The FTSE Finish Line - Friday, Sep. 5

Image Source: Pexels

London stocks edged higher on Friday, buoyed by gains in heavyweight banks and industrials, as investors digested corporate updates and retail sales data. However, sentiment turned negative towards the close, following sharp reversals in U.S. markets from record highs after jobs data highlighted a worsening employment landscape. Earlier in the week, concerns over Britain's financial stability and the government's ability to manage it effectively had rattled markets, briefly pushing long-term government bond yields to a 27-year high. Uncertainty persists over potential tax hikes that could hamper economic growth, with the country's budget announcement slated for November 26. On the economic front, July retail sales surpassed expectations, driven by favorable weather and enthusiasm surrounding the women's European soccer championship. However, annual growth fell short of forecasts due to significant revisions in prior-month data.

The delayed UK retail sales report shows mixed results. Headline sales rose 0.6% m/m, beating the 0.2% forecast, but y/y growth was revised down to 1.1% from 1.7%, missing the 1.3% median. These revisions stem from ONS's earlier miscalculation of seasonal adjustments, lowering H1 sales figures. Ex-fuels sales rose 0.5% m/m, above the 0.3% median, while y/y remained steady at 1.3%, with June revised down from 1.8%. July spending benefited from favorable weather and the Women’s Euro football tournament, but underlying demand remains weak. If inflation moderates and the labor market softens as the BoE predicts, retail sales are unlikely to gain momentum in the near term amidst broader uncertainties.

The week ahead is packed with key events for markets. In France, a confidence vote (Mon) kicks off a busy week, while Fitch reviews the sovereign rating (Fri). EU President Von der Leyen’s State of the Union address (Wed) may touch on political and market impacts, potentially influencing the ECB press conference (Thu), though no rate changes or major macro revisions are expected. Economic indicators include German trade and industrial production data (Mon) and final August CPI prints (Fri). In the US, PPI (Wed), CPI (Thu), and payroll employment revisions (Tue) could shape Fed rate cut odds. In the UK, July’s GDP estimate (Fri) offers insight into Q3 growth against the BoE’s 0.3% q/q forecast.

-

Shares in British betting firm Entain rose by 2.6% to 858.5p. The stock is the leading gainer on the FTSE 100 index, which saw an increase of 0.3%. Jefferies has adjusted its price target for Entain to 1,200p from 1,140p, maintaining a "buy" rating. The brokerage noted that Entain has established a consistent performance over the past few quarters, suggesting that investor focus is likely to shift back to mergers and acquisitions. They also mentioned that recent interim results have demonstrated advancements in their technology investment strategy, which aims to develop independent business segments, including BetMGM, a collaboration with MGM Resorts. Of the 21 analysts rating the stock, 14 have issued a "buy" or higher recommendation, while 7 have a "hold" rating; the median price target is set at 1,111p according to LSEG data. Overall, including gains from the current session, Entain's stock has increased by 24.8%, while the FTSE 100 has seen a 14.1% rise year-to-date.

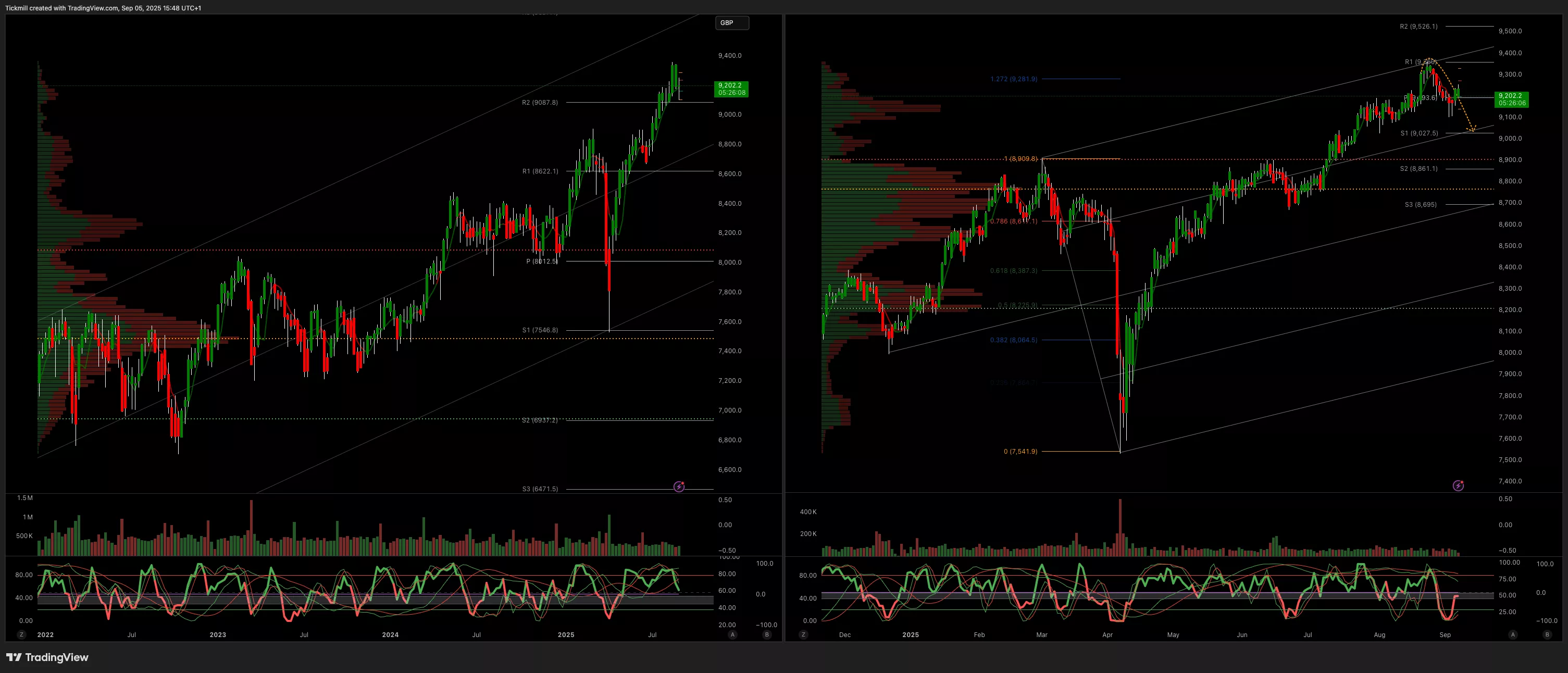

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9000

- Primary support 9000

- Below 8900 opens 8600

- Primary objective 9600

- Daily VWAP Bullish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Friday, Sep. 5

Daily Market Outlook - Thursday, Sept. 4

The FTSE Finish Line - Wednesday, Sep. 3