Why Did The Canadian Federal Government Deficit Increased Dramatically In 2023 And Does It Matter

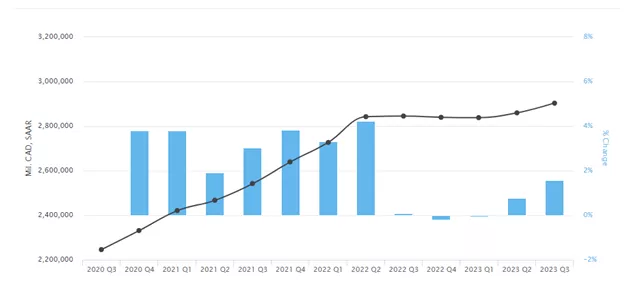

Image Source: Pixabay

Federal government expenditures in Canada are often a frequent flyer in debates about the role of government in promoting economic wellbeing. Before we turn to the issue of Ottawa’s spending patterns, it is important to note how weak the Canadian economy has become over the past 12 months. Tax and spending must be measured against nominal economic growth which has declined dramatically since the end of the pandemic years. Nominal growth has fallen short of price increases, signaling that the economy is shrinking in real terms as consumers spend more money to buy fewer goods and services. During the period 2020 Q3 to 2022 Q3, the economy was expanding annually at 4%, only to suddenly come to a halt in the last half of 2022 Q3 and has barely budged since. The engine of growth just sputtered (Figure 1). A recent report by the CIBC states that:

“Consumer spending in Canada is already weaker than most people realize, particularly in per capita terms, and is already bringing weakness in employment within affected sectors such as retailing, restaurants and hotels. That could spark a vicious cycle of even weaker spending and further job losses, while mortgage refinancing remains a risk as households that have seen weaker average income growth since taking out their current mortgage have to refinance.”

Figure 1 Nominal GDP Canada

Source: Statistics Canada

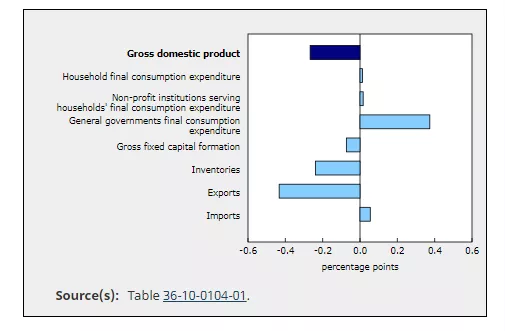

Another way to view this weakness is to note that in 2023 Q3, public expenditures were the only source of positive growth. Declines in exports, inventories, and business investment overpowered the meager growth generated in the household sector (Figure 2). The economy simply relied upon governments at the Federal and provincial levels to prevent a worsening environment.

Figure 2 Contribution to GDP 2023 Q3 Canada

Source: Statistics Canada

Government deficits are the first victim of a slowdown in economic activity. The federal budget deficit soared to C$19.14 billion (US$14.23 billion) for the first eight months of the 2023/24 fiscal year. By comparison, the Federal deficit was C$3.55 billion in the period from April to November 2022. Year-to-date revenues were up 2.6%, largely reflecting higher personal income tax revenue, Program expenses, however, were up 6.3% due to increases across all major categories of spending, while public debt charges went up by 37.7% largely because of higher interest rates.

To the question: how much does it matter that the deficit has increased so dramatically? Consider the surge in interest costs. Much of the Federal debt load is held by Canadians, either as individuals or within financial institutions and pension funds. So, it is perfectly valid to look at the higher interest payments as a form of transfer payments within the Canadian economy which will, ultimately, be used for consumption or capital investment feeding back into economic growth. The other consideration is the degree to which deficit financing is sustainable in the longer run. Canadian Federal government debt-to-GDP ratio remains one of the very lowest amongst the OECD nations at 106%. The US ratio, by comparison, is currently at 121%, and most EU countries (Germany is the exception) have ratios greater than Canada’s.

Figure 3 Canada's Debt as a Percent of GDP

Source: Statista.com

Given that the government is already spending beyond its revenues, an economic revival can only be generated by the Bank of Canada's interest rate cuts. So far, the Bank has not signaled when rates will begin to fall, thus leaving the economy without any stimulus beyond government spending. As the economy continues to soften, the need for rate cuts will only accelerate.

More By This Author:

The Great Debate In Canada On How Much Immigration Is Needed

What Happens If The Inflation Rate Never Gets Back To 2 Percent?

The Bank Of Canada Needs To Change Horses