Tuesday Talk: Stocks Still Stoked

Stocks seem stoked and poised to go higher as the three major indices all registered strong gains for the fourth day in a row. Santa Claus is in the house.

Yesterday, the S&P 500 closed at 4,791, up 65 points or 1.38%, the Dow closed at 36,302, up 352 points or 0.98%, and the Nasdaq Composite closed at 15,871, up 218 points or 1.39%. Currently market futures are green. S&P futures are trading up 13 points, Dow futures are trading up 95 points and Nasdaq 100 futures are trading up 80 points.

Monday's top gainers were all Energy and Tech issues.

Chart: The New York Times

In typical tongue-in-cheek style, TM contributor Jesse of Jesse's Cafe Americain sums up the outlook for the last trading week of the year in verse, in, Stocks And Precious Metals Charts - Here Comes Santa Claus - Paint The Tape:

"Stocks were steadily drifting higher on light volumes.

Barring some exogenous event, this is how they like to paint the tape for the end of the year.

If the specs start leaning too hard on the melt-up we might see a wash and rinse, after we see the big houses close their books.

Or before. It's always something.

The Dollar chopped sideways on the 96 handle.

Gold and silver were higher.

VIX of course dropped.

Underneath the markets, a simmering volcano."

See the article for his charts.

Contributor Ron DeLegge reflects on 2021 and looks toward 2022 in a 41 minute video: Recap Of 2021. What Comes Next?

In a TalkMarkets Editor's Choice piece entitled, A Stealth Bear Is Bull, contributor Alex Barrow "lay(s) out the bull case for risk assets over the near-term".

"Large swaths of this market have gone through a stealth bear market of sorts over the last few months. Many of the popular growth names were bulldozed while the indices were kept aloft by the megacaps that continue to act as cash-sweep vehicles for every new dollar added to ETF heavy portfolios...Relative lows hit, well, their lows earlier this month. Close to levels that have marked bottoms of past major selloffs. Yet, the Qs only came as far as 7% off their all-time highs before rebounding (QQQ). This is most likely a short-term bullish thing as we should see the beaten down group continue to revert upwards, giving a tailwind to breadth and the overall market."

Barrow illustrates this in the chart below which shows, "Nasdaq new highs – lows versus how far the market is off its top".

For additional proof Barrow takes a look at the Russell 3000 and concludes:

"The R3K is just off its highs but % of stocks > 50dma are coming off deeply oversold levels that typically mark bottoms. Again, I read this as bullish. The path of least resistance is up, my friends…"

But still in stealth bear mode:

"What can kill this juggernaut of a rally? Inflation, or at least the belief that inflation will stay well above current expectations."

In his article Barrow also takes a look microprocessor maker Micron Technologies (MU), EUR/USD (FXE), Corn (CORN), Argentinian Agtech firm, Bioceres (BIOX) and potash producer, Intrepid Potash (IPI).

Two concerns going into 2022 on the minds of TalkMarkets contributors are Wage Inflation and the Chinese economy.

TalkMarkets contributor John Rubino says Wage Inflation Might Shock The World In 2022.

"(In 2020, when COVID-19 hit)...governments – not understanding the genie they were letting out of the bottle – told millions of Millennials to stay home for an entire year...As the pandemic winds down (in 2021), companies are calling their former drones back, and a shocking number are saying “no thanks.” Jobs are going unfilled, orders unshipped, and customers unsatisfied."

"...the financial point of the story, is that employers are going to have to pay up, in many cases waaayyy up, to put the hamsters back on their wheels... yes, some parts of the current inflation spike are “transitory”, including base effects and certain commodity prices. But rising wages might have long enough legs to keep overall inflation elevated for years. If so, the Fed will be under increasing pressure to raise interest rates for real instead of just promising to act someday."

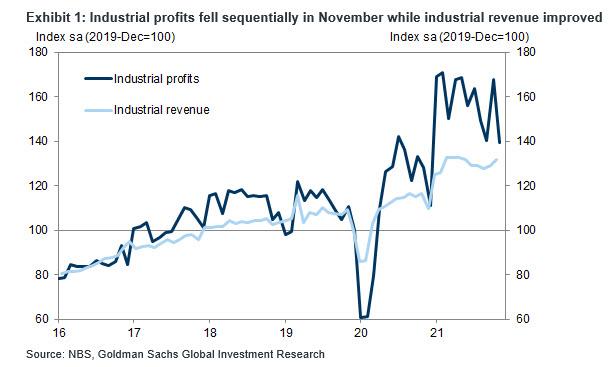

In Chinese Industrial Profit Growth Tumbles As Raw Material Prices Plunge, contributor Tyler Durden notes:

"Profit growth at China's industrial firms tumbled in November, pressured by plunging prices of some raw materials, a faltering property market, and weaker consumer demand, the national bureau of statistics said on Monday. Overall, profits rose just 9.0% on-year in November to 805.96 billion yuan ($126.54 billion), a drop of more than half from the 24.6% gain reported in October...In sequential terms, profits contracted 16.8% mom in November after seasonal adjustment, after a sharp rebound of +19.7% in October."

