Weekly Economic Activity In The UK, And Two Self-Inflicted Wounds

So far, the UK economy is plugging along, according to the OECD Weekly Tracker (through Sept. 17). But (understatement of the year), challenges have arisen.

Figure 1: Weekly Tracker (blue), in %. Source: OECD, ECRI and author’s calculations.

The OECD Weekly Tracker reading of 1.4 is interpretable as a year-over-year growth rate of 1.4% for year ending Sept. 17. How well does the OECD Weekly Tracker do for the UK? Here’re two pictures, for quarterly and for monthly GDP (the monthly is official ONS series, unlike US monthly GDP I’ve been reporting, sourced from IHS Markit).

Figure 2: Year-on-year UK real GDP at quarterly frequency (teal), implied from Weekly Tracker (black), in %. Q3 observation is for data through 9/17. ECRI defined peak to trough recession dates shaded light green. Source: OECD via FRED, OECD, ECRI and author’s calculations.

Figure 3: Year-on-year UK real GDP at monthly frequency (teal), implied from Weekly Tracker (black), in %. Q3 observation is for data through 9/17. ECRI defined peak to trough recession dates shaded light green. Source: UK ONS, OECD, ECRI and author’s calculations.

Based on Q2 negative GDP read, and its own forecasts of GDP, NIESR has already declared the UK is in recession (again).

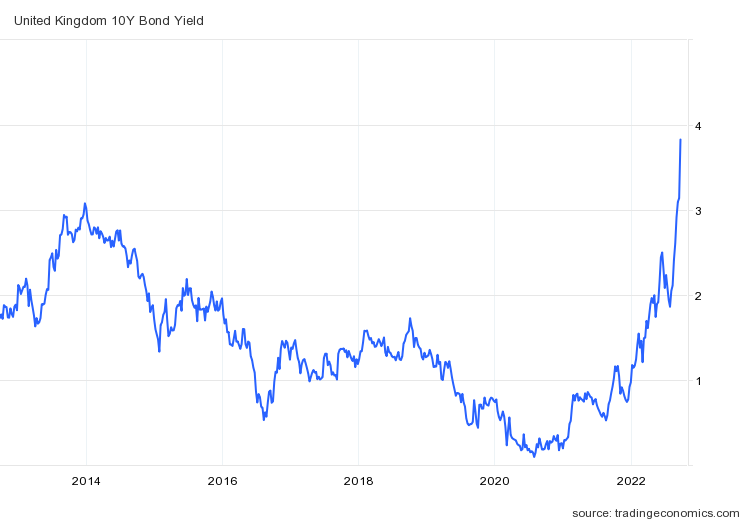

Now, what to think of the (in pretty much everybody’s view ill-conceived) fiscal plan forwarded by the new government? Well, to me, the reaction of financial markets indicates a lack of credibility, insofar as the promised results will actually occur.

Interest rates on 10-year government bonds spiked — which makes sense to the extent that an increase in borrowing colliding with anticipated tightening monetary policy should increase yields.

It’s not clear to me that the increase in yields is purely driven by expectations hypothesis of the term structure; i.e., perhaps some of the increase is due to increase in inflation risk association with nominal bonds (I don’t know where one might get estimates of inflation risk premia for UK gilts).

The drop in the pound’s value against the US dollar is counter-intuitive (at least to me) for a country with government bonds that would be perfectly substitutable with say US government bonds — i.e., a situation where uncovered interest parity would hold. However, if bonds are not perfectly substitutable, then one could resort to a portfolio balance model.

The simplest version would indicate a large expected increase in bond supply would then lead to a depreciation of the currency. And that is exactly what we have seen. While the parameters of the so-called mini-budget are not too different from anticipated, it seems that the announcement of two — rather than one — tax cuts in the context of already big budget and trade deficits is eroding credibility.

All I can say: I’m glad I don’t have to sell this fiscal package to anyone…

Oh, while the first self-inflicted wound is obvious, the second can be seen in the 2016 drop in the pound’s value (happening in June of that year). That decline in the real value of the pound means a deterioration in the UK’s terms of trade...

More By This Author:

Tracking The Euro Area At High Frequency

US, Euro Area And China GDP Over The Pandemic And Recovery

Weekly Economic Activity through September 10th