Thoughts For Thursday: Dip N Dip

Less sweet than the international dessert chain of the same name, the market continues to dip 'n dip, day after day.

Image: YouTube

Yesterday, the market worked diligently to rally upwards, but ultimately failed and closed down lower. Today, it will try to reach higher, again. On Wednesday the S&P 500 closed at 4,533, down 44 points or 0.97%, the Dow closed at 35,029, down 340 points or 0.96% and the Nasdaq Composite closed at 14,340, down 165 points or 1.15%. Currently market futures are trading in the green, S&P futures are up 14 points, Dow futures are up 116 points and Nasdaq 100 futures are up 54 points.

The daily and monthly charts below clearly illustrate the current dip 'n dip state of affairs:

Charts: The New York Times

Yesterday's top loser was Ford (F) which closed at $22.45, down 7.9%. TalkMarkets contributor Melanie Schaffer says Ford's Stock Pulls Back, But Here's Why Bulls May Soon Regain Control.

Photo: Courtesy of Mike Mozart on Flickr

"If the stock falls to fill the gap (between $21.88 and $22.42) and prints a reversal signal near a support level at $21.69, it could provide a solid entry point for investors waiting to take a long position over 2022 as the legacy automaker continues to ramp up its electric vehicle production...On Wednesday, Ford broke bearishly from an inside bar pattern, which likely spooked some investors. The fall lower, however, was made on lower-than-average volume intraday, which suggests that the long-term uptrend is likely still intact."

"Bulls want to see the move lower consolidated on low volume and then for big bullish volume to come in and push Ford back up over the eight-day EMA. There is resistance above at $23.52 and $24.71. Bears want to see big bearish volume come in and drop the stock below support at $21.69 and then for momentum to push Ford below the most recent weekly higher low to negate the long-term uptrend. Ford has further support at $20.51 and $18.99."

Contributor and chartist Chris Kimble notes that Nasdaq Weakness Has Bears Circling Tech Stocks.

"One theme we have often seen over the past several months has been tech stocks' under-performance...Today’s chart focus is on the ratio of the Nasdaq Composite to the S&P 500 Index."

"...there’s a potential that the ratio double topped last year at the 2000 highs. And weakness this month has it attempting to break dual support at (2). The good news is that the ratio is in a rising up-trend marked by each (1). This is long-term bullish. The bad news is that there’s room for a bigger decline if support at (2) breaks...Further weakness at (2) would send a negative message to technology stocks (and the broader market). Stay tuned."

Looking at the bullish side of all things Nasdaq, contributor Sean at WarriorTrading weighs in on Microsoft’s Big Bet On Activision Blizzard.

"Microsoft is buying Activision for $95 per share in an all-cash transaction that values the video game maker and interactive entertainment content publisher at $68.7 billion (it's biggest acquisition to date). The per-share bid represents a 45% premium to the $65.39 closing price of Activision stock on Friday, Jan. 14...The deal is a strategic one for both companies: It comes amidst a string of sexual harassment allegations at Activision while also boosting Microsoft’s presence in the gaming space."

"By buying Activision, Microsoft gives itself a major platform to increase its gaming revenues. Microsoft will own Activision, Blizzard, and all of its subsidiary studios including Digital Legends, Beenox, High Moon Studios, Radical Entertainment, Demonware, Infinity Ward, Sledgehammer Games, King, Toys for Bob, Major League Gaming, Treyarch, and Raven Software. It also takes over popular game franchises including “Call of Duty,” “Overwatch,” “Candy Crush,” and “World of Warcraft” in addition to major game studios like Treyarch and Blizzard Entertainment. Microsoft plans to add franchises into its GamePass streaming service, which has over 25 million subscribers, across both Xbox and PC.

The deal comes just days after Take-Two Interactive (TTWO), the maker of the popular Grand Theft Auto game series, scooped up rival Zynga (ZNGA), the maker of “Words with Friends” and “FarmVille,” for $12.7 billion. Following the closing of the transaction, Microsoft (MSFT) will become the third-biggest gaming company by revenue in the world, behind Japan’s Sony (SONY) and China’s Tencent (TCEHY)."

"...the acquisition cements Microsoft’s big lead over other tech companies...Wedbush analysts said the acquisition will “help jump start Microsoft’s broader gaming endeavors and ultimately its move into the metaverse with gaming the first monetization piece of the metaverse"

Take that, Nasdaq bears.

Shifting focus from US markets the column takes a look at what some TalkMarkets contributors have to say about Asia. In a globally entwined world, when someone sneezes here, someone over there catches a cold, as the saying goes.

