Futures Tumbled Overnight

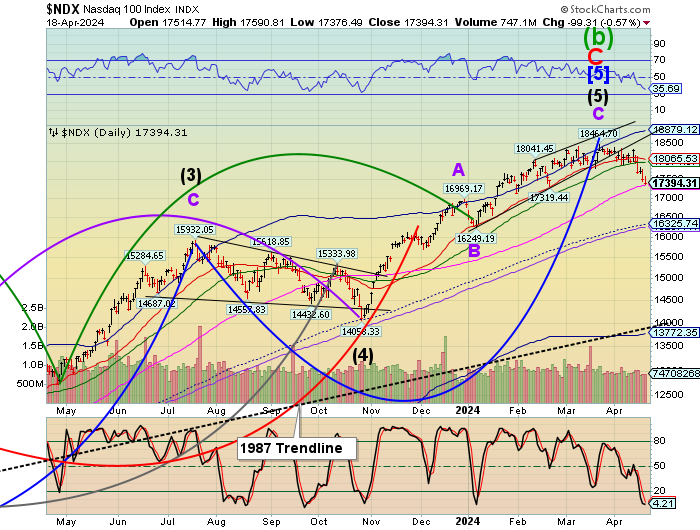

NDX futures tumbled to 17038.70 overnight on news of a battle between Israel and Iran. A partial recovery brought the NDX back up to test the 100-day Moving Average at 17349.76 where it remains now. Yesterday afternoon’s call on the Market was prescient as we may not see those levels again for quite a while. The overnight action may be called an irregular correction, where yesterday’s high at 17590.00 marks the top of a new Cycle.

Today’s options chain has the potential to be a train wreck, as Maximum Investor Pain lies at 17500.00. Anything beneath that is in short gamma, which may feed on itself.

ZeroHedge reports, “SUMMARY:

- Iran says its nuclear facilities remain unharmed: Reuters

- Situation in Iran’s Isfahan is normal, no explosion taken place on ground: PressTV

- CNN: Two US oficials say Israel indicated they would not attack nuclear targets. US didn’t “green light” this attack.”

