Tuesday Talk: Higher Amid Horror

The West condemns and the war goes on. The stock market rose higher on Monday even as Russian war horrors in Bucha, Ukraine were making headlines. Amidst the chaos Elon Musk stepped in and increased his stake in Twitter (TWTR) to become the company's largest shareholder, holding 9.2%. Musk's action helped drive markets higher across the board.

Yesterday, the S&P 500 closed at 4,583 up 37 points, the Dow closed at 34,922, up 104 points and the Nasdaq Composite closed at 14,533 up 207 points. Most active issues were largely, higher, too, led by Twitter which gained 27%.

Chart: The New York Times

In morning trading market futures are red, S&P futures are trading down 11 points, Dow futures are trading down 88 points and Nasdaq 100 futures are trading down 41 points.

TalkMarkets contributor Frank Holmes notes that current events call for Questioning The Merits Of Globalization.

"Globalization in all its forms, from social to economic to political, has been on the rise since about the 1970s, and I genuinely believe it’s had more benefits than drawbacks on average. Although it may seem hard to believe right now, the real cost of finished goods has trended down over the decades, and there’s evidence that the world has become more peaceful, with fewer wars and war-related deaths than in years past...

It goes without saying that the events of the past two years, including the U.S.-China trade war, the COVID pandemic, and now the Russia-Ukraine war and international sanctions, have challenged the merits of globalization...

Russia’s invasion of Ukraine “has put an end to the globalization we have experienced over the last three decades,” says Larry Fink, co-founder, and CEO of BlackRock, the world’s largest asset management firm. In last week’s letter to shareholders, he adds that “companies and governments will also be looking more broadly at their dependencies on other nations” as a result of not just the war but also the pandemic. “Nearshoring,” the practice of moving business operations closer to home, could benefit Mexico, Brazil, and even the U.S."

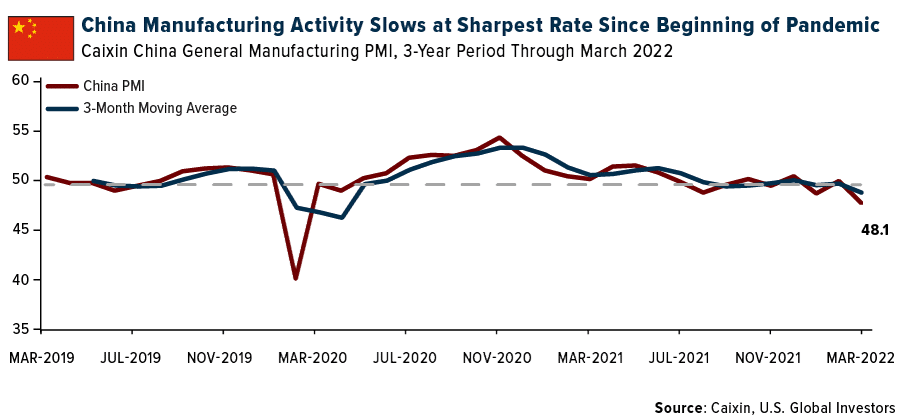

Holmes goes on to discuss the issues confronting China (largely due to COVID) particularly with regard to manufacturing and shipping, as well as suggesting hedging investment bets in precious metals.

"With shipping rates on the rise, I would be taking a long look at container shipping stocks, including Maersk (AMKBY). The group generated record profits last year as rates tripled on a pandemic-related demand explosion. Global disruptions, from the ongoing pandemic to war in East Europe, means that rates may remain elevated for some time longer.

Precious metals such as gold and silver also continue to look attractive. As of last month’s close, gold posted its best quarter since June 2020 on safe-haven demand (GLD)."

Contributor Mike Zaccardi takes a look at QT actions in Global Policy Tightening: Headwinds Rising. Zaccardi is cautious regarding optimism in upcoming quarter.

- "The second quarter will undoubtedly feature an acceleration in the trend of higher central bank policy rates

- The US Federal Reserve will also begin reducing the size of its balance sheet

- People are not confident and investor sentiment is souring despite steadying oil prices and a bounce in stocks

...here we are in Q2—fully in the midst of a globally coordinated effort to hike rates and tighten credit conditions..."

"Last year alone, there were 123 policy rate increases across 41 central banks. Q1 featured another 67 hikes. By the way, the FOMC is expected to announce quantitative tightening at next month’s meeting. No doubt, monetary policy is a huge headwind for the balance of 2022...

