Wednesday, September 13, 2023 4:56 AM EST

The monthly GDP numbers have been highly volatile, but we do expect slower growth over coming months as the cooler jobs market and higher rates continue to bite.

Pixabay

The UK economy contracted by half a percent in July, though frankly, these numbers have been all over the place recently.

Remember that output had increased by the same percentage in June, thanks in no small part to a highly unusual surge in manufacturing. That boost to production, which was linked to car production and pharmaceuticals, partially unwound in July. But the hit from there was amplified by the service sector, which saw output fall by 0.5%. Strikes offer part of the explanation, with losses most visible in health. But we also saw declines in a range of other sectors, including IT and admin/support services, and this is harder to explain.

Cutting through the noise, the economy seems to be still growing, albeit fractionally. The change in activity over the past three months relative to the three months before is still slightly positive. We think the economy is likely to more or less flatline over coming quarters – and a mild recession can’t be ruled out.

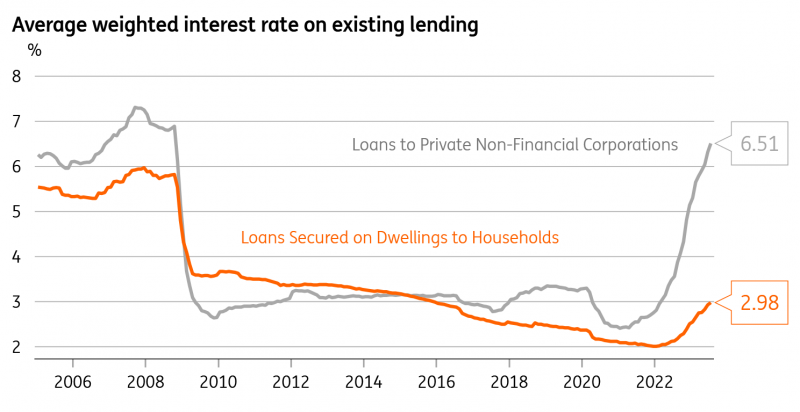

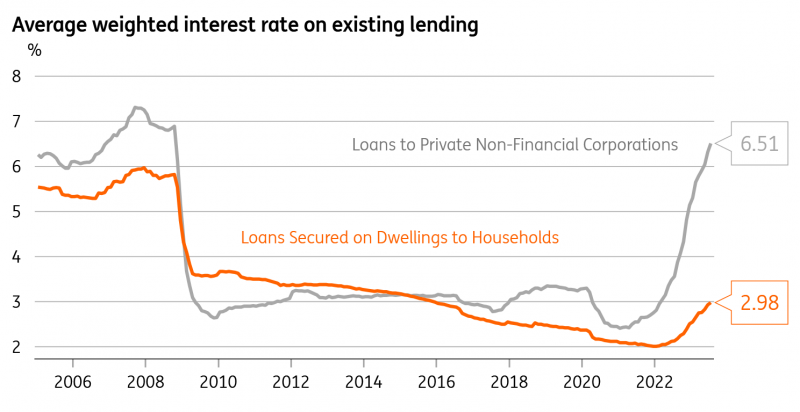

The jobs market is cooling, while the impact of higher rates is still yet to hit the economy. The average rate paid on outstanding mortgages is roughly 3%, up from a low of 2% but well below the 6%+ rates being quoted on two-year mortgages for new lending. As more and more borrowers refinance, we expect the average mortgage rate to rise above 4% in 2024, even without any further Bank of England rate hikes. That’s a gradual process so we don’t expect an abrupt hit to GDP in any specific quarter, but it will act as an ever-increasing drag on consumer spending.

Corporates have felt the impact of higher rates more quickly than households

Macrobond

The caveat of course is that considerably more households own their home outright than 10 years ago (39%), relative to those with a mortgage (28%). Then again, businesses have already felt the full effect of higher borrowing costs, given lending is more typically on floating rates.

Back to this latest data, and given the volatility in the GDP figures, we expect the Bank of England to largely ignore them. Officials have been clear that they are focused on wage growth, services inflation and labour market slack – and not a lot else. We expect one more rate hike at next week’s meeting, before a pause in November.

More By This Author:

FX Daily: Sticky US Inflation To Keep Dollar Bid FX Daily: Muddling Through The UK Jobs Report Is More Dovish Than It Looks

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

less

How did you like this article? Let us know so we can better customize your reading experience.