The Long Awaited Canadian Budget In Perspective

Photo by Michelle Spollen on Unsplash

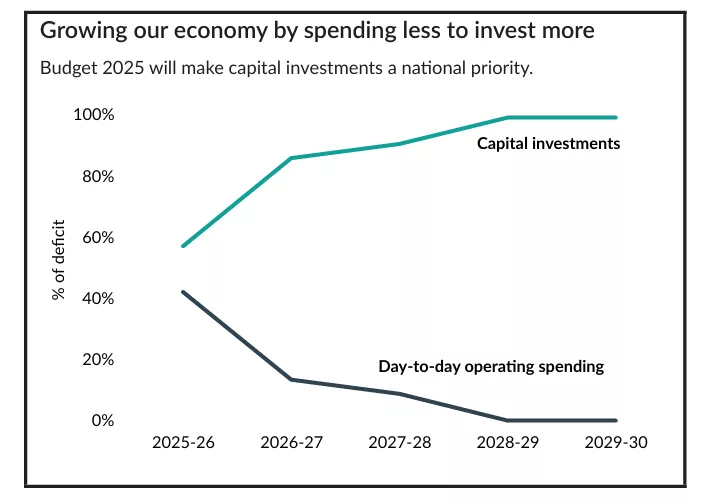

Ever since Mark Carney was elected this past winter, the political discourse was about Canadian fiscal policy in the face of the threats from US tariffs. Many anticipated that this would be a “generational budget’, in the sense it will mark a departure from conventional budgets in which the government lumps operating and capital expenditures into one ball of wax. PM Carney offered two separate budgets, one featuring ongoing costs of running a government day-to-day, and one featuring large capital expenditures spread over several years.

The budget is presented against a backdrop of an economy that is clearly underperforming. Private sector forecasters anticipate that GDP to limp along at 1.5% to 2% in 2026 and 2027. Unemployment remains elevated at 7%, while wage growth is 3.5% barely above the rate of inflation. The impact of the US tariffs is evident with auto sales down 9% this year. Business investment has been very sluggish for several years, hence the poor productivity performance throughout industry.

Pundits were making all manner of guesses about the size of the deficit, then wrapping around those estimates were threats that the budget would not pass. The Carney government is now just two votes shy of an outright majority. But once the posturing of the opposition quietens down, the budget is expected to pass without any real changes.

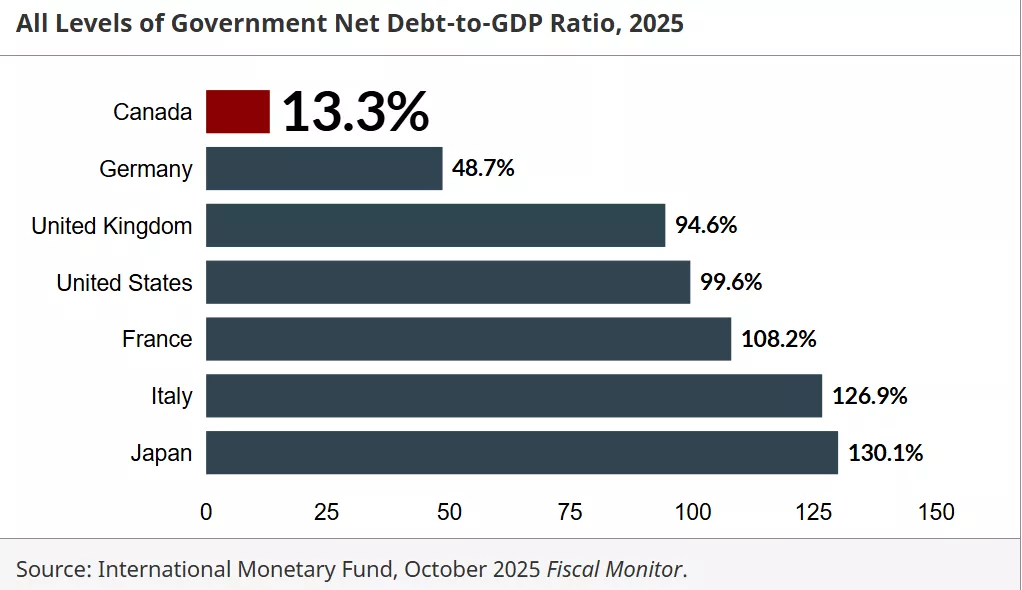

The federal deficit is projected to hit the C$78 billion mark in the coming fiscal year, 2025/26. Considering debt held by the provinces and the federal government combined, the budget deficits pose no real concern within the financial markets. Combining debt held by the provinces and the federal government Canada has the lowest net debt-to-GDP ratio at 13% of any G-7 nation. The US and European counterparts' debt ratios range from 90% to over 130%. Canada has been awarded AAA credit rating for its past performance and this rating should prevail going forward.

Furthermore, the federal deficit, as a percentage of GDP is 2.5%, well below that of the 6% US deficit ratio. Expect a big yawn from the debt markets as investors anticipate the markets will absorb the additional funding needs without any change in yields.

The other important feature is the separation of long-term capital investments from day-to-day operating costs. The long-term spending is related to several obligations, such as commitments to NATO defense, improved infrastructure, housing, and adjustments to tariff-induced impacts on workers in specific sectors.

More By This Author:

The Bank Of Canada Calls A Halt To Future Rate Cuts

The Israeli Economy Is Poised To Take Off Post Gazan War

The Missing Link In Canada’s Pipeline Debates