The FTSE Finish Line - Tuesday, April 15

Image Source: Pexels

On Tuesday, the UK's major indexes rose, bolstered by gains in financial stocks after U.S. President Donald Trump hinted at possible exemptions on auto tariffs. Investors were also assessing job market data for clues on monetary policy amid ongoing global economic uncertainty. Trump suggested he might adjust the 25% tariffs on imported cars and auto parts from Mexico, Canada, and other regions. This followed the recent exemption of smartphones, computers, and other electronic devices from his "reciprocal" tariffs. After recent market declines, investors responded positively to the news, pushing shares up for the second consecutive day.

The latest official assessment of the UK labour market reveals ongoing resilience, as the ONS's Labour Force Survey (LFS) shows a significant increase in employment in the three months leading up to February. However, other indicators, including unofficial surveys like S&P's Report on Jobs and the employment component of the widely monitored UK PMIs, suggest more subdued trends, raising concerns about the quality of the LFS data. In fact, more current administrative data from HMRC indicates a second consecutive monthly decline in payrolled employees, along with a continued drop in vacancies. Additionally, further moderation in pay growth measures collectively suggests that the UK labour market conditions are cooling. Investors estimated that there is over a 90% chance that the Bank of England will reduce rates by 0.25% on May 8.

Single Stock Stories & Broker Updates:

- Shares of B&M rose 7.2%, the highest since February 14. Co reports FY25 adjusted EBITDA above guidance at £605-625 mln. FY25 revenue up 3.7% to £5.6 bln. Jefferies notes a positive uptick in BME's underlying LFL trend. Year-to-date, BME's stock value has decreased by approximately 14.5%.

- Shares of De La Rue rise 13.4%, the highest since February 2022, after agreeing to be acquired by U.S. firm Atlas Holdings for £263 million ($346.8 million), valuing the company at 130 pence per share, a 16% premium to its Monday closing price. The board recommends the deal as "fair and reasonable". DLAR shares are up ~8.2% YTD.

- Shares of Halfords Group rose 9.5% as it expects annual pretax profit at the upper range of £32-37 million. The company aims to mitigate the direct inflationary impact of the autumn budget in FY26, while the indirect supply chain impact is uncertain. Henry Birch has been appointed as the new CEO, replacing Graham Stapleton. The stock is down ~5.19% YTD.

- Shares of British retailer Next rose 1.36% after Goldman Sachs upgraded the stock to "Buy" and raised the price target to 14,000p, citing strong international growth and recovering UK retail sales, as well as limited U.S. tariff exposure and benefits from Asia sourcing. Last month, the company increased its profit outlook for 2025. Analysts' average rating remains a "Hold" with a median price target of 11,500p. The stock is up 23.4% year-to-date.

- Domino's Pizza Group shares fell 1% after Barclays downgraded the stock to "underweight" with a price target cut from 290p to 250p. Barclays is one of two brokerages with a "sell" rating among 10 analysts, citing declining like-for-like orders and cost challenges. Concerns over increased debt from adding a second brand and core business maturity highlight the need for sustained growth. Last month, the company reported a slow start to 2025 with muted profit growth projections. Analysts' average rating is "buy" with a median price target of 380p. The stock is down 13% this year.

- Frasers Group's shares rose 2% after signing a 25-year deal with Australia's Accent Group to operate Sports Direct in Australia and New Zealand, increasing its stake to 19.57% in the Australian footwear retailer. The company is also investing in global retailers like AO World and ASOS but cannot acquire more than 26% of Accent for the next three years. As of the last close, FRAS shares are up approximately 1.1% YTD.

