USD/JPY Price Bearish Below 127.51 Static Resistance, Eying JP Data

The USD/JPY price rebounded in the short term as the US dollar found some slight traction after the corrective downside initiated last week. Unfortunately for the USD, the Dollar Index seems determined to resume its sell-off (FXY, UDN).

As you already know, the DXY is in a corrective phase. A deeper drop could weaken the USD. On the other hand, the Yen Futures was in a rebound, but this could be only a temporary one as the bias remains bearish.

Technically, the USD/JPY pair is in a corrective phase. A larger retreat needs strong confirmation. Now, the price moves sideways. Fundamentally, the US reported mixed data on Friday, while the Japanese Tokyo Core CPI came in worse than expected.

Today, the US Banks will be closed in observance of Memorial Day. Tomorrow, the Japanese economic data could be decisive. The Unemployment Rate is expected to remain at 2.6%, Prelim Industrial Production may report a 0.1% drop, while the Retail Sales could register a 2.6% growth in April. In addition, the Consumer Confidence could jump from 33.0 points to 33.9 points, while the Housing Starts may report a 2.5% growth versus 6.0% in the previous reporting period.

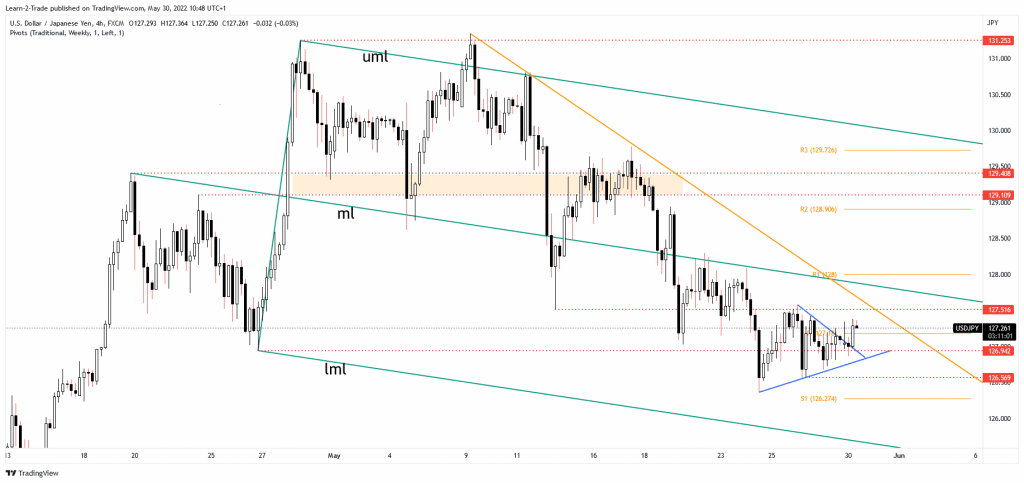

USD/JPY price technical analysis: Ranging

From the technical point of view, the bias remains bearish as long as it stays under the downtrend line. Its failure to make a new lower low signaled that the sellers were exhausted. It has registered only false breakdowns below 126.94. Now, it could approach the downtrend line, which stands as a dynamic resistance. Testing the downtrend line, registering only false breakouts may signal more declines.

On the other hand, making a valid breakout above the downtrend line and through the median line (ml) indicates that the corrective phase is over and that the USD/JPY pair could come back towards a 131.25 higher high. It has escaped from a minor triangle signaling strong upside pressure in the short term.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more