But everyone knows interest rates are on the rise...What’s not talked about as much could be a bigger story as we navigate the second quarter – worsening/tightening financial conditions. With higher rates comes more uneasiness to extend loans. Just look at the latest US 30-year fixed-rate mortgage figure – near 4.9%. That’s about 250bps above the benchmark 10-year Treasury note yield (a widespread by historical averages)...

Bottom Line: While stocks have bounced sharply from their mid-March lows, many headwinds remain. Not the least of which is a global effort to whip inflation by hiking rates and tightening credit conditions. We assert that equities are left in a vulnerable position."

TM contributor Keith Weiner in a piece entitled Oil, The Ruble, And Gold Walk Into A Bar… discusses current banter about Russia's ruble strengthening strategy to dethrone the dollar.

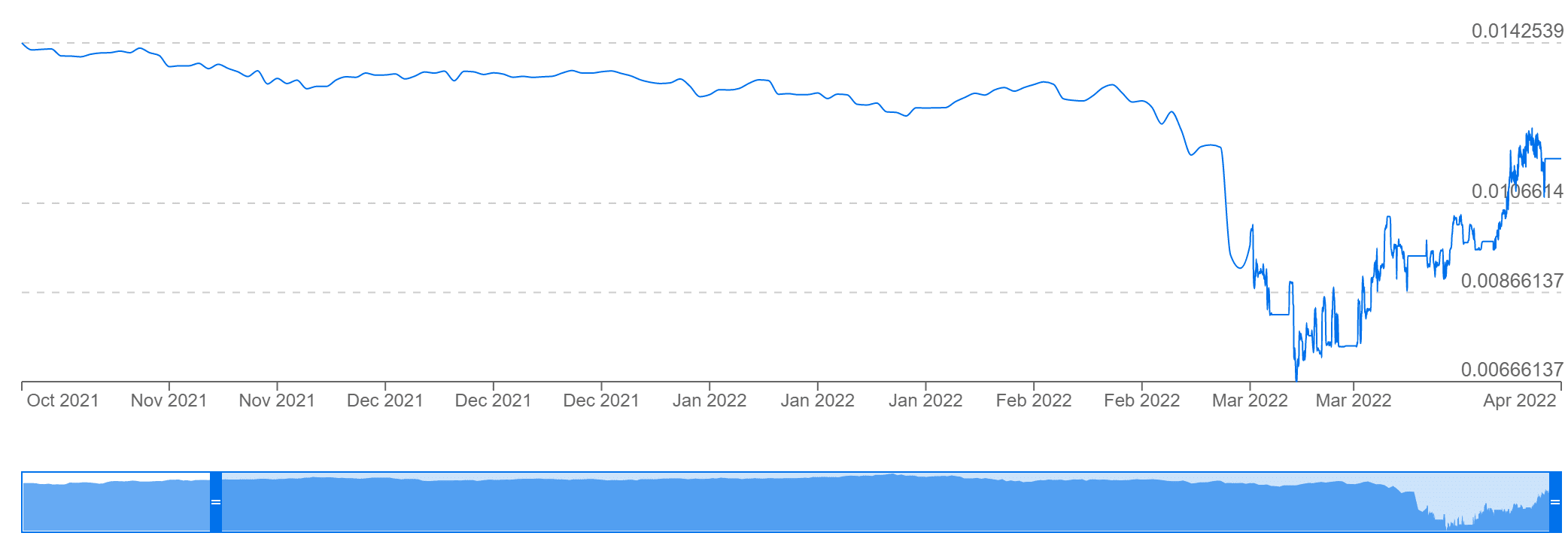

"There is a Narrative about Russia and how it will change the monetary system. Many analysts in the gold community are promoting this story...The basic premise of this Narrative is that Russia will create a new gold standard, the dollar will crash, and of course, gold will go to the moon...The Narrative starts with the fact that Russia’s central bank is now buying gold from Russian commercial banks, at a price of 5,000 rubles per gram. 5,000 rubles is worth $58.31 as of market close on Friday, April 1. Let’s pause here to look at a graph of the price of the ruble."

Price of the Ruble

Source: xe.com

Last October, the ruble was around 1.4 cents (yes, it was a toilet paper currency even long before the Ukraine war). It slowly slid to 1.3 cents—which is a loss of 9%, by the way! Then it crashed to 0.66 cents on March 7. Since then, it has bounced to a high of 1.2 cents before leveling back down to 1.1 cents. Some analysts are trumpeting that it recovered its previous level. As of market close on Friday, April 1, it had not...

