Happy New Year Analysis

Good Morning! The Christmas Season extends to January 6 for many Christians.

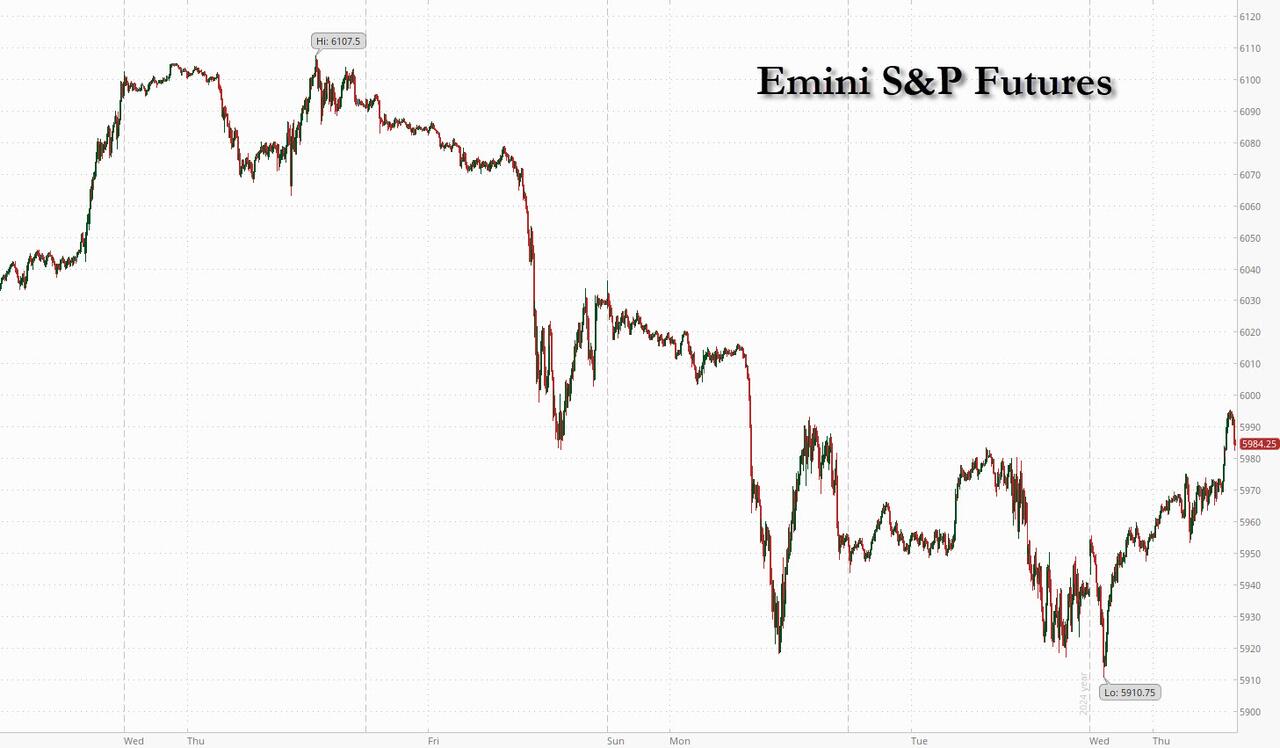

SPX futures rose to a holiday high at 5945.40, but has since eased lower, completing a 42.3% retracement of its post-Christmas decline thus far. It is probable that the bounce was repelled by the 50-day Moving Average at 5939.03. Should it go higher, the next resistance is the Intermediate resistance at 5991.30. However, should it open beneath the 50-day Moving Average at 5939.02, the way forward is declining. The Cycles Model shows strengthening of the (declining) trend through the weekend.

Today’s options Chain shows Max Pain at 5925.00. Long gamma may set in above 5950.00 while short gamma may begin beneath 5915.00 but strengthens beneath 5900.00.

ZeroHedge reports, “US equity futures rebounded strongly on the first trading day of 2025 after 4 straight days of losses, ending 2024 on a soggy note, thanks to – what else – a bounce in tech stocks, even as China suffered its worst start to a new year since 2016. Nasdaq 100 and S&P 500 contracts rallied by at least 1%, although gains eased modestly by 8:00am ET. All the Mag7 names traded higher (Nvidia (NVDA) +1.7%, Microsoft (MSFT) +1%, Alphabet (GOOGL) +1%, Amazon (AMZN) +1.4%, Meta Platforms (META) +1% and Tesla (TSLA) +1%). European energy shares outperformed after a sharp increase in natural gas prices. The euro fell to the weakest against the dollar in over two years. Treasuries and European government bonds gained. Bitcoin extended its rally to a third day. Macro data today includes initial and continuing jobless claims, as well as the Mfg PMI and construction spending.”

VIX futures declined to 17.03 this morning, bouncing above the 50-day Moving Average at 16.67. The Cycles Model allows for a further pullback by the weekend. Trending Strength may return by mid-week.

The January 8 options chain shows short gamma clustered at 15.00 while long gamma may begin at 16.00. However, although short gamma is thinning, long gamma does not apear to have much support at this time.

The Shanghai Composite Index fell to 3242.00 today, declining beneath its major supports, the most important being the 50-day Moving Average at 3360.82. This is a confirmed sell signal. The Cycles Model anticipates a decline to the end of January, so buckle up! Speculation, the backbone of Chinese equities may be drying up.

ZeroHedge remarks, “China’s market turmoiled overnight after the Caixin Manufacturing PMI fell to 50.5 from 51.5 in November (significantly worse than the median forecast of 51.7 by economists).

The findings reflect uncertainties facing Chinese exports, which have powered the $18 trillion economy’s uneven recovery but may take a hit when Trump takes office later this month.

“Exports dragged on demand amid mounting uncertainties stemming from the overseas economic environment and global trade,” Wang Zhe, senior economist at Caixin Insight Group, said in a statement accompanying the release.”

TNX made a morning low at 45.17. It is consolidating and may retest the trendline near 44.00 by the weekend. However, the positive trend re-asserts itself by early next week with a burst of trendline strength due on Monday. However, the current Master Cycle may end next week, as well. Should the Pivot day be a low, it increases the probability of a resumption of the trend. A pivot high may allow a three-week correction in the trend.

Bitcoin is back-testing overhead resistance as it completes its Master Cycle by early next week. Resistance levels are Intermediate resistance at 98045.00 and the Cycle Top at 104176.61. The Cycles Model shows a burst of speculative energy on over the weekend, favoring the higher resistance.

BKX may be extending its Master Cycle high, first recorded last Friday, day 255. Today is day 260 of that Master Cycle, within an acceptable range to extend. The 50-day Moving Average is at 130.02, while the trendline is near 131.00. Either of these resistance levels may allow the Master Cycle to extend. Note the similarities between the BKX and Bitcoin performance.

More By This Author:

US Stocks Reset Record Highs Overnight

Futures Tumbled Overnight

USD Futures: New Low Overnight

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more