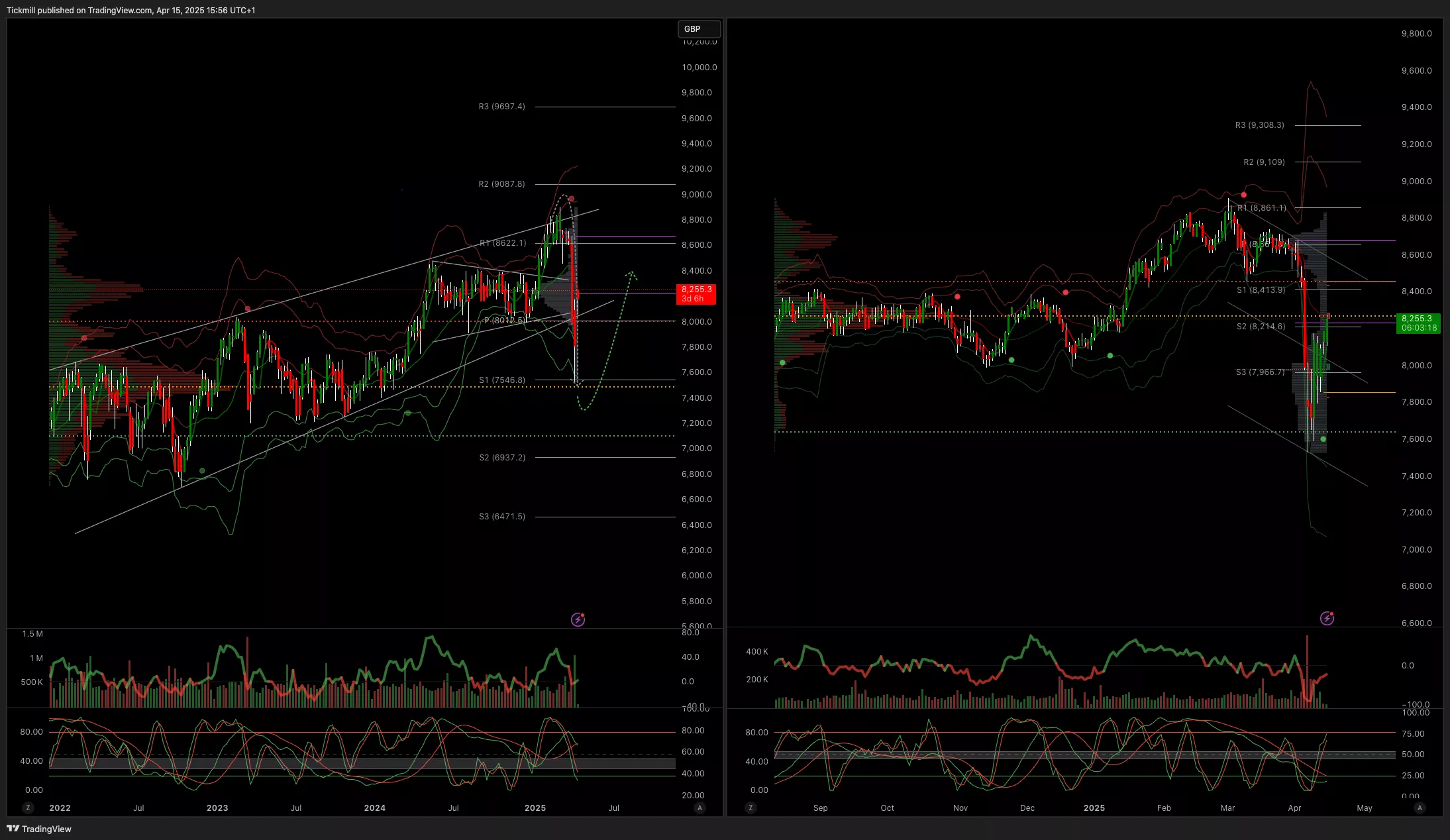

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 7600

- Primary support 7500

- Below 7400 opens 6850

- Primary objective 8500

- Daily VWAP Bullish

- Weekly VWAP Bearish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Tuesday, April 15

The FTSE Finish Line - Monday, April 14

S&P 500 Weekly Action Areas & Price Targets - Monday, April 14