In global markets, a gram of gold is worth $61.89 (april 1) . In other words, the Russian central bank is paying 6% below the market price...(However) Russian gold is no longer accredited as “good delivery”. We could not find data on the magnitude of the discount on its gold, but for the same reasons as with (Russian) oil, it must be substantial to induce buyers to take the risks...

Sanctions have impaired Russia’s ability to trade the dollars for rubles in the market. Russia is (partially) locked out of the market. So, it gets Europe to do that trade for them...The normal oil case is Europe pays Russia dollars. Then Russia trades the dollars for rubles. The negotiated case is Europe trades the dollars for rubles and remits them to Russia. In order for the ruble to rise against the dollar, people would have to change their preference from holding dollars to holding rubles. Is this happening, or likely to happen?"

See Wiener's article for the fuller version.

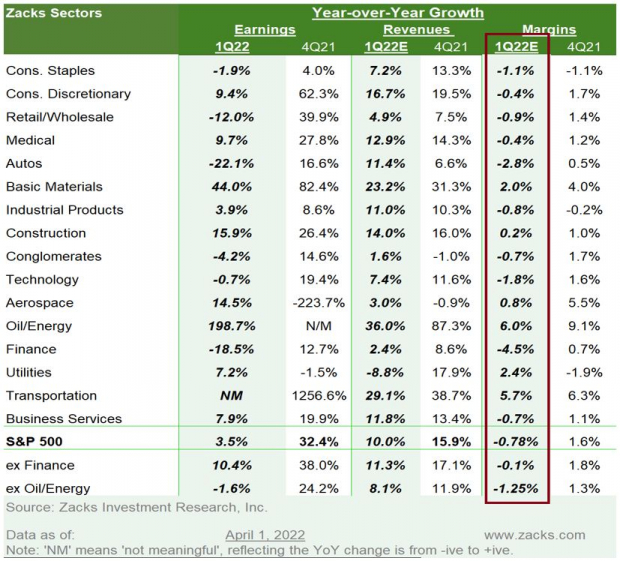

TM contributor Sheraz Mian gives a detailed preview of the Q1'22 earnings seasons in a TalkMarkets Editor's Choice piece entitled Making Sense Of The Earnings Uncertainty. It is worth the read. I have excerpted the Zacks Sectors Q1 estimates for revenue, earning and margins.

"In the aggregate, 2022 Q1 estimates for the S&P 500 index are up +0.1% since the start of the quarter. However, if we look at the revisions trend on an ex-Energy basis, Q1 estimates for the rest of the 15 sectors are down -1.3% since the start of the quarter...Excluding the positive revisions to the Energy sector, total S&P 500 earnings for 2022 would be down -11.9% since the start of January. The biggest declines have been for the Consumer Discretionary, Transportation and Utilities sectors...For Q1, margins are expected to be below the year-earlier level for 9 of the 16 Zacks sectors, with strong margin gains for three sectors (Energy, Transportation and Basic Materials)...the growth picture has shifted materially for the Finance and Technology sectors, the two biggest earnings contributors to the index. Total Finance sector earnings are expected to be down -18.5% from the same period last year on +2.4% higher revenues while Tech sector earnings are expected to be down -0.7% in Q1 on +7.4% higher revenues."

In the "Where To Invest Department" contributor Bryan Hayes wonders Is It Time To Give Chinese Stocks The Green Light?

"Chinese stocks opened notably higher to kick off the week and have rallied sharply off the March lows. Many investors have allocations in their portfolios to emerging markets which normally include exposure to China. After a long and gut-wrenching decline spanning over a year that has tested even the most patient of investors, the question now is – are Chinese stocks ripe for a turnaround?...

On a relative basis, the KraneShares CSI China Internet ETF has been steadily underperforming the Nasdaq over the past year."

"The issues in China translate to problems for investors in diversified emerging market equities. In recent years, China has become much larger in terms of weight in several widely-used emerging market funds. Index providers have steadily increased their exposure to Chinese equities, an ostensibly active decision that may be a shock to passive investors.

The notion of China weighing down emerging markets is far from a new reality. While certain emerging markets may represent attractive valuations for the value-focused investor, notice how emerging markets have fared much better when we strip out China."

Image Source: StockCharts

"While investing in some of the beaten-down Chinese names may be tempting, ideally we’d like to see this ratio turn the corner and show some signs of improvement before increasing exposure. Risks are still high for Chinese equities and better opportunities exist in the current investment landscape. Rather than attempt to catch a falling knife, it’s likely a better idea to wait for more signs of a turnaround."

Hayes has included the Caveat Emptor warning in his concluding remarks, already.

Hope you find some nice Spring weather to brighten your day. I'll be back on Thursday.