Unlocking ASX Trading Success: Cochlear Limited - Thursday, June 12

COCHLEAR LIMITED - COH Elliott Wave Technical Analysis TradingLounge

Overview:

Our updated Elliott Wave analysis for the Australian Stock Exchange (ASX) focuses on COCHLEAR LIMITED – COH. According to our forecast, ASX:COH may have finished a second wave correction and might be starting a third wave rally. This stage often brings more price gains. In this report, we outline the next price target, the invalidation level, and possible medium-term trend direction.

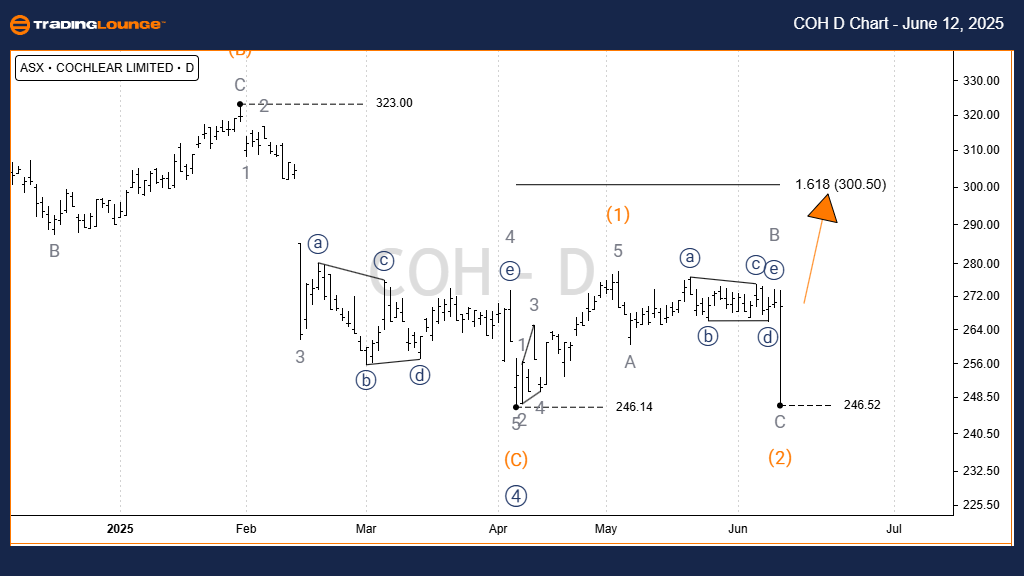

COCHLEAR LIMITED - COH 1D Chart (Semilog Scale) Analysis

- Trend: Intermediate (Orange)

- Wave Mode: Motive

- Wave Structure: Impulse

- Wave Position: Wave 5)) - navy

Analysis Details:

Wave 4)) - navy likely just ended a correction pattern marked A,B,C) - orange. Now, it appears ready for Wave 5)) - navy to rise. This scenario supports a bullish market view, with the next potential target being the prior high from Wave 3)) - navy, near $350.00.

- Invalidation Point: 246.52

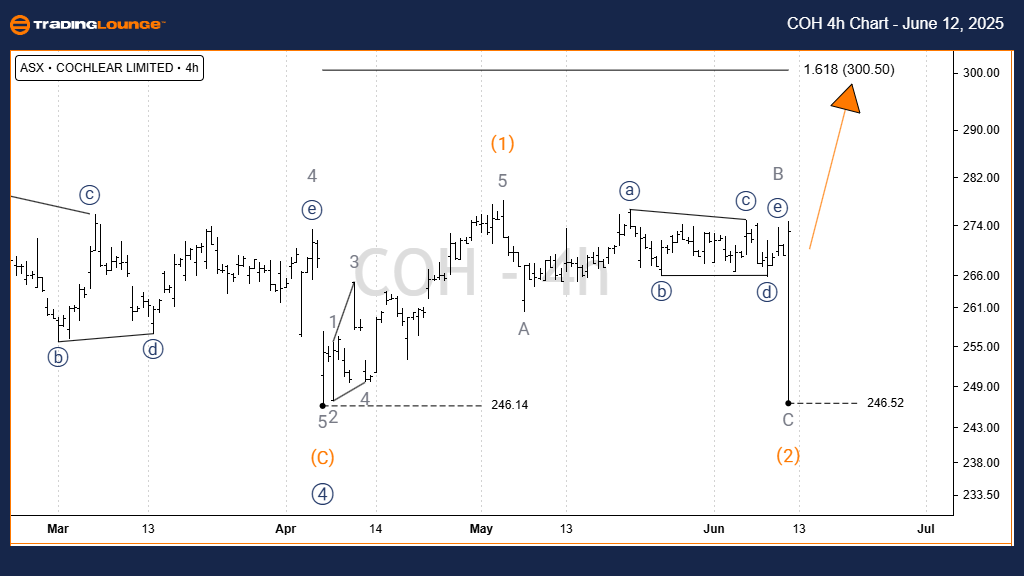

COCHLEAR LIMITED - COH Elliott Wave Technical Analysis TradingLounge (4-Hour Chart)

4-Hour Chart Analysis:

- Trend: Intermediate (orange)

- Wave Mode: Motive

- Wave Structure: Impulse

- Wave Position: Wave B - grey of Wave 2) - orange

Short-Term View:

Recently, after forming a Diagonal pattern in Wave 1) - orange, COH saw a sharp drop in Wave 2) - orange, shaped as a Zigzag. This correction appears to have finished at 246.52 on a clear three-wave count. If this holds, Wave 3) - orange may now be beginning, targeting the short-term price level of 300.50 or higher.

- Invalidation Point: 246.52

Conclusion:

Our forecast aims to clarify the current Elliott Wave position of COCHLEAR LIMITED - COH. With well-defined price levels acting as confirmation or invalidation for the wave structure, our analysis helps traders build confidence in their strategy. The goal is to provide a neutral, professional outlook that supports smart trading decisions.

Technical Analyst:

Hua (Shane) Cuong, CEWA-M (Certified Elliott Wave Analyst - Master Level)

More By This Author:

Palo Alto Networks Inc. U.S. Stocks Elliott Wave Technical Analysis

S&P BSE Sensex Next 50 Index Wave Technical Analysis

Technical Analysis: Euro/U.S. Dollar

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more