Daily Market Outlook - Tuesday, April 15

Image Source: Pixabay

Asian markets advanced, spearheaded by Japan, as US President Donald Trump suggested a possible halt in auto tariffs, offering additional comfort to the market following the suspension of tariffs on certain consumer electronics. Japanese indexes surged more than 1%, with firms like Toyota Motor Corp. and Honda Motor Co. seeing significant gains. Shares in China and Hong Kong displayed volatility while futures contracts for both the US and Europe reduced earlier losses. The pharmaceutical industry appears to be the next target of Trump's tariffs, which could negatively impact European drug companies such as Novo Nordisk, known for their successful weight-loss medications recently. The ongoing discussions about tariffs have diminished the perceived stability of the U.S. dollar and Treasuries. The dollar remained near a three-year low compared to the euro and a six-month low against the yen during trading in Asia. Meanwhile, gold, considered the ultimate safe haven asset, saw a slight increase as it approached the record level it reached on Monday. Markets are stabilising as the exemptions have sparked optimism for potential negotiations after the president’s reciprocal tariffs this month resulted in a $10 trillion loss in global equities and triggered a decline in Treasuries. Nevertheless, the inconsistencies are leaving investors anxious, and business leaders, including JPMorgan Chase & Co.'s Jamie Dimon, have cautioned that Trump's attempts to alter the global trading framework might drive the US towards a recession.

The latest UK ONS labor market report supports the case for a May rate cut by the BoE. Despite concerns over high pay growth affecting inflation, private sector pay grew by 5.9% in January and February, likely undershooting the BoE's February projection. Even with a 0.5% increase in March, Q1 growth would be around 5.75%, below the expected 6.2%. HMRC data shows median pay growth dropped to 4.8% from 5.5%. While the ONS notes revisions to past earnings data, evidence suggests cooling momentum. Employment data remains mixed; the LFS reports a 206k increase for February, while HMRC data shows a 78k decrease in March. With unemployment steady at 4.4%, the softer pay growth strengthens the case for a rate cut, though upcoming CPI data will also be crucial.

On the macro slate today investors will be watching Q1 earnings announcements from J&J, Bank of America, United Airlines, and Citigroup. U.S. import prices for March are projected to remain unchanged after a 0.4% increase in February. Federal Reserve Bank of Richmond President Thomas Barkin will speak at the University of North Carolina, while Fed Governor Lisa Cook will deliver a speech in Washington DC. Canada's inflation report for March is anticipated to remain steady at 2.6%, unchanged from the previous month.

Overnight Newswire Updates of Note

- Fed’s Bostic Emphasizes Patience, Says Not A Time To Move Boldly

- FMR Trsy Sec Yellen: Trump Policies Eroding Trust In US, Dollar Assets

- Trsy Sec Bessent: Treasury Has Big Toolkit If Needed For Bond Market

- Treasury Term Premium Jumps to Decade High on Policy Uncertainty

- Netflix Aims $1T Club, Plans To Double Ad Rev, Tripple Oper Income

- S&P's 'Death Cross' May Not Be As Ominous As It Sounds, Analysts Say

- Trump’s Tariff Rationale Challenged In Suit By Small Companies

- UK Plan Consumers To ‘Buy British’ AsTrade War Bites, Survey Shows

- EU Explores Legal Options For Ending Russian Gas Deals

- LVMH Misses Sales Forecast As Core Business Slumps In First Quarter

- Tariffs Drag AMRO Asia Growth Outlook To Weakest Since Covid

- China’s Economy Likely Grew 5.2% In Months Before Big US Tariffs

- UBS Lowers China's 2025 GDP Growth Projection To 3.4%

- Japan’s Kato Denies Extra Budget Plan Amid Bond Yield Surge

- Japan Super-Long Yield Premium At Widest Since 2002 Amid Tariffs

- TSMC Moves Closer To Next-Gen Packaging For Nvidia, Google AI Chips

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0800 (EU1.56b), 1.1250 (EU1.4b), 1.0870 (EU1.29b)

