Unlocking ASX Trading Success: Car Group Limited - Monday, April 14

ASX: CAR GROUP LIMITED – CAR

Elliott Wave Technical Analysis – TradingLounge

Greetings,

Today's Elliott Wave update on the Australian Stock Exchange (ASX) focuses on CAR GROUP LIMITED – CAR.

Our current analysis suggests that ASX:CAR may have recently completed a corrective phase, specifically wave (4) - orange, in a Zigzag form. This scenario increases the likelihood of a bullish continuation. This brief update highlights the potential upcoming trend and critical invalidation level that supports this outlook.

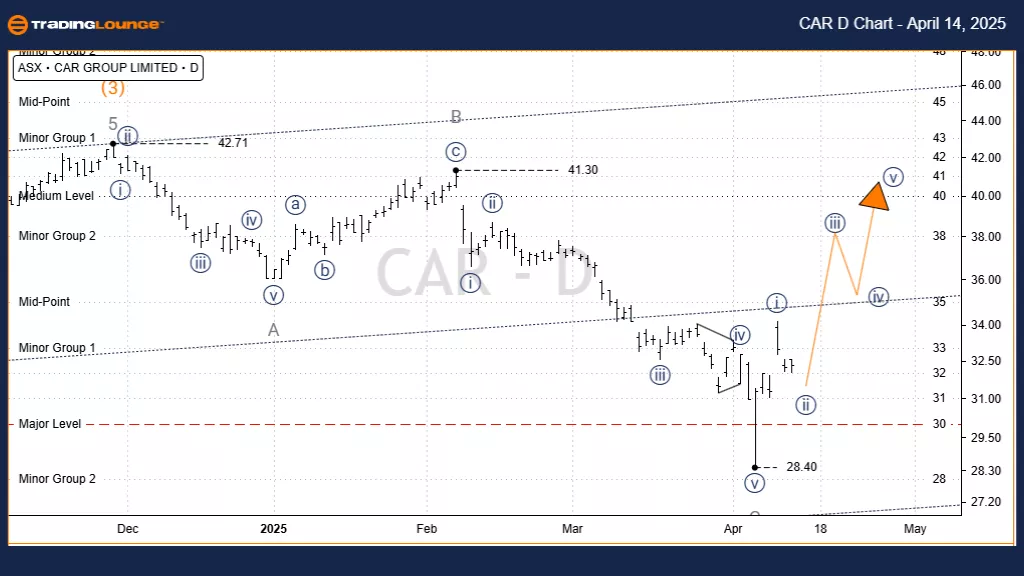

ASX: CAR GROUP LIMITED – CAR – 1D Chart (Semilog Scale) Analysis

- Function: Major trend (Intermediate degree, orange)

- Mode: Motive

- Structure: Impulse

- Position: Wave (5) - orange

Details:

Wave (4) - orange appears to have developed following the peak near 42.71 and may have completed at the low of 28.40 as a Zigzag labeled A, B, C - grey. The C - grey leg contains a completed five-wave sequence, which supports the idea that wave (5) - orange has begun. The first subwave, i)) - navy, seems nearly complete, indicating a likely upward move via the next wave, i)) - navy.

-

Invalidation Point: 28.40 (Price must remain above this level to validate this scenario.)

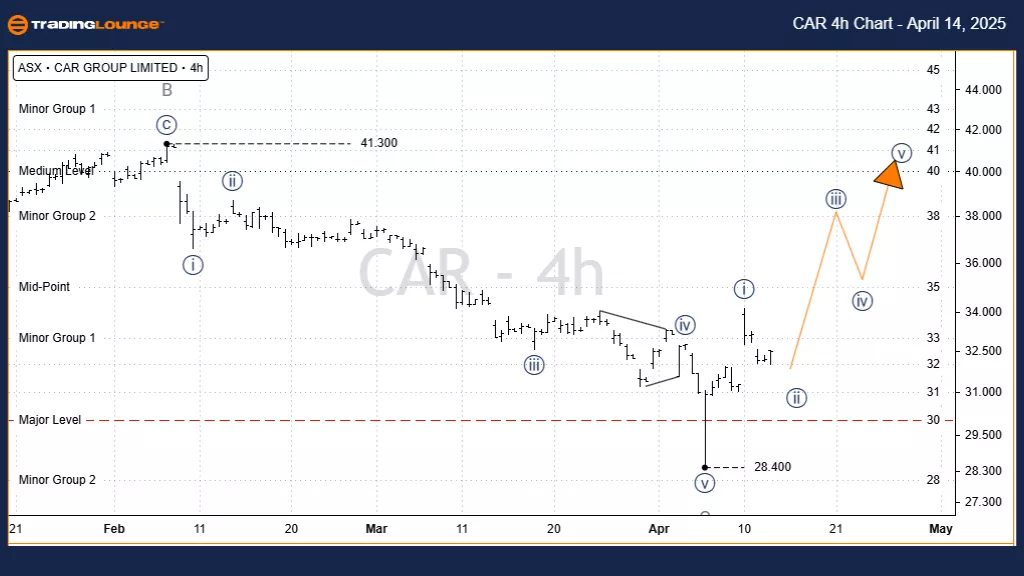

ASX: CAR GROUP LIMITED – CAR – 4-Hour Chart Analysis

- Function: Major trend (Minor degree, grey)

- Mode: Motive

- Structure: Impulse

- Position: Wave ((ii)) - navy of Wave (5) - orange

Details:

From the low at 28.40, wave i)) - navy has completed. Now, wave ii)) - navy is developing and pulling back slightly. This correction may not yet be finished. If so, wave iii)) - navy could follow, with a potential target near the previous high of 41.30.

-

Invalidation Point: 28.40 (Maintaining levels above this price is crucial to confirm this wave structure.)

Conclusion:

This analysis and forecast aim to guide traders by highlighting current market dynamics and identifying key trend signals for ASX: CAR GROUP LIMITED – CAR. Our outlined price levels act as validation or invalidation zones, helping improve the reliability of the wave count and supporting more confident trading decisions. Through this approach, we provide a precise and professional insight into market behavior.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation)

More By This Author:

Elliott Wave Trading Strategies: SP500, Nasdaq & April Tech Earnings Insights

Elliott Wave Technical Forecast: Suncorp Group Limited

Elliott Wave Technical Analysis: Berkshire Hathaway Inc. - Friday, April 11

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more