The Missing Link In Canada’s Pipeline Debates

Photo by Martin Adams on Unsplash

With a new sheriff in town, Canada has embarked on a major undertaking to develop new energy pipelines as part of an overall strategy to diversify away the over dependence on the US market. Prime Minister Mark Carney has introduced new measures to streamline the decision-making process for approvals.Although the legislation is not without its critics, the federal government passed legislation (Bill C-5) that fast-tracks major capital projects in the interest of providing economic benefits and strengthening national security.

While the governments of Alberta, British Columbian and Canada tussle over the implementation of delivering oil and gas to west coast ports, no private sector energy supplier has stepped forwarded showing any interest in partnering with these governments in building and eventually servicing a pipeline.The absence of any industry partner is the “elephant in the room”, in the sense that, should any project to go ahead, governments will be taking on all the risk.Two major reasons explain why the private sector is so reluctant to join forces with government on new pipeline projects.

A History of Uncertainty Regarding the Regulatory Environment

The previous Liberal government passed regulations involving impact assessments and oil tanker bans that introduced legal challenges and long delays in getting final approvals. For example, the federal government’s purchase and ultimate completion of a private-sector investment in the Trans Mountain project left a bad taste in the mouth of the industry. And, the federal government remains reluctant to be in the position of salvaging future projects in mid-stream. Other high-profile projects, such as the Northern Gateway, were abandoned after years of sizable industry investments that became tangled up in politics and jurisdictional arguments. Nonetheless, the federal government is placing a lot of its reputation on this new legislation designed to speed up pipeline approvals. But the outlook for long term demand and prices throws cold water on potential new projects.

The Long-term Outlook for Oil and Gas Prices

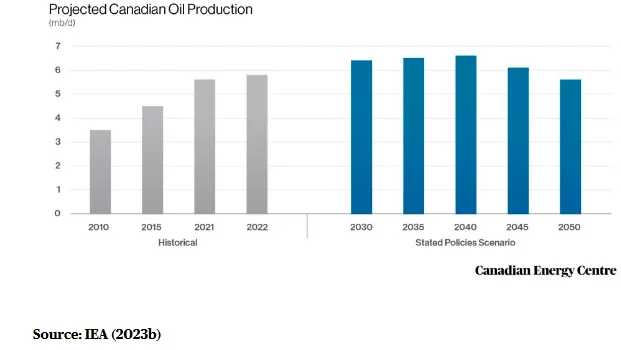

The Alberta Energy Regulator agency anticipates thatprice of Canadian Western Select (WCS) will barely increase from $61 bbl today to $63 bbl by 2034.Price forecasts are not encouraging to get the industry to buy into new pipelinesThis forecast is consistent with global forecasts issued by IEA which anticipates that oil and gas demand will peak by 2035 and then steadily decline. Long-term forecasts are speculative and depend on such factors as global economic growth, the transition to electric vehicles and climate change policies. On balance, the Canadian fossil fuel industry expects peak oil to occur around 2035, a short time horizon when considering the viability of multi-billion-dollar investments over a much longer time span than the coming decade.

The IEA warns of the risks in over-investment in new fossil fuel supplies. Consequently, there is this underlying concern that over-investment will take place should the industry risk partnering on pipelines which have very long lead times, only to prove unprofitable upon implementation due to unfavourable market conditions.

The federal and provincial governments should continue to look at cooperative ways to develop new markets for Canadian oil. But the market may have a different view as to how much can we expect to develop profitably. The current silence of industry participants speaks volumes as to the task ahead.

More By This Author:

Why It Is So Difficult To Forecast TodayWhat Will It Take To Turnaround The Canadian Housing Market

A Great Unease Is Sweeping Through The Government Bond Markets