When It Comes To The Canadian Dollar The Bank Of Canada Is Caught Between A Rock And A Hard Place

As if managing monetary policy is not enough of a challenge, the Bank of Canada has to keep watch on the soaring Canadian dollar at the same time that the economy continues to languish during COVID-19 lockdowns. Currencies never move independently but against each other. Over the past 12 months, the US dollar has declined by approximately 8% against a basket of currencies, including the Canadian dollar. (Figure 1). After reaching a low of US$0.69, the loonie has been on a steady march upwards and currently trades at US$0.79, creating a real dilemma for the Bank of Canada.

(Click on image to enlarge)

Figure 1 Canadian Dollar/ US Dollar Exchange Rate

Re-iterating a long-standing Bank policy, Governor Tiff Macklem made it abundantly clear that:

“We don’t target the value of the Canadian dollar. We don’t have an objective for the Canadian dollar. We have an objective for the inflation rate. But the exchange rate is a very important relative price in our economy and it affects the competitiveness of our exports. It also affects the competitiveness of other countries’ exports into Canada.” (Dec 16, 2020)”

Exchange rates are a double-edged sword when it comes to dealing with inflation. A rising exchange rate, such as we have seen over the past year, has suppressed increases in the price of imports, supporting the Bank’s inflation goals. Viewed from the export side, the rise in the Canadian dollar is not welcomed, hence the Bank’s dilemma. As the Governor explains:

“When our currency changes for reasons that are unrelated to Canada, in that case, it’s not acting as a shock absorber,” he said. “It’s becoming a force in its own right. It’s not offsetting something else; it’s becoming a force in the economy.”

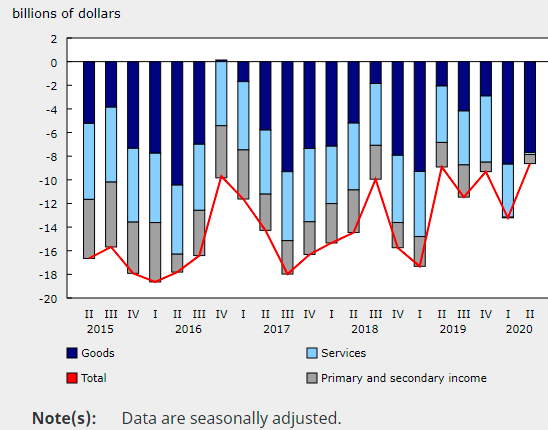

The rise in the Canadian dollar affects both the trade and the capital accounts (the net flows of foreign investment). Canada’s current trade account deficit decreased over the past year because of shrinking levels of both imports and exports (Figure 2).

(Click on image to enlarge)

Figure 2 Canada's Current Account Balance

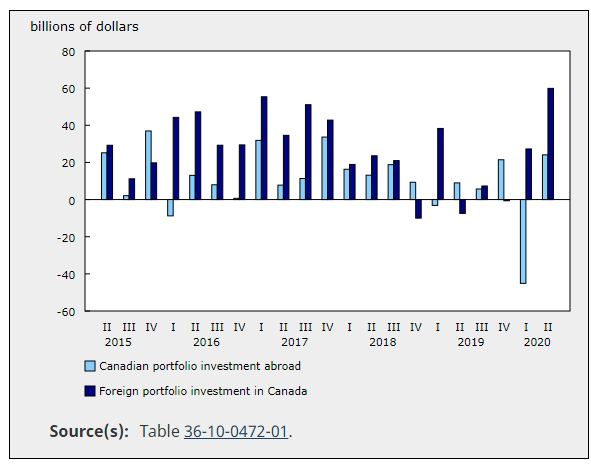

Foreign investors sought out Canadian assets in record amounts last year. They acquired a record C$80.5 billion of Canadian debt securities in the second quarter of 2020, almost twice as high as the previous record of $46.3 billion set in the third quarter of 2017. Foreign investors continue to favor Canadian government debt, given its triple-A rating. Also, overseas buyers purchased Canadian private corporate bonds placed in both Canadian dollars and foreign currencies. Canada continues to record net inflows of foreign portfolio investment (Figure 3).

(Click on image to enlarge)

Figure 3 Foreign Portfolio Investment in Canada

So far, the rise in the Canadian dollar has not materially affected the current and capital accounts, even during one of the most tumultuous years in living memory. But the Bank of Canada now acknowledges that the Canadian dollar is “becoming its own source of drag,” according to Macklem. He goes on to explain that:

“As we make our projections of the Canadian economy, it’s beginning to become a material factor. It’s on our radar screen. In our press releases, we highlight things that are material, that are on our radar screen, and that’s why you’ve seen it in the last couple of press releases.”

Benjamin Tal of the CIBC argues that the Canadian dollar has “no business” at the current level of 79 cents. That is, the trade account fundamentals do not support the current exchange rate (exchange rate too high). Lowering the bank rate has the potential of encouraging foreign investors to sell Canadian dollars and seek higher returns in other currencies. However, The Bank of Canada has consistently resisted lowering the bank rate, currently at 0.25%. Yet, Canada has the highest bank policy rate among industrialized nations and thus has room to cut that rate further. The Bank fears going down the road towards negative interest rates. So, the Bank of Canada is somewhat stuck at this stage of the business cycle, unable to get any real stimulus from cutting rates further, yet deeply concerned that a rising currency only makes the recovery all that more difficult.

Very interesting and educational. Thanks for the post.

My pleasure

nice article Norm

The C$ certainly is too strong for the Canadian economy at this time.

But as you point out, its strength is really the mirror image of the US dollar weakness.

The Fed also does not target its currency.