USD Futures: New Low Overnight

NDX futures rose to an overnight high of 17961.00 as the am options settlement looms. The significance of this is that, if this bounce is a Wave two, it may not exceed the all-time high, leaving empty space beneath it at the end of the day. The 50-day Moving Average at 16930.42 may be its first stop on the way down.

Today’s options chain shows Maximum Investor Pain at 17825.00. Long gamma resided above it with heavy emphasis from 17900.00 to 18000.00. Short gamma resided beneath 17800.00.

ZeroHedge remarks, “Junk takes over leadership

Low quality led the way yesterday with Commercial Real Estate (+3.75%) and Regional Banks (+3.40%) while Megacap Tech (-0.5%) and Obesity Drugs (-1%) lagged meaningfully. Buying junk and selling Thematic Winners of course only happens in the 8th or 9th inning of a bull run. If only there were more signs of peakish frenzy….

Is the whole market about to go Meme…?

SMCI is +86% in February (11 sessions). The stock finished the day with an RSI of just under 97, the highest level since Gamestop in early 2021, and look how well that turned out. SMCI is currently on a 9-day winning streak.”

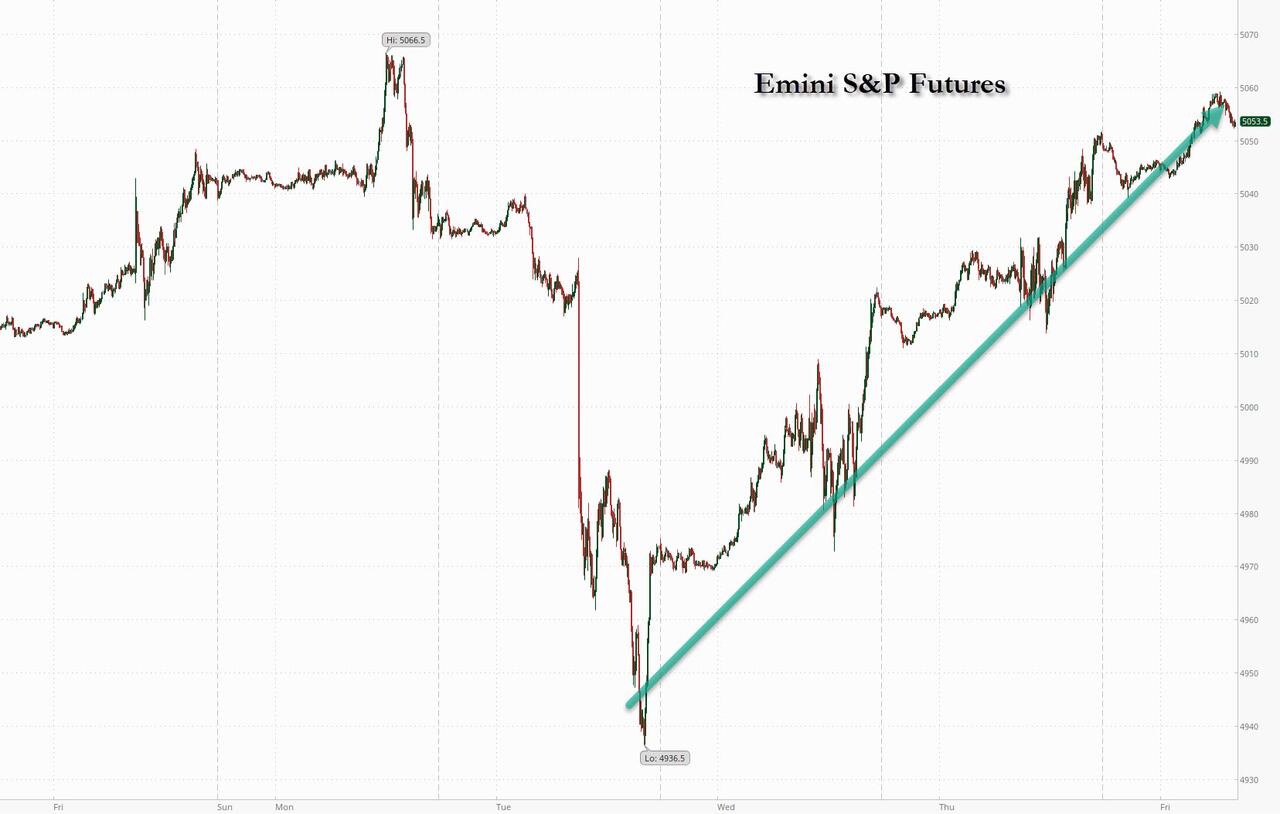

SPX futures have risen to 5043.20 in the overnight market, not exceeding the all-time intraday high at 5048.39. Some look at the closing high last Friday at 5026.61, but I do not, since the market is continuous. In addition, the futures are pulling back and the cash market may open in the red this morning. Emotions are running high and the most looked-for information on Google has been “call options.” Time to sell.

Speaking of options, today’s morning op-ex shows Max Pain at 5025.00. Long gamma resided above this with heavy emphasis at 5050.00 and above. Short gamma may begin at 5020.00, but short speculation becomes very crowded beneath 5000.00.

The PM options are similar but with massive puts & calls at 5000.00. There may be high dudgeon in the options market today.

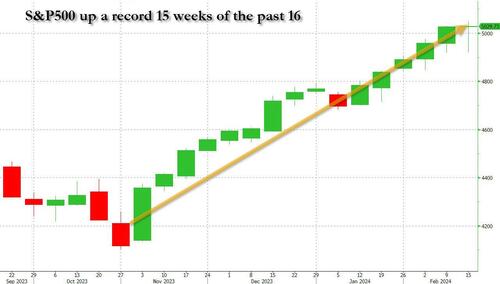

ZeroHedge reports, “after stocks successfully recovered from a mid-week rout following the much hotter than expected CPI print, resulting in a burst of BTFD and flurry of 0DTE buying, on the last day of the week, S&P 500 futures were up 0.2% – amid bigger gains in European stocks …

… and were on pace to dodge a weekly red candle in the process setting up a record 15th weekly gain of the past 16, as the market no longer drop. Ever. Meanwhile, the euphoria was even more ridiculous over in the tech world where Nasdaq futures accelerated their silly meetup, rising 0.5%, propelled by Applied Materials rising ~13% in premarket trading while the current generation’s Gamestop, Supermicro, was up another 6% premarket, sending its RSI to a record 98.”

(Click on image to enlarge)

VIX futures rose to a morning high at 14.48, as it edges back toward (above) the mid-Cycle support/;resistance at 14.87. It remains on a buy signal above the 50-day Moving Average with further confirmations possible above the mid-Cycle and at a probable breakout above 17.54. Most investors are slow to realize the nuances of the VIX.

Next Wednesday’s op-ex shows Max Pain at 14.00 with short gamma primarily at 13.00-1350.00. Long gamma dominates at 16.00 and runs to 42.50.

ZeroHedge observes, “VIX seasonality

We are just at the point in time in the calendar when VIX tends to spike.

Source: Equity Clock

Just in time

The second half of February is bad for stocks.”

USD futures made a modest new low overnight but appear to be reversing as it may resume the rally. The Cycles Model suggests trending strength may be on the rise this weekend and into next week.

More By This Author:

Sentiment Is EuphoricVIX Futures: On The Rise

SPX Futures: Back To A Flat Position

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more