- USD/CAD: 1.4375 ($1.52b), 1.4650 ($973.2m), 1.4280 ($452.6m)

- USD/JPY: 145.00 ($1.97b), 144.00 ($1.68b), 151.00 ($1.17b)

- AUD/USD: 0.6200 (AUD1.39b), 0.6300 (AUD462.3m), 0.6150 (AUD439.6m)

- USD/CNY: 7.3600 ($606.9m), 7.2700 ($426.3m)

- GBP/USD: 1.2100 (GBP720m), 1.2600 (GBP603.2m)

- EUR/GBP: 0.8620 (EU692.1m)

- USD/MXN: 20.10 ($408.9m), 20.00 ($355m), 19.30 ($348m)

- USD/BRL: 5.4450 ($324.6m), 5.8980 ($317.9m)

CFTC Data As Of 11/4/25

- S&P 500 CME net long position was reduced by 75,583 contracts by equity fund managers to 803,250, while S&P 500 CME net short position was increased by 22,408 contracts to 287,605 by equity fund speculators.

- CBOT Speculators reduce their net short position in US Treasury bond futures by 14,494 contracts to 18,154. CBOT Speculators reduce their net short position in US Ultrabond Treasury futures by 53,719 contracts to 200,310. CBOT Speculators reduce their net short position in US 2-year Treasury futures by 28,282 contracts to 1,198,109 CBOT Speculators' net short position in US 5-year Treasury futures increased by 102 contracts to 2,021,575 Japanese yen net long position is 147,067 contracts, while CBOT US 10-year Treasury futures net short position is 215,207 contracts to 1,078,470.

- 17,310 contracts make up the British pound net long position.

- There are 59,980 contracts in the Euro net long position.

- The net short position of the Swiss franc is -30,277 contracts.

- 1,332 contracts make up the Bitcoin net long position.

Technical & Trade Views

SP500 Pivot 5610

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 5665 target 5792

- Below 5000 target 4755

(Click on image to enlarge)

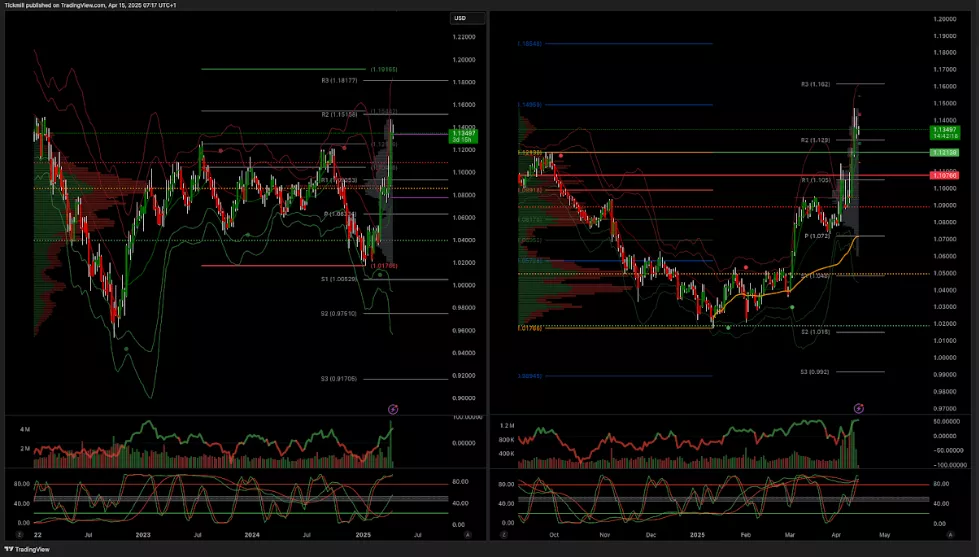

EURUSD Pivot 1.11

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into the end of April

- Above 1.12 target 1.15

- Below 1.1070 target 1.0945

(Click on image to enlarge)

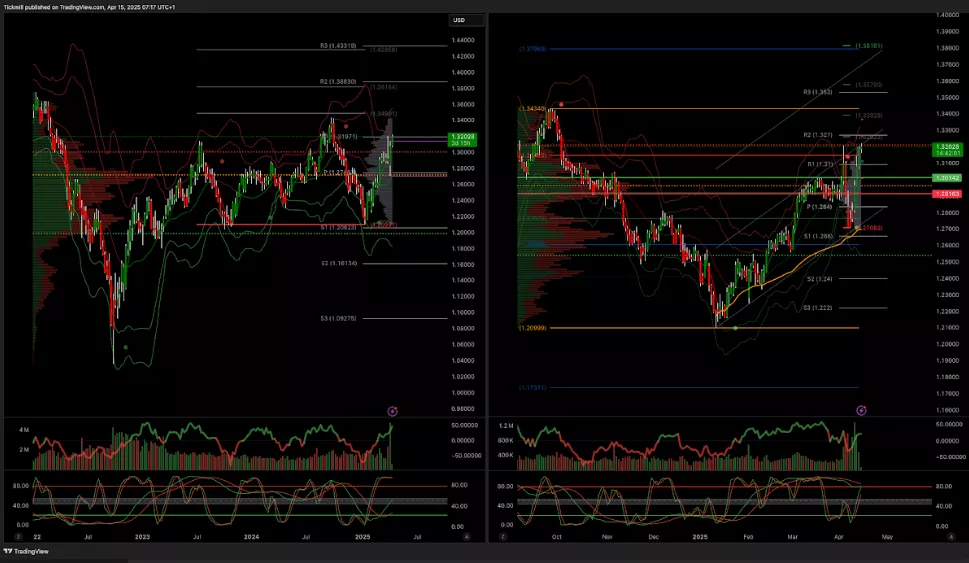

GBPUSD Pivot 1.28

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 1.2850 target 1.32

- Below 1.2790 target 1.2660

(Click on image to enlarge)

USDJPY Pivot 147.70

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness into early May

- Above 1.52 target 153.80

- Below 146.53 target 140

(Click on image to enlarge)

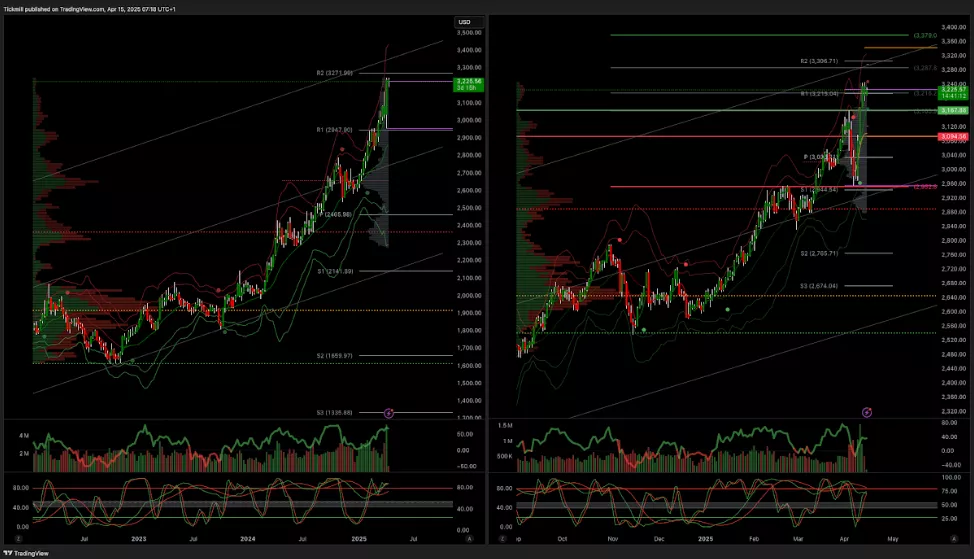

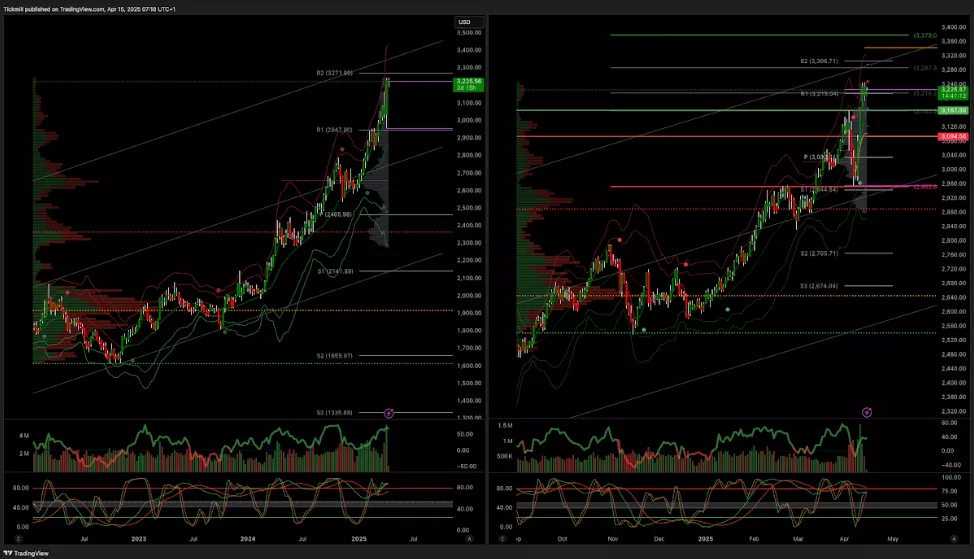

XAUUSD Pivot 3100

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into mid/late April

- Above 2900 target 3280

- Below 2880 target 2835

(Click on image to enlarge)

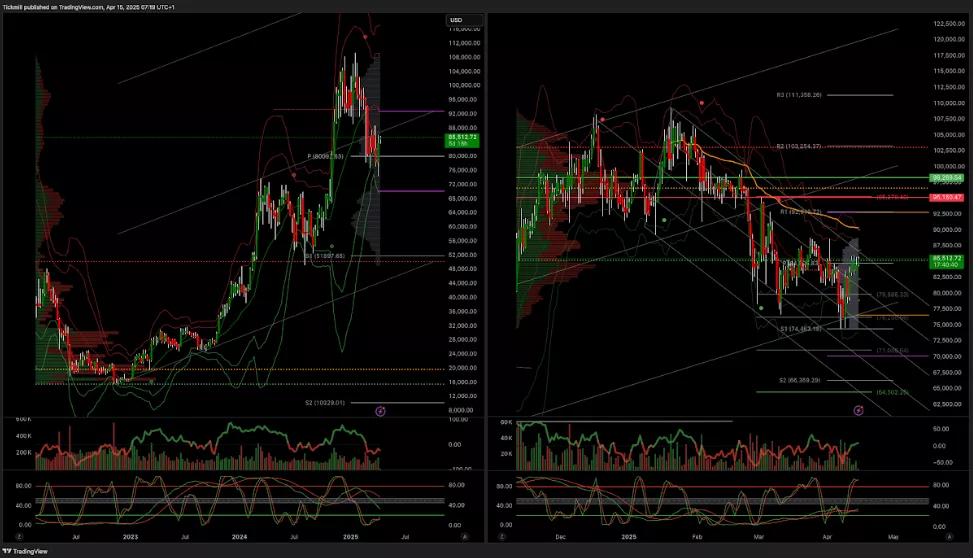

BTCUSD Pivot 90k

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into mid April

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Monday, April 14

S&P 500 Weekly Action Areas & Price Targets - Monday, April 14

Daily Market Outlook - Monday, April 14