The Myth Of Pent-Up Demand

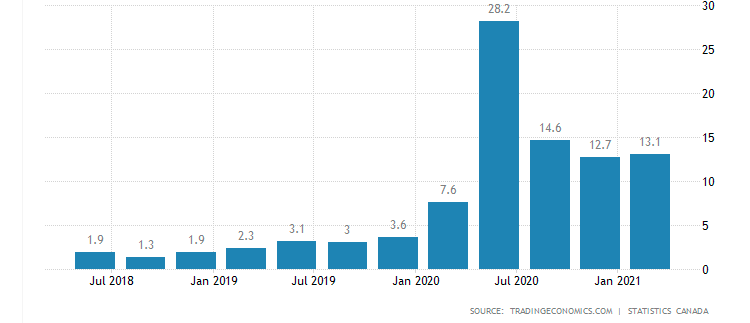

Canadians have been hearing a lot about the “pent-up demand” that will characterize the recovery from the 2020 deep recession. Within the Canadian banking community of economists, there is considerable group-think which forecasts a surge in consumer demand now that there is a loosening of many of the harshest COVID-19 restrictions. Household spending is expected to shift from purchases of goods to services, according to many Canadian economic observers. (Household spending). The driving force behind this expected recovery is posited on government stimulus programs and very low-interest rates. The result has been a historically high savings rate, reaching28% during the summer of 2020 and moderating to 13% today, still well above recent trends (Figure 1).

Figure 1 Canadian Household Savings Rate

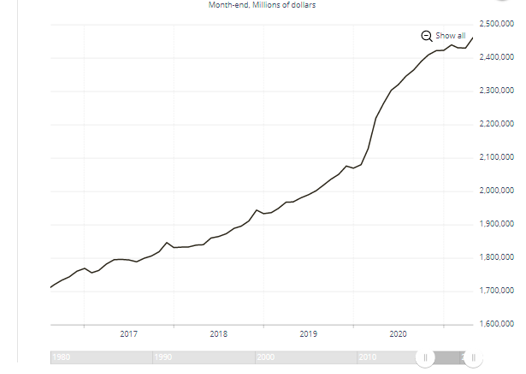

In particular, forecasters point to the exceptional growth in bank deposits as one of the principal sources to spurt spending, especially in the consumer sector (Figure 2). Yet, so far, consumers are hoarding cash and other liquid assets and do not demonstrate any willingness to dip into their savings to fuel current consumption.

Figure 2 Total Deposits in Canadian Commercial Banks

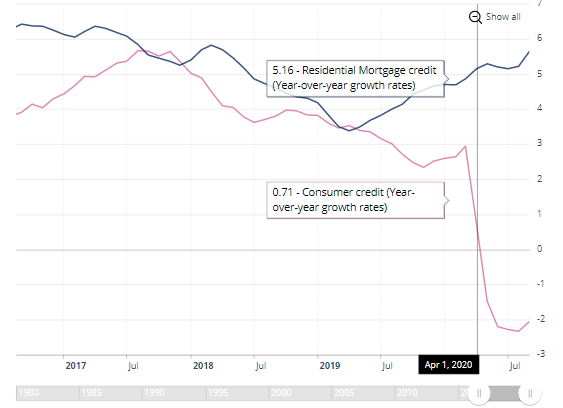

Of special interest is the major dichotomy in the consumers’ decisions involving the purchase of a home and the spending on consumables. Canadians have chosen to pay down considerable amounts of credit card debt (Figure2). Commercial banks are falling over one another to offer incentives to attract new credit cardholders. At the same time, Canadians have turned to the mortgage market in droves as the demand for housing continues to be well above trend lines. If there is any pent-up demand, it exists in long-term investments in personal real estate.

Figure 3 Annualized Growth in Residential Mortgages and Consumer Credit

The realization that the remainder of 2021 is not going to the barnburner many envisaged is now taking hold. Goldman Sachs just downgraded its GDP growth forecasts noting that, "as it is becoming apparent that the service sector recovery in the US is unlikely to be as robust" as the bank had expected. (GDP forecasts slashed). Incoming data in both United States and Canada is nowhere near as strong as initially forecasted in January. Regardless of whether one believed that pent-up demand ever existed there in the first place, it is becoming more and more evident that consumers are not about to unleash the spending needed to recover fully from this recession.

"Pent upDemand" is such a very Keynsian concept, and certainly a term useful for describing future growth and profit. Unfortunately it aso seems to be a bit mythical, and actually an incorrect understanding of cause and effect. It is not that there is such a demand, but rather that many tend to avoid spending money that they do not have. Sometimes "common wisdom" leads to holding on to one's resources in anticipation of future conditions being unfavorable. When that future is found to be not as bad as anticipated the priorities change. But when the future remains uncertain then the holding persists.