ECB Cheat Sheet: Is A Hike Hawkish Enough?

Markets are torn. Will the ECB hike this week or not? We think it will, but we look at how different scenarios can impact rates and FX. Even in our base case, we suspect that convincing markets that this is not the peak will be very hard, and dovish dissenters may get in the way. The upside for EUR rates and the euro may not be that big and above all, quite short-lived.

(Click on image to enlarge)

As discussed in our economics team’s European Central Bank meeting preview, we narrowly favour a rate hike this week. The consensus of economists is slightly tilted towards a hold, and markets also see a greater chance of no change (60%). In the chart above, we analyse four different scenarios, including our base case, and the projected impact on EUR/USD and 10-year bunds.

We expect to see a more fragmented than usual Governing Council at this meeting. Whichever direction the ECB decides to take, the debate will likely be fiercer than in previous meetings, as lingering core inflationary pressure is being counterbalanced by evidence of rapidly worsening economic conditions in the euro area. Accordingly, expect the overall messaging by the ECB to be influenced not only by the written communication but also by: a) how much President Christine Lagarde manages to conceal growing division and disharmony within the Governing Council during the press conference and; b) any post-meeting “leaks” to the media, which could be used by dissenters to influence the market impact.

Rates: How to convey a hawkish message against macro headwinds

A subdued macro outlook is keeping a lid on ECB hike expectations and this has led to real interest rates, a measure of how the market perceives the ECB’s policy stance, dropping considerably since July. In fact, as the ECB’s Isabel Schnabel pointed out recently, the level of real interest rates out the curve has fallen to levels that also prevailed at the ECB meeting in February, if not even lower.

With the ECB preaching data dependency, it has curbed its ability to make credible commitments with regards to the rates outlook, despite its pledge to keep policies sufficiently restrictive to achieve its inflation goals.

This is why we see the balance of risks still tilted to a hike this week – actions speak louder than words. The market is attaching only a 40% probability to a hike, highlighting some potential to surprise the market. But the market does see an overall probability for a hike at 70% before year-end, which suggests much of the repricing could just be pulling forward future hike expectations, but not necessarily embracing further tightening on top of that. After all, the macro story has not changed and even in the ECB’s own deliberations this week, the weakening backdrop could gain a greater weight.

Markets could sense that this is the likely end of the hiking cycle. Still, the ECB may want to counter the notion that this is the end of its overall inflation-fighting endeavours. The degree to which this is successful will determine how much of a curve bear flattening we get in the event of a hike. A renewed focus on quantitative tightening could help to prop up longer rates on a relative basis. Other means of tightening, such as adjusting the minimum reserve ratios (some ECB members such as Bundesbank President Joachim Nagel see room for action here) would probably have less impact on longer rates.

ECB may be a lifeline not a trampoline for EUR/USD

September’s ECB meeting will be a binary risk event for the euro. Our baseline scenario sees a rate hike, which would translate into a stronger euro in the aftermath of the announcement, as market pricing is leaning in favour of a hold. But with EUR/USD having been on a steady bearish path since the 1.12 July peak, the real question is whether a hike would invert the trend. The short answer is probably not, but there are some important considerations to make.

First of all, it’s worth explaining why we think the FX impact of an ECB hike will be short-lived. One key reason is pricing: markets have doubted the ability of the ECB to hike this week (9bp priced in), but are still factoring in a total of 17bp of tightening to the peak by year-end. Arguably, the ECB hawks won’t have much interest in delivering one hike this week and striking a dovish tone, as the effective tightening via rates would be limited, so they should accompany a hike with openness to do more. However, with economic conditions deteriorating fast in the eurozone and dovish dissent within the ECB growing, it will be hard to convince markets to price in any additional tightening.

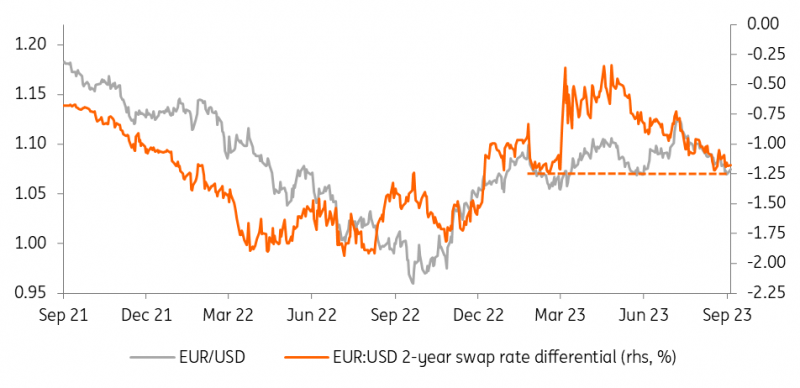

When we look at the 2-year swap rate spread between the euro and the dollar, an important driver of currency fluctuations, we can tell that it has recently approached the -125bp support level (five central bank “lengths” between the Federal Reserve and ECB). Let’s remember that the swap rate tells us the expected average rate for the next two years, so includes expectations for the final moves in the tightening cycle (if any) and rate cuts. What has really driven the recent widening of the spread in favour of the dollar has not been any repricing higher in Fed rate hike expectations, but a downsizing of easing bets in the US for next year.

EUR/USD and short-term swap spread

ING, Refinitiv

With rate hike cycles coming to an end, swap rates are increasingly sensitive to expectations about the timing and pace of easing cycles. Those expectations are, however, far less controllable by central bank communication, and much more dependent on data.

But can the ECB at least show signs of a united hawkish front and convincingly push back against rate cut speculation? (The first ECB cut is priced in for July 2024). If it can, then you have a trampoline for a sustainable EUR/USD rebound, otherwise – and we really think this will be the case – the best President Lagarde can do for the euro is to offer a lifeline.

One way the ECB could, however, end up having a longer-lasting FX impact is via an acceleration in quantitative tightening. However, that obviously comes with non-negligible risks to peripheral spreads, and policymakers may want to tread quite carefully in that sense.

After the short-term impact, EUR/USD should revert to being driven primarily by the dollar leg, or in other words by Fed rate expectations and US data. We still expect a turn higher in the pair, but patience is the name of the game for EUR/USD bulls like us, and more downside corrections even after a potential ECB hawkish surprise are a very tangible risk.

More By This Author:

Asia Morning Bites - BOJ Governor's Remarks

FX Daily: Hawkish Vibes From Asia

Asia Week Ahead: Major China Data Release And India’s Inflation Report

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more