The ETF Portfolio Strategist - Sunday, May 16

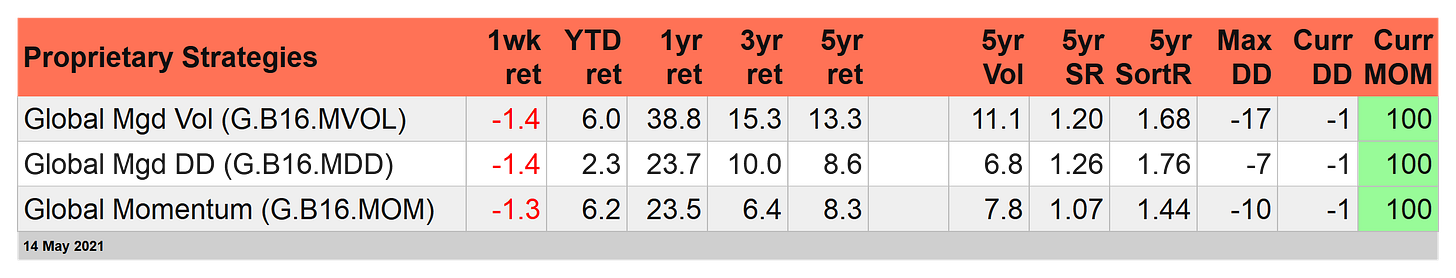

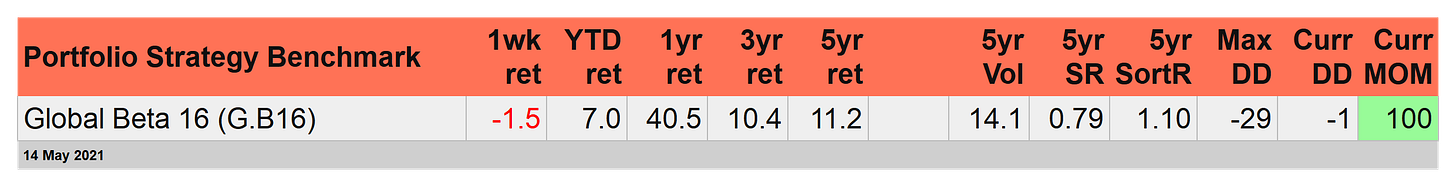

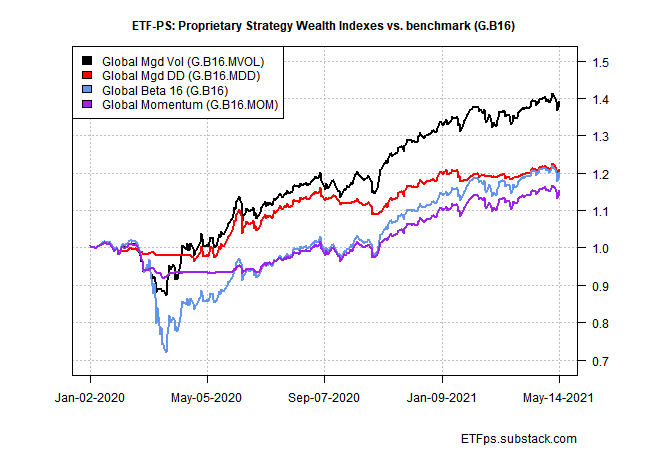

