The ETF Portfolio Strategist: Sunday, May 23

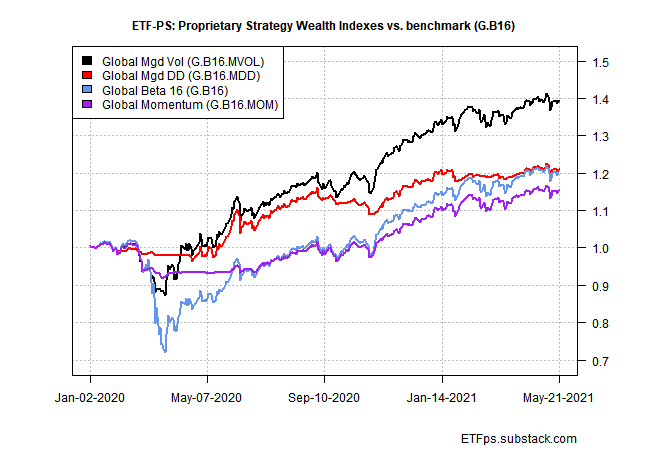

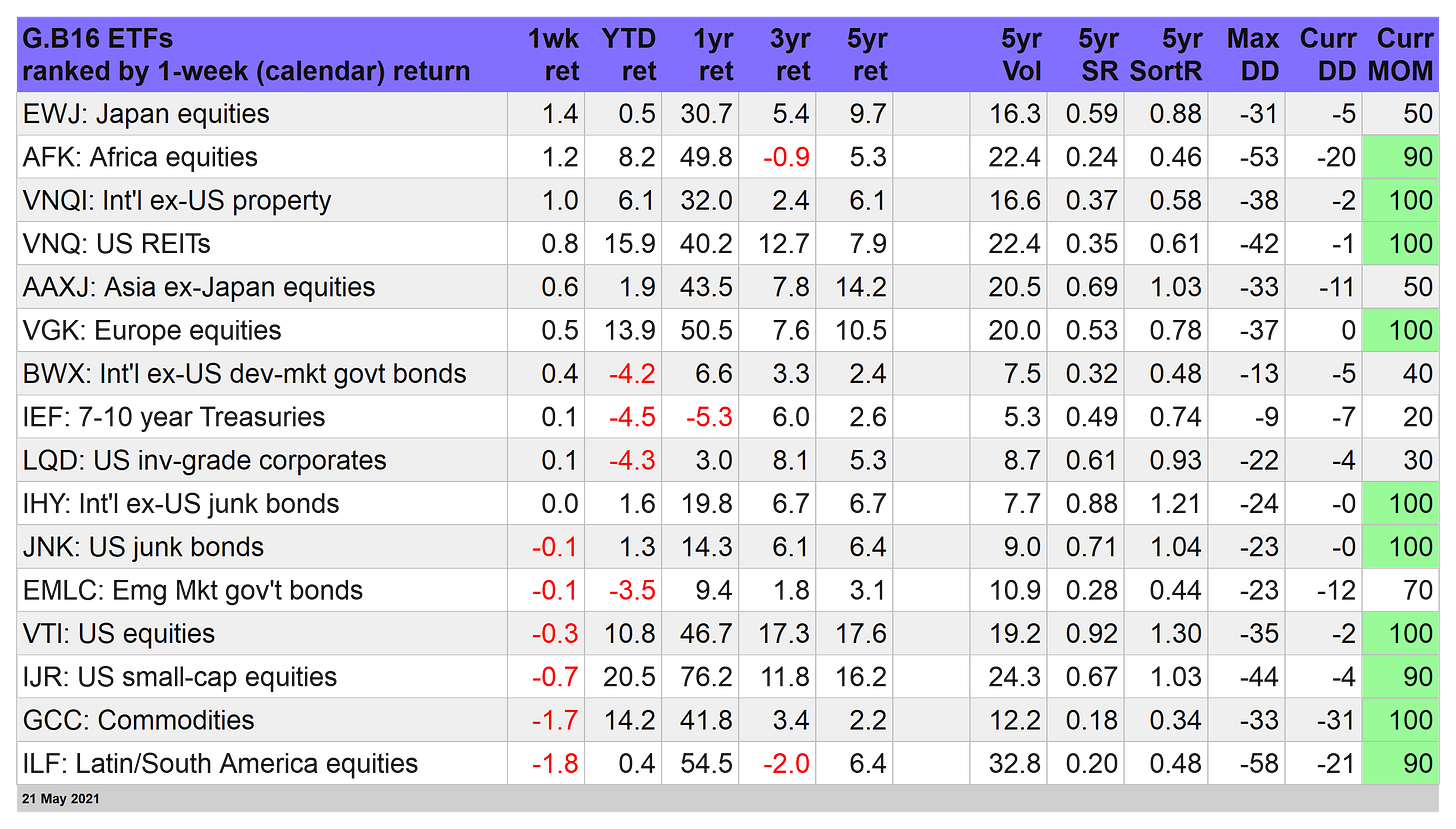

Global markets posted a mixed but mostly serene week of results through Friday, May 21. The tranquility spilled over to our proprietary strategies, which were essentially unchanged last week. The flat results are welcome after the previous week’s sharp declines. No news is good news, as the saying goes, and for the moment that’s a reasonable takeaway of what just passed.

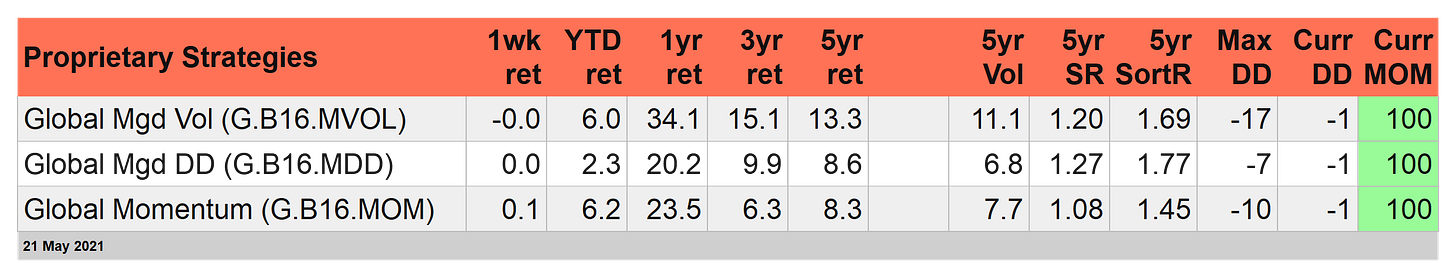

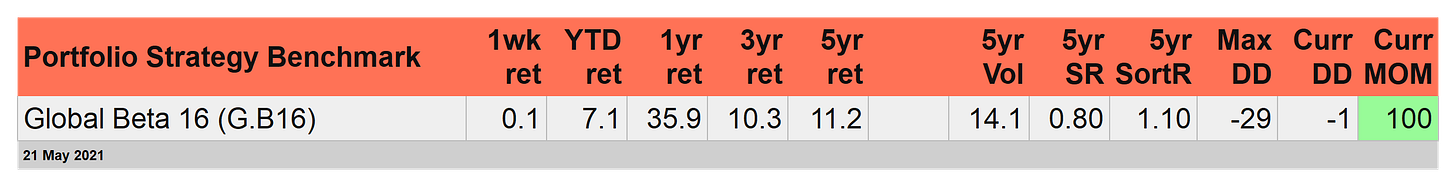

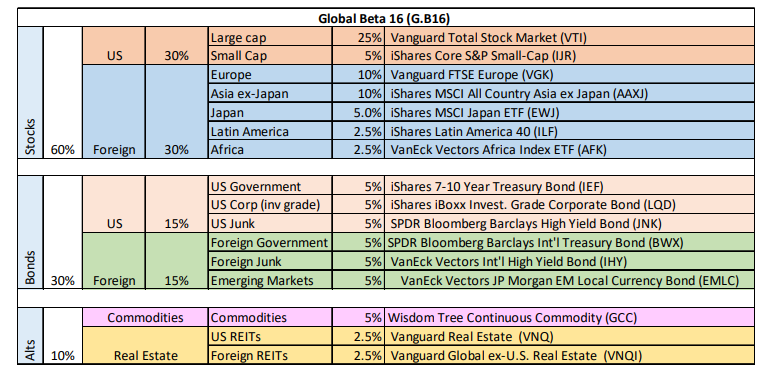

Year-to-date performances didn’t budge, either. The Global Beta 16 Index (G.B16), the benchmark for our three proprietary strategies, continues to lead in 2021 with a 7.1% gain. G.B16’s edge is modest over Global Managed Volatility (G.B16.MVOL) and Global Momentum (G.B16.MOM), each of which is up by roughly 6%.

Global Managed Drawdown (G.B16.MDD), on the other hand, remains considerably further behind with a 2.3% year-to-date gain. Adjusting for risk, however, still favors the proprietary strategies by a wide margin over the trailing five-year window.

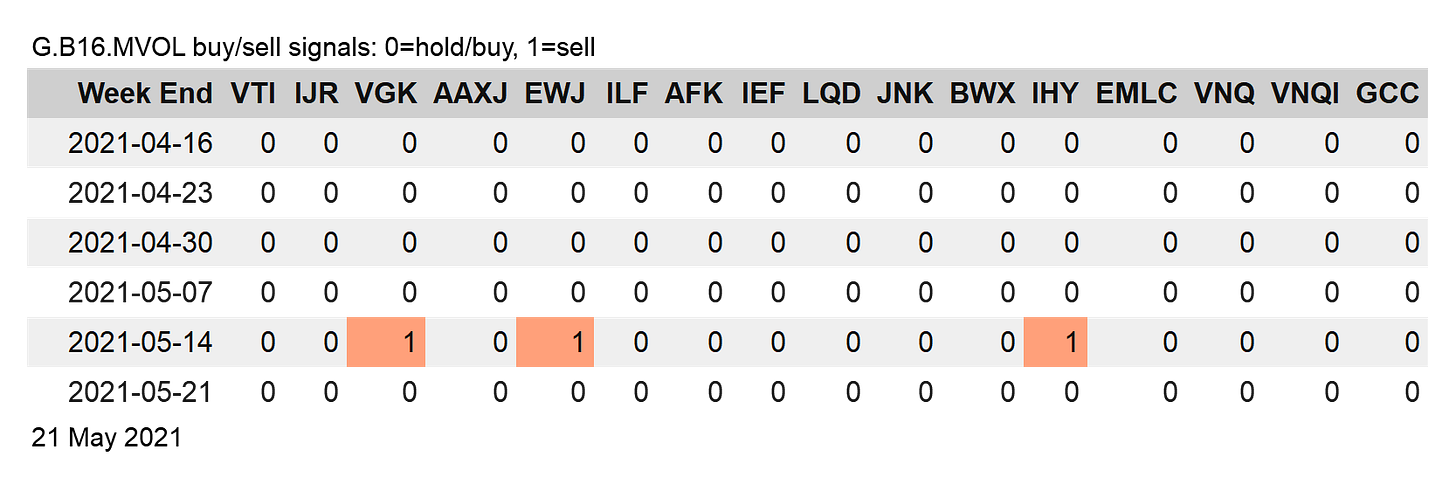

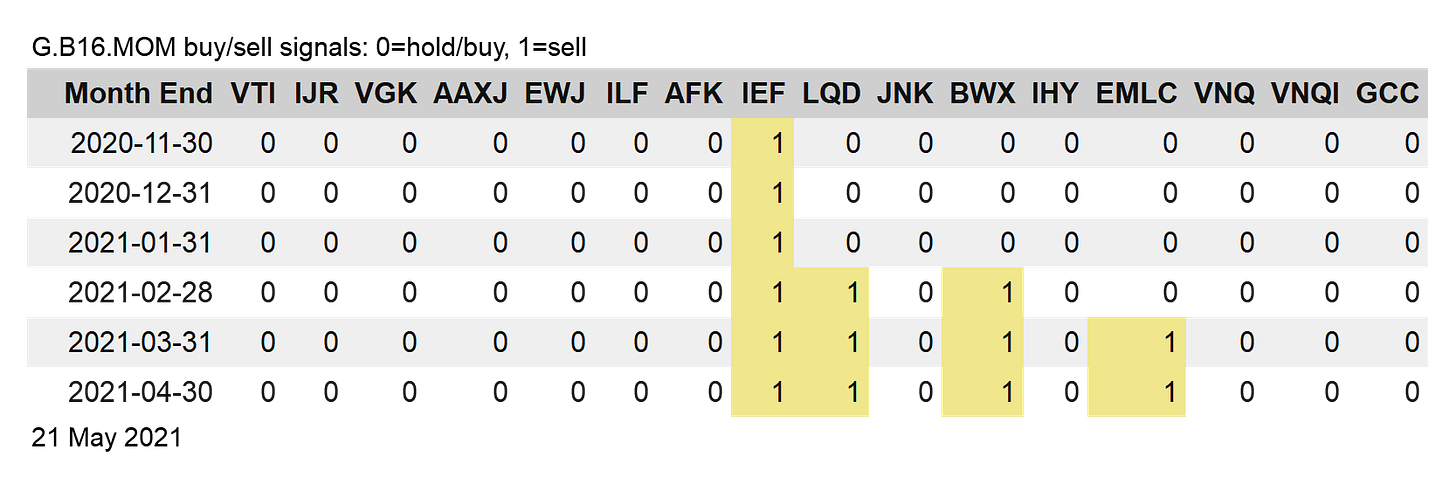

There was only one risk-related rebalancing change last week: G.B16.MDD added SPDR Barclays High Yield Bond (JNK) to the risk-off camp. Otherwise, risk positioning for G.B16.MVOL and G.B16.MOM remains unchanged from the previous week.