"...the traditionally close relationship between China's wholesale prices (PPI) and Industrial Profits is reestablishing itself, only this time it will lead to downside pain as PPI tumbles thanks to the recent plunge in coal prices following aggressive state intervention which confirmed that China's "green" talk is nothing but one giant joke...China's economy, which lost steam after a solid recovery from the pandemic last year, faces multiple challenges as a property downturn deepens, supply bottlenecks persist and strict COVID-19 curbs hit consumer spending. The country's property distress has also hurt the steel sector while production of cement, glass, and household appliances remains vulnerable to falling demand. It has led to speculation Beijing will cut its 2022 GDP forecast to as low as 5% (while the real number will be even lower)."

Closing out the column today, contributor Kevin Mahn, in another TM Editor's Choice column, looks at what he thinks will be the Top 10 Investment Themes For 2022.

They are (in abbreviated format) as follows:

Investing For A Rising Rate Environment

...The “Dot Plot” chart that was released after the Fed's December 2021 FOMC meeting shows the median forecast of FOMC voting members projecting three rate hikes of 25 Bp each in 2022, another three rate hikes of 25 Bp each in 2023, and two additional rate hikes of 25 Bp each in 2024. While it seems unlikely that there will be three rate hikes in 2022 at this time, and those that do occur will likely occur no earlier than the 2nd quarter, it is fair to conclude that we are entering a rising rate environment. Asset classes that have historically performed well during periods of rising interest rates include, but are not necessarily limited to, equities, high yield bonds, precious metal miners, and convertible bonds.

The E-commerce Growth Story Continues

...It is also estimated that a record $207 billion will be spent online in the U.S. during the 2021 holiday shopping season. Additionally, it is forecasted that E-commerce will account for nearly 22% of all retail sales globally by the end of 2024... In our view, opportunities exist for traditional E-tailers and other companies that derive revenues from their role in the overall E-commerce ecosystem, such as payment providers, Industrial REITs, and air freight & logistics firms.

Financials Positioned To Perform As Rates Rise And The Economy Expands

...notably the smaller-cap regional banks and mortgage and thrift institutions, is also worthy of investment consideration as technology transforms the banking industry, enhancing operational efficiencies and profitability...ongoing trends in technology advances and consumer preferences will likely keep industry consolidation at an elevated level throughout 2022...Financials historically have strong performance in a rising rate environment when economies are expanding.

Sustainable Impact Investing Attracts More Retail Investors

...We believe that sustainable impact investing strategies will attract more and more attention from retail investors in 2022 and beyond, as retail investors prioritize whether companies treat their employees well, give back to their communities, and are good stewards of the environment...it is important to appreciate that sustainable impact investing allows investors the opportunity to incorporate the Environmental, Social, and Governance (ESG) ratings of a company...into the portfolio selection process.

Continued Demand For The Tax-Free Income Of Municipal Bonds

...21% of outstanding tax-exempt debt will mature or be called by the end of 2024 and 31% by the end of 2026...it is hard to imagine that there will be enough new supply to offset all the matured or called municipal bonds...(with) increased demand anticipated for the tax-free income associated with municipal bonds if/when personal income tax rates are raised, and the existing supply/demand imbalance for municipal bonds will likely continue and perhaps even widen.

Big Pharma (And The World) Needs Innovative Healthcare Solutions From Biotech

...innovative solutions typically come from smaller-cap Biotech firms, which are often pursued as take-over targets by larger-cap pharmaceutical companies...acquisitions slowed in 2020 ...and remained sluggish in 2021...As things return more to normal in 2022, perhaps Biotech M&A activity will as well. PwC...are forecasting exceptional M&A activity in 2022.

Technological Innovation Remains Critical For An Evolving Society

...revolutionary technologies, such as artificial intelligence, robotics, blockchain, cybersecurity, and even 5G, will be of paramount importance to individuals, corporations, and governments. Companies across multiple market capitalizations that are proven innovators and deliver or utilize these types of revolutionary technologies most effectively will best be able to adapt to our ever-evolving society.

Don’t Discount The Potential Of Dividend-paying Stocks

According to the Hartford Funds, dividend income’s contribution to the total return of the S&P 500 Index averaged 41% from 1930–2020. During certain time periods, the contribution percentage was even greater, such as the decade of the 1970s (a decade when total returns were low by historical standards) when dividends accounted for 73% of the total return of the S&P 500...find the stocks of large-cap, mid-cap, and small-cap domestic, as well as...companies across the globe with competitive advantages, future earnings growth, and stock price appreciation potential, strong balance sheets, and a history of increasing their dividends...

Consider Preferred For Income Potential

...preferred securities represent ownership in a corporation and have both bond and stock-like features. Often referred to as “preferred stocks,” preferred usually pay a fixed income, have a par value, hold a credit rating, and trade on a major exchange...most important to income-oriented investors, preferreds also have dividends paid out before dividends to common shareholders and typically have a higher stated dividend payout than the corporation’s common shares...In some instances, preferred securities provide qualified tax treatment of their dividends, creating an additional benefit to income-seeking investors...

Infrastructure Spending May Help Propel Growth To Value Rotation

Traditional infrastructure spending in the areas of surface transportation, broadband access, and electrical grid upgrades were all part of the infrastructure spending bill that was... signed into law in 2021...On the equities front, Communication Services, Energy, Industrials, Materials, and utility sectors seem poised to benefit from the expenditures. These value-oriented, cyclical sectors should also help with the Growth-Value Rotation that started early in 2021, slowed in the middle of the year, and then gained some new momentum at the end of the year heading into 2022."

I'm off this Thursday. I'll see you in 2022.

Have a happy and safe New Year!