/carbidopa followed by dopamine agonists. It's important to highlight that these drugs treat the symptoms of the disease, and don’t address the root cause. IkT-148009 is a small molecule designed as a once-daily oral medication that targets the underlying mechanism of PD by blocking the activation of the Abl Kinase. This is a validated target that was also researched by John Hopkins University which licensed a companion diagnostic to be developed by Valted Seq in Parkinson’s Disease. In November 2021, Valted Seq raised $10.5 million in a seed round. If this drug develops into a disease-modifying drug then it could quickly become the major therapeutic in the pie chart below.

There is a sound basis for optimism that this phase 1a/b trial readout will be positive besides the obvious concept that failed or marginal studies don’t typically take center stage at a conference. Preclinical mouse models demonstrated that activation of c-Abl was needed to create neurodegeneration. Mice unable to produce c-Abl were not able to develop any neurodegeneration in animal models of progressive Parkinson’s disease. In phase 1 study IkT-148009 showed no clinically significant adverse events up to the 175 mg level. The dose escalation should have continued to 250mg or beyond if they didn’t reach their maximum tolerated dose. Getting into this region of dosing provides a lot of flexibility in clinical trial design to achieve efficacious endpoints.

The phase 1b trial was randomized 3:1 and was set to do 3 dose escalations of 7-day dosing. The treatment group contained 3 cohorts of 8 patients with mild to moderate Parkinson’s Disease. Beyond the safety and tolerability endpoint that they are likely to meet, the clinical trial is also looking to assess motor and non-motor function, gut motility, and measures of alpha-synuclein aggregate clearance as exploratory endpoints. There could be some very positive surprises early with these exploratory endpoints that could be very exciting for patients and investors alike.

Investment Summary

The upcoming trial results are expected to show an excellent safety profile of the drug and perhaps some biomarkers that translate into efficacy. This opens the door to label expansion in another indication called Multiple System Atrophy (MSA), another PD indication, Neurogenic Constipation, and Dysphagia. With 4 possible phase 2 indications this year and the money to start them this asset is extremely undervalued compared to its peers. Each phase 2 indication is roughly worth $200 million-plus. The stock is trading at a discount to cash placing no value on one indication let alone the 4 possible this year. The company’s ability to raise cash after meeting its clinical endpoints could lead to an up round if they play their cards right. The company’s disastrous second round may have investors skittish, but it really may have been more of a function of a horrific bear market in biotech. The real wild card is the potential for fast track approval in the medium term which may keep investors in the stock looking for more. Their meeting with the FDA for Fast Track was scheduled for this quarter. For biotech investors that understand this as a validated target, there isn’t much downside risk and a lot of potential going into an announcement that is likely to be extremely positive.

This is indeed a good promising company still in its early stage with the potential for upcoming positive results. Although the conference is concluded the news was greeted quite positively with potential for great gains now they have the attention of their peers.

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their ...

more

Good stuff.

An interesting article. PD patients need better medicines and Inhibikase has a successful suite of therapies the sky is the limit as far as future valuation for the company. Today is April 1, I wonder if their request to the FDA for Fast Track approval was granted.

Good analysis. Sounds like there's tremendous potential for $IKT!