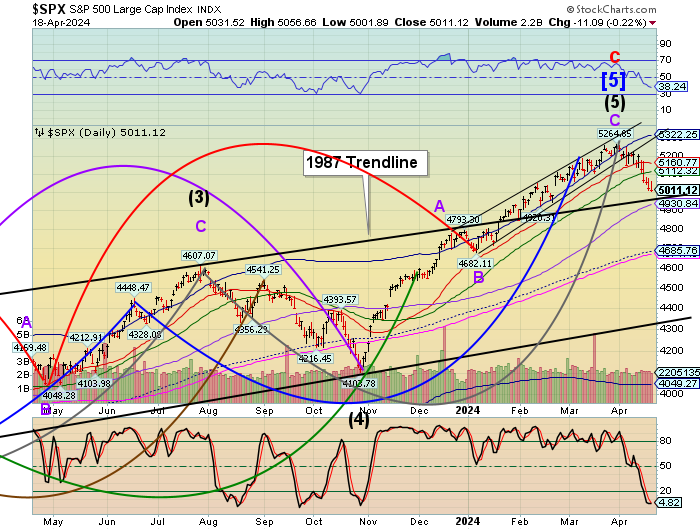

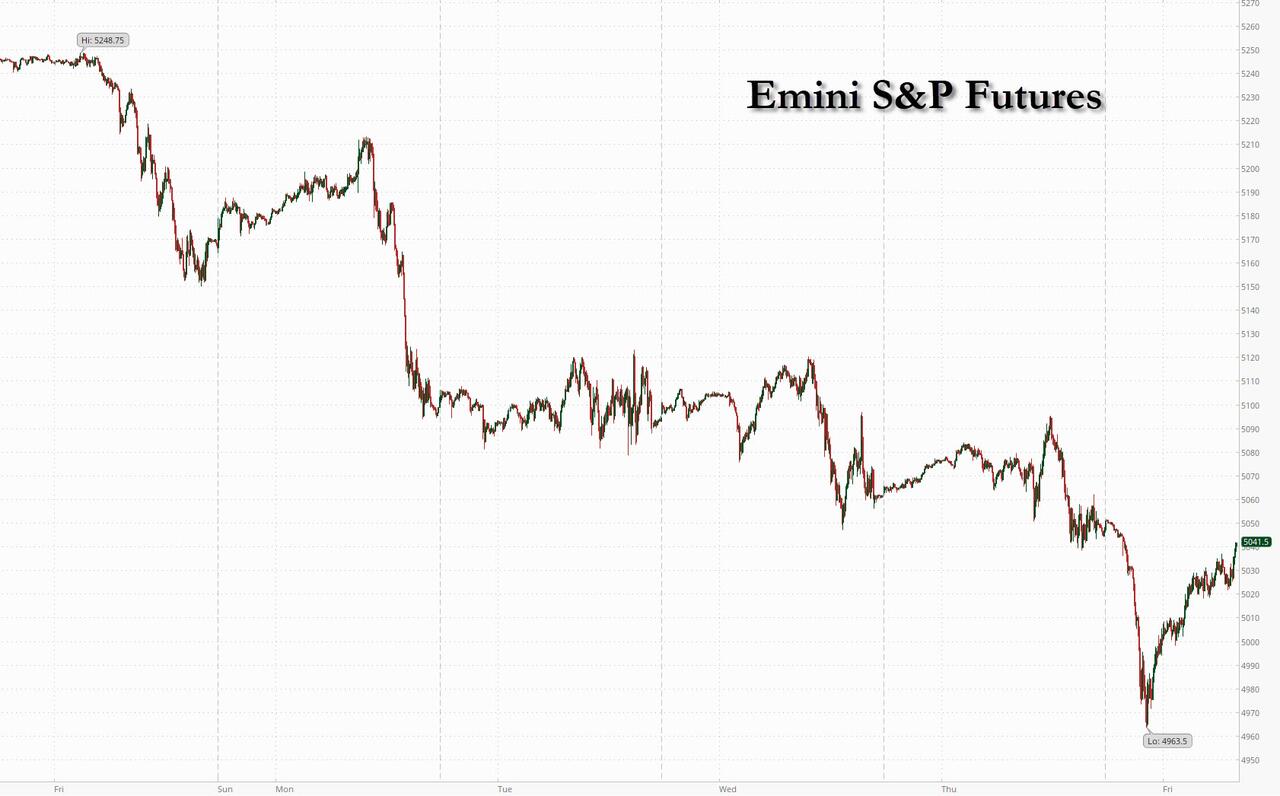

SPX futures declined to 4927.10 before a bounce ensued. It has recovered back to 5009.00 thus far, near yesterday’s close. However, participants are shaken and low liquidity may exacerbate a further decline. The Cycles Model indicates a strong reaction over the weekend, regardless whether the SPX is stabilized for options expiration or not.

Today’s morning expiration shows options are tilted toward the short side on all strikes beneath 5100.00.

ZeroHedge reports, “While US futures are still modestly in the red, they are not only well off the worst overnight levels, but they are almost unchanged since yesterday’s close following a performative Israeli retaliation. which followed a performative Iranian attack, which appears to be the end of the story. For those who missed it, early on Friday local time, explosions echoed over an Iranian city on Friday in what sources described as an Israeli attack, but Tehran played down the incident and indicated it had no plans for retaliation – a response that appeared gauged towards averting region-wide war. The limited scale of the attack and Iran’s muted response both appeared to signal a successful effort by diplomats who have been working round the clock to avert all-out war since an Iranian drone and missile attack on Israel last Saturday. And so, after a whole lot of nothing overnight, as of 730am, S&P futures are practically unchanged at 5,045, Brent is actually lower compared to Thursday’s close after briefly rising above $90 earlier, gold is unchanged, bonds are modestly firmer though have pared the majority of the overnight advances, and bitcoin is higher after aggressively dumping late on Thursday. There is nothing of significance on today’s calendar.”

More By This Author:

USD Futures: New Low OvernightSentiment Is Euphoric

VIX Futures: On The Rise

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more