Unlocking ASX Trading Success: Car Group Limited - Tuesday, May 27

ASX: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis – TradingLounge

Today’s Elliott Wave analysis presents an update on CAR GROUP LIMITED (ASX:CAR) listed on the Australian Stock Exchange. Based on our recent review, CAR may have just finalized a corrective wave labeled (4) - orange Zigzag. This development suggests potential upside, encouraging a bullish outlook for the stock. This brief technical overview provides a forecast, as well as a critical level that could invalidate this bullish view.

ASX: CAR GROUP LIMITED – CAR

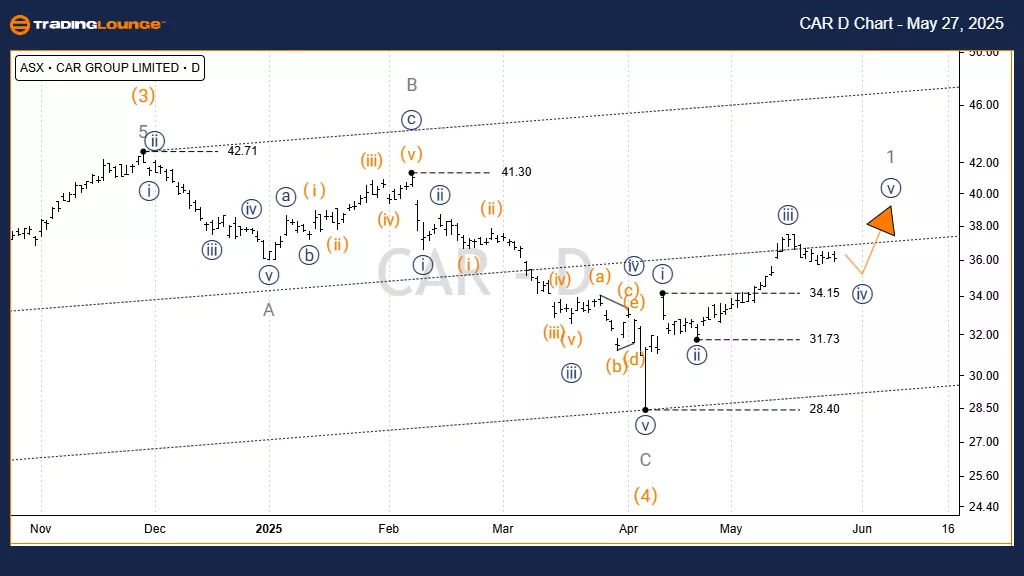

Elliott Wave Technical Analysis – 1D Chart (Semilog Scale)

Function: Intermediate Trend

Mode: Motive

Structure: Impulse

Wave Position: Wave iv)) - navy of Wave 1 - grey of Wave (5) - orange

Details:

Wave (4) - orange started from the high around 42.71 and likely ended at 28.40, structured as a Zigzag (A-B-C - grey).

The C wave - grey consists of five identifiable waves, indicating likely completion.

Wave (5) - orange appears to be unfolding now.

The ongoing wave iv)) - navy is retracing slightly without breaching wave i)) - navy, implying a potential rise through wave v)) - navy.

Invalidation Point: 34.15 (If price falls below this level, the wave count could be incorrect.)

ASX: CAR GROUP LIMITED – CAR

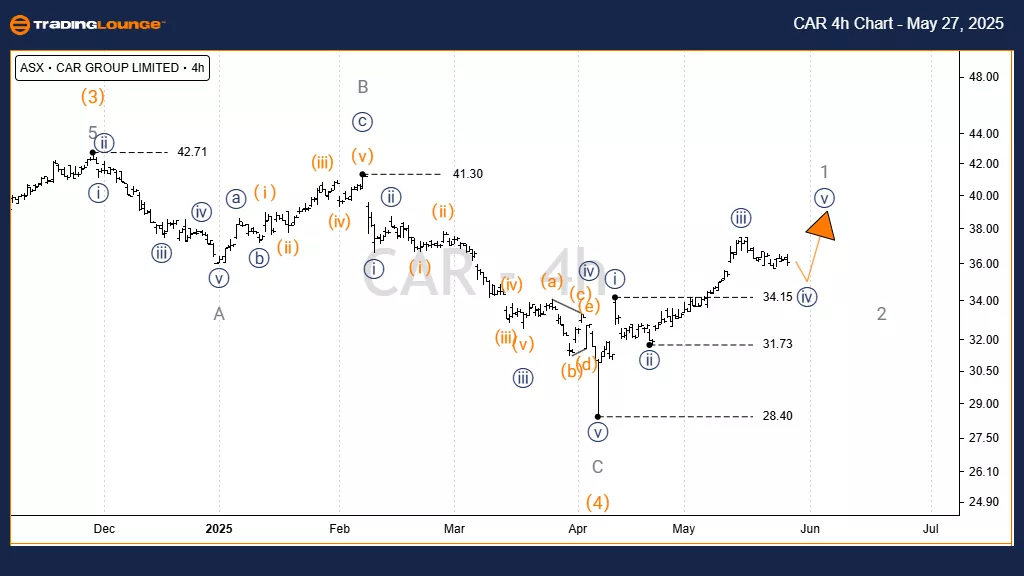

Elliott Wave Technical Analysis – TradingLounge (4-Hour Chart)

Function: Minor Trend

Mode: Motive

Structure: Impulse

Wave Position: Wave ((iv)) - navy of Wave 1 - grey of Wave (5) - orange

Details:

The structure aligns with the daily chart analysis.

Wave iv)) - navy is still forming, showing consistent behavior with no invalid overlap yet.

Invalidation Point: 34.15 (Maintains same critical level for validation.)

Conclusion:

This analysis aims to outline the expected trend of ASX: CAR GROUP LIMITED. By identifying wave counts and specific price triggers, traders gain clarity on how to position effectively. Our review includes validation and invalidation levels that provide solid support to our interpretation of the market. With this professional overview, we aim to support traders in making informed decisions.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Certified Elliott Wave Analyst – Master Degree)

More By This Author:

Elliott Wave Technical Forecast Dow Jones

Elliott Wave Technical Analysis: Tesla Inc. - Monday, May 26

Elliott Wave Technical Analysis: British Pound/U.S. Dollar - Monday, May 26

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more