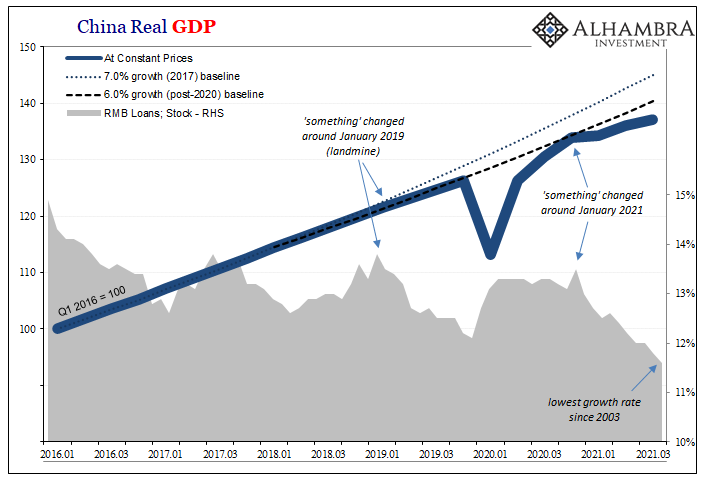

TM contributor, Vivian Lewis in her Wednesday File says quite simply, "It sounds odd but the real threat to markets is slowing Chinese growth which fell to 4% in Q4 from double that earlier last year. What started out as an attempt to chop real estate speculation has turned out to be a broad negative for the economy."

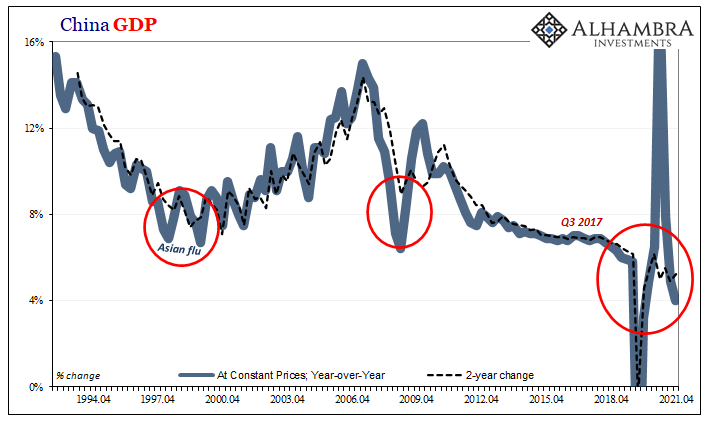

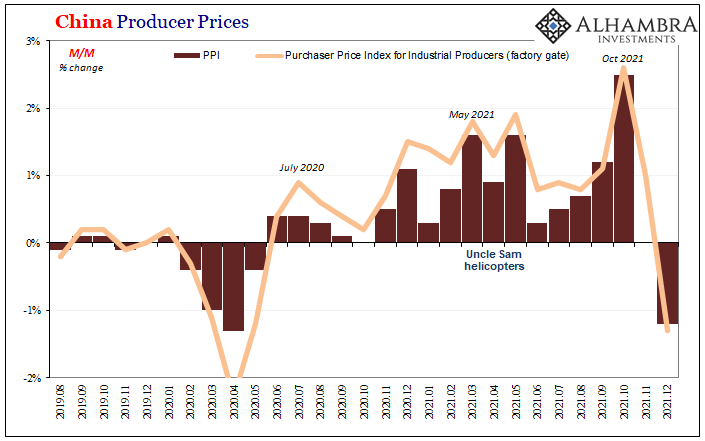

In a TalkMarkets Editor's Choice article contributor Jeffrey P. Snider asks What Kind Of Tiger ‘Needs’ Wings?. In his article, Snider through the use of several charts, paints a less than rosy picture of the state of the Chinese economy and its implications for other world economies. The title is a reference to President Xi's remarks at the recent 2022 Davos conference.

"Xi Jinping began his sermon this year with a doozy of a downer. He told his audience...how in two weeks it will begin China’s Year of the Tiger. The great cat symbolizes “bravery and strength” to the Chinese people who often, Xi said, pair the “leaping tiger” alongside the “soaring dragon” both together symbolizing the one-half of the binary nature of this our globalized economic system.

We need not guess to which of those options the “spirited dragon and dynamic tiger” might refer. But Xi claimed that this year we all must instead make sure to “add wings to the tiger.” Huh? What kind of sickly beast is this?...You can only spin so much before such context of a wingless and ailing tiger cuts straight through such semantic reflexiveness."

Time to go to the charts.

There are several more charts in the full article, but it is clear that China has a cold and signals as Snider writes: "the decaying tiger (is) in need of a lift just to keep from sinking further toward the abyss."

Elsewhere in Asia, the Staff at contributor Equitymaster India rounds out this morning's column with a look at today's trading in Mumbai where the Sensex Loses The Psychological 60,000-Mark, Dips 900 Points; Finance & IT Stocks Bleed.

"Share markets in India have extended early losses and are presently trading deep in the red. Taking the recent fall to the third straight day, benchmark indices extended losses amid persisting concerns over inflation and Fed rate hikes. Back to Indian markets, the BSE Sensex lost the psychological mark of 60,000 while the NSE Nifty was trading below 17,700 levels. Presently, the BSE Sensex is trading down by 925 points, down 1.5%. Meanwhile, the NSE Nifty is trading down by 265 points. The selling is seen across major sectors, particularly in the IT, energy and finance stocks. The fall on broader markets is less severe. The BSE Midcap index is down 0.5%, and the BSE Smallcap index is down 0.2%."

Here's hoping for a more persevering rally in the US markets, today.

Have a good one. I'll see you on Tuesday.