Elliott Wave Technical Analysis: Berkshire Hathaway Inc. - Friday, April 11

Berkshire Hathaway Inc. (BRK-B) – Daily Chart

Mode: Corrective

Structure: ZigZag

Position: Wave B of (4)

Details: The bounce seen in wave B, following the tariff suspension, is now interpreted as a corrective move, not impulsive. Watching for a top in wave B.

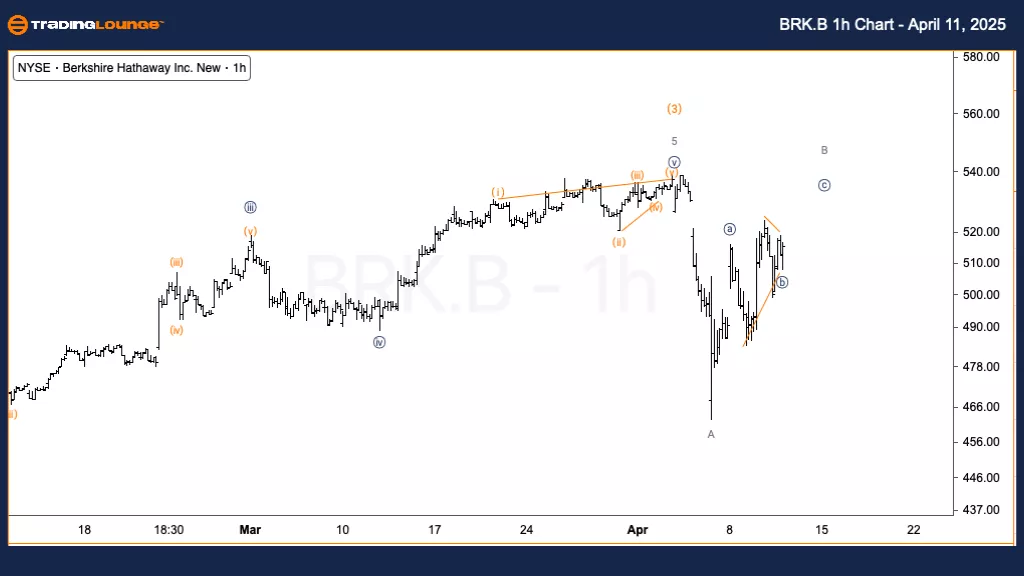

Berkshire Hathaway Inc. (BRK-B) – 1-Hour Chart

Mode: Corrective

Structure: ZigZag

Position: Wave {c} of B

Details: Possibly forming a triangle in wave {b}, leading to an upward extension in wave {c}. This structure supports the overall corrective count. Look for signs of reversal confirming the continuation of the correction.

Berkshire Hathaway (BRK-B) Elliott Wave Analysis – April 11, 2025

This article presents a detailed Elliott Wave analysis of Berkshire Hathaway Inc. (BRK-B) using both the Daily and 1-Hour Charts. The stock is currently moving through a corrective zigzag structure, with Wave B of (4) likely nearing its peak. The reaction to recent tariff news is viewed as corrective, not impulsive. On the 1-hour chart, a potential triangle formation within Wave {b} of B is unfolding, leading into Wave {c}. The analysis guides traders on what signals to watch for, to confirm the corrective structure and identify optimal timing for the next phase.

Technical Analyst: Alessio Barretta

More By This Author:

Elliott Wave Technical Analysis: S&P/TSX 60 Index - Friday, April 11

Elliott Wave Technical Analysis: Cardano Crypto Price News For Friday, April 11

Elliott Wave Analysis: Block, Inc.

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more