Daily Market Outlook - Monday, April 14

Image Source: Pixabay

Asian stocks experienced a notable rise overnight, although the ongoing confusion regarding tariff implementations poses a continued risk. Market sentiment in Asian equities has been somewhat positive during the overnight trading session, with several major indices advancing by 1-2% at the time of this report. This follows Friday's announcement of a suspension of tariffs on select items in the consumer electronics sector, such as smartphones. However, news on Sunday indicated that tariffs on semiconductors, which had been exempt from import duties, will now be imposed. This situation adds to the growing confusion and uncertainty surrounding US trade policy, making it increasingly challenging for markets to navigate as discrepancies emerge across sectors, products, and regions regarding tariff rates and enforcement. Consequently, the reliability of the overnight equity rally seems relatively weak when viewed in a longer-term perspective. This cautious outlook is mirrored in other markets, as gold (~$3,225/oz) remains close to Friday’s peak, and the Dollar index opens lower, with the Yen slightly stronger at around ~143 against the USD. Thus, although a new week begins, the theme of heightened volatility and tariff-related developments appears to persist. This raises significant concerns about the performance of risk assets due to the unpredictability of trade policy. Nevertheless, in the short term, there is a possibility of volatility driven by the ‘bad news is good news’ phenomenon, which could prompt equity market participants to anticipate a higher likelihood of stabilisation efforts from central banks or other policy interventions. While the Fed's focus on inflation seems to be steady for now, this aspect might be more pertinent for Chinese authorities than for the US. In the bond market, US Treasury yields are slightly down compared to Friday’s close, buoyed by Japanese news that the country will not leverage its holdings as leverage in tariff discussions. Consequently, the 10-year rate stands at 4.46%.

Over the weekend, the UK parliament approved a measure allowing the government to assume control of British Steel by directing the company’s board and workforce, stopping short of full nationalisation for now. This decision raises questions among gilt market participants regarding its impact on the deficit and funding plans. According to the government’s statement, all related funding will be sourced from existing budgets, with no additional borrowing planned. However, as seen before the Spring Statement, reallocating funds can lead to internal political tensions and challenges within the government’s own party. Additionally, the government announced a two-year suspension of import tariffs on 89 products to help businesses manage input costs and curb output price increases. While the estimated revenue loss of £17 million is minimal, it highlights the significant ripple effects of US-led global trade developments, quickly rendering the OBR Spring Statement forecast outdated. Supporting this view, Meghan Greene remarked during a panel in Greece that the exchange rate is now crucial for the MPC, and growth is expected to slow due to tariffs, despite an uncertain inflation outlook. Slower growth poses a challenge for public finances, and the risks to government financing requirements are increasing.

Focusing on particular data releases, the upcoming week in the US will center around March's retail sales and industrial production figures, scheduled for release on Wednesday. Markets project a month-over-month growth in headline retail sales of +2.0%, a rise from February's +0.2%. The industrial production is expected to increase by a more modest +0.3% month-over-month, which is a decrease from the +0.7% increase seen in February. On Thursday, attention will shift to the ECB's decision and the press conference with President Lagarde. Economists predict a 25bps reduction. Markets in the US and several other countries will be closed for Good Friday.

Overnight Newswire Updates of Note

- Fed Kashkari: All The Fed Can Do Is Keep Inflation Anchored

- Ray Dalio: Trump Trade War Has Put US 'Close To A Recession'

- Trump: Chips From China To Face Probe; Further Tariffs Expected

- WH Trade Adviser Navarro: No Talks Yet With China

- UK Retail Bosses Raise Fears Of Chinese ‘Dumping’ Due To Tariffs

- UK Lenders Fret Over Risk-transfer Market After BoE Warning

- UK And EU Close Ranks On Defence Amid Trump Turmoil

- China Is Well Positioned To Weather Trump’s Trade War

- Chinese Exports Swell Ahead Of US Tariffs That Will Snarl Trade

- China’s March Lending Jumped On Government Stimulus Push

- Japan Policymaker Wants Stronger Yen: Shouldn't Sell Treasuries

- Australia’s Leaders Vow Housing, Tax Cuts At Dueling Rallies

- Singapore Cuts Growth Forecast As Trade War Hits Global Outlook

- Bitcoin Holds Strong Above $84,000 Amid Market Volatility

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1300-05 (666M), 1.1345-50 (1BLN), 1.1400 (210M)

- USD/CHF: 0.8340 (200M), 0.8360 (300M)

- GBP/USD: 1.3000 (638M)

- AUD/USD: 0.6180 (372M), 0.6200 (381M)

- USD/CAD: 1.3825 (430M), 1.3965 (295M)

- USD/JPY: 143.50 (200M)

- AUD/JPY: 86.00 (320M)

CFTC Data As Of 11/4/25

- S&P 500 CME net long position was reduced by 75,583 contracts by equity fund managers to 803,250, while S&P 500 CME net short position was increased by 22,408 contracts to 287,605 by equity fund speculators.

- CBOT Speculators reduce their net short position in US Treasury bond futures by 14,494 contracts to 18,154. CBOT Speculators reduce their net short position in US Ultrabond Treasury futures by 53,719 contracts to 200,310. CBOT Speculators reduce their net short position in US 2-year Treasury futures by 28,282 contracts to 1,198,109 CBOT Speculators' net short position in US 5-year Treasury futures increased by 102 contracts to 2,021,575 Japanese yen net long position is 147,067 contracts, while CBOT US 10-year Treasury futures net short position is 215,207 contracts to 1,078,470.

- 17,310 contracts make up the British pound net long position.

- There are 59,980 contracts in the Euro net long position.

- The net short position of the Swiss franc is -30,277 contracts.

- 1,332 contracts make up the Bitcoin net long position.

Technical & Trade Views

SP500 Pivot 5610

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 5665 target 5792

- Below 5000 target 4755

(Click on image to enlarge)

EURUSD Pivot 1.11

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into the end of April

- Above 1.12 target 1.15

- Below 1.1070 target 1.0945

(Click on image to enlarge)

GBPUSD Pivot 1.28

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 1.2850 target 1.32

- Below 1.2790 target 1.2660

(Click on image to enlarge)

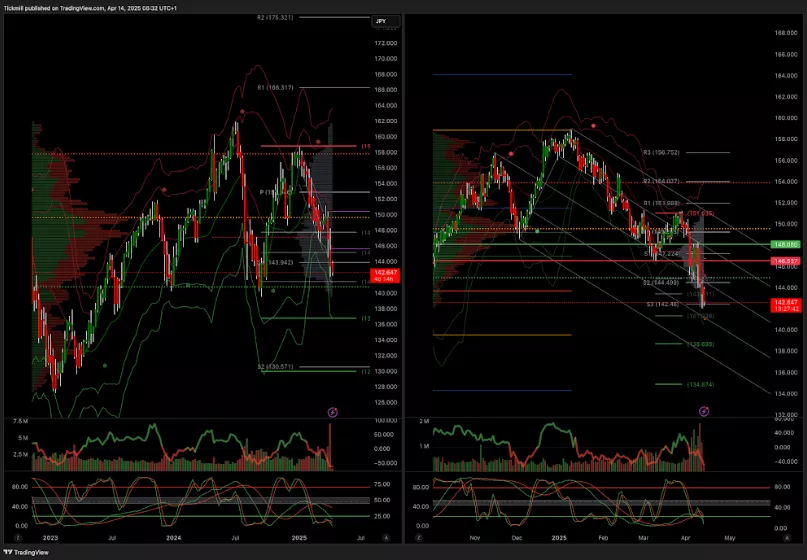

USDJPY Pivot 147.70

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness into early May

- Above 1.52 target 153.80

- Below 146.53 target 140

(Click on image to enlarge)

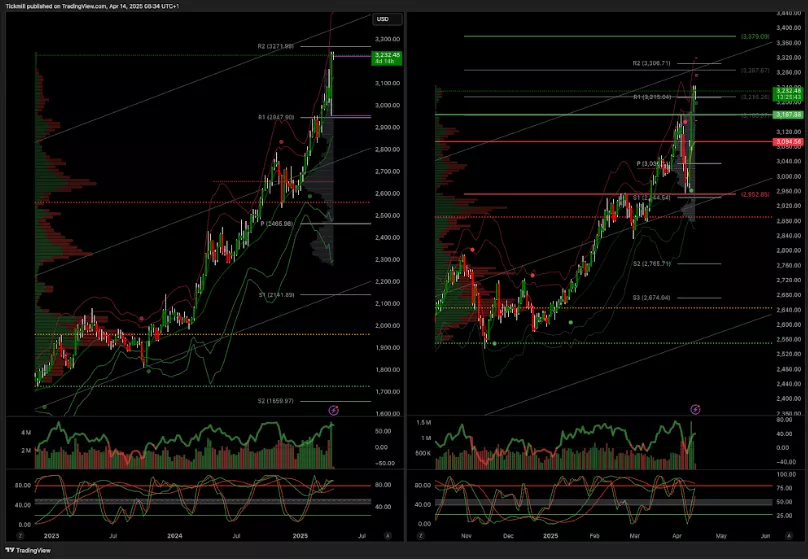

XAUUSD Pivot 3100

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into mid/late April

- Above 2900 target 3280

- Below 2880 target 2835

(Click on image to enlarge)

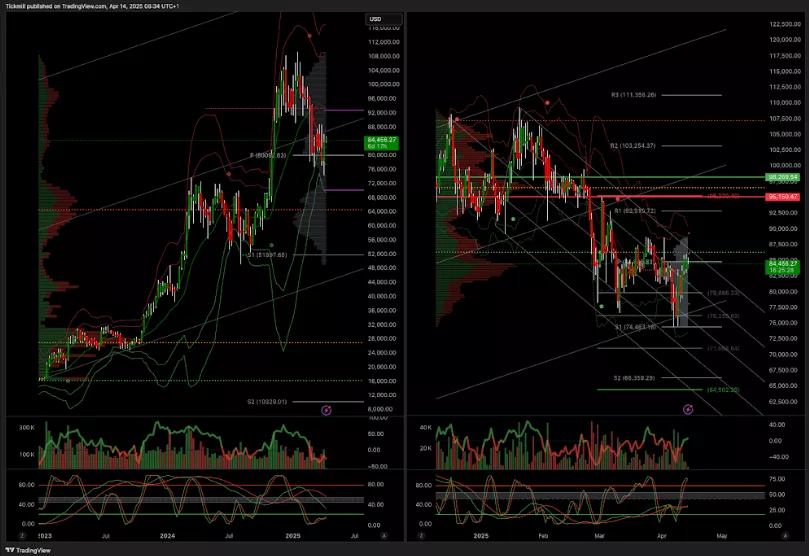

BTCUSD Pivot 90k

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into mid April

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Friday, April 11

Daily Market Outlook - Friday, April 11

The FTSE Finish Line - Thursday, April 10