The UK Jobs Report Is More Dovish Than It Looks

Private-sector wage growth in the UK barely increased in level terms between June and July, and alternative data from payrolls showed a second consecutive fall in median pay. We still expect a rate hike next week but with unemployment rising too, this latest data doesn't scream a need to lift rates much further.

The UK wage numbers are more dovish than they look at first glance

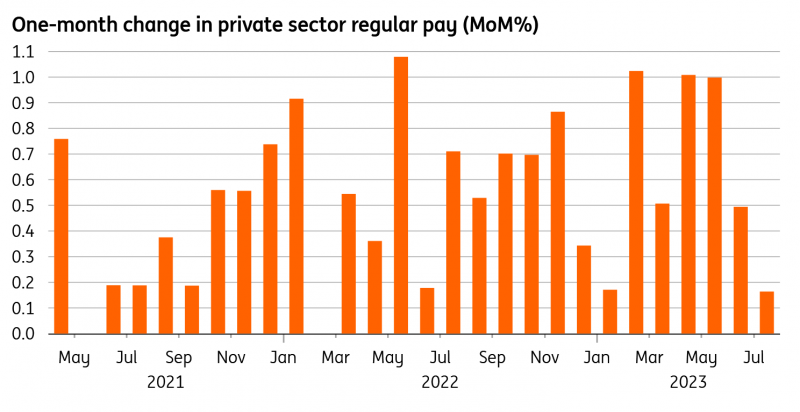

At headline level, regular pay growth stayed at 7.8% on a 3M/YoY basis - no surprises there. But drill down and if you strip out the public sector, private sector pay barely increased in level terms between June and July. And if we look at the alternative wage data which is based on payroll figures (or PAYE), that actually fell in level terms for the second consecutive month.

Admittedly we do need to treat all of this with some caution. One month doesn’t make a trend and the latest private-sector regular pay figure, which is the bit the Bank of England is focused on, was preceded by several upside surprises over recent months.

But it comes alongside various signals that the labor market is cooling more noticeably.

Private sector pay barely increased in level terms

Macrobond

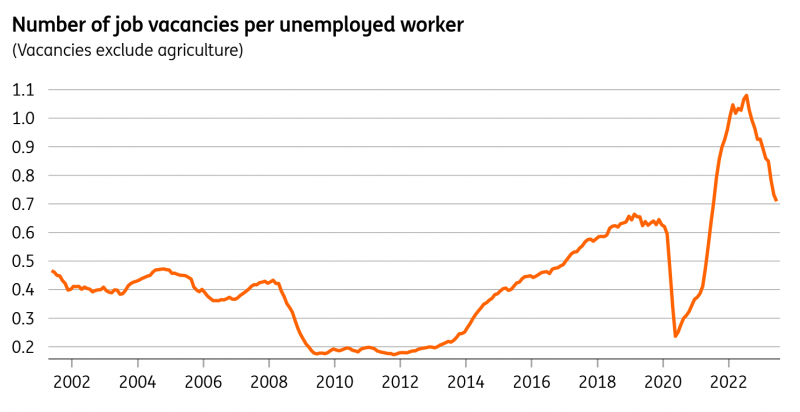

The ratio of unfilled job openings to the number of unemployed workers, a ratio that BoE Governor Bailey has consistently referenced, is falling quickly now and will more-than-likely be back to pre-Covid levels within the next couple of months. Unlike the US, where so far a fall in vacancies hasn’t been paired with an increase in joblessness, the UK is experiencing a undeniable increase in the number of people unemployed for less than six months. Unsurprisingly that tends to trigger increases in longer-term unemployment with a lag.

The vacancy-to-unemployment ratio is falling quickly

Macrobond, ING calculations

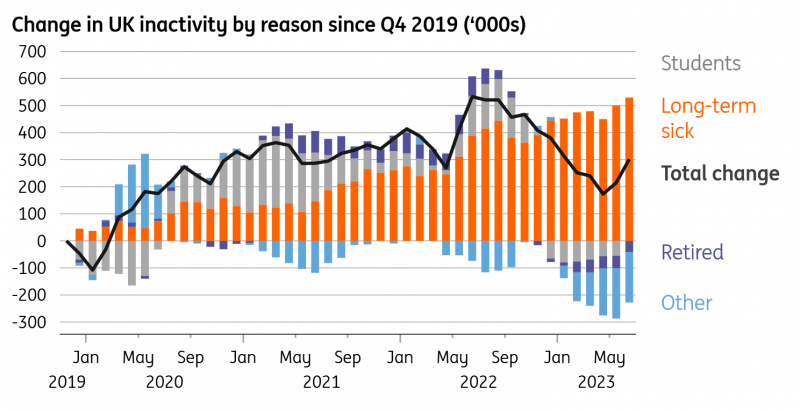

The bottom line is that with the jobs market cooling and wage growth, for now at least, not coming in as hot, the labour market data does not scream a need for the Bank to keep hiking rates much further. The only thing that won’t please officials is that economic inactivity – that is the number of people neither employed nor unemployed – has started to rise again, driven by long-term sickness and a renewed rise in student numbers. In general the data has been saying that worker supply has been increasing, so this is something to keep an eye on.

Worker inactivity has begun to inch higher again

Macrobond, ING calculations

Ultimately we still expect a rate hike next week, but a number of BoE comments suggest that officials are laying the ground for a pause. We don’t totally rule that out next week, though remember we still have a round of inflation data due the day before the announcement. For now our base case is that September’s hike will be the last.

More By This Author:

ECB Cheat Sheet: Is A Hike Hawkish Enough?

Turkey’s Current Account Deficit Widens In July

Asia Morning Bites - BOJ Governor's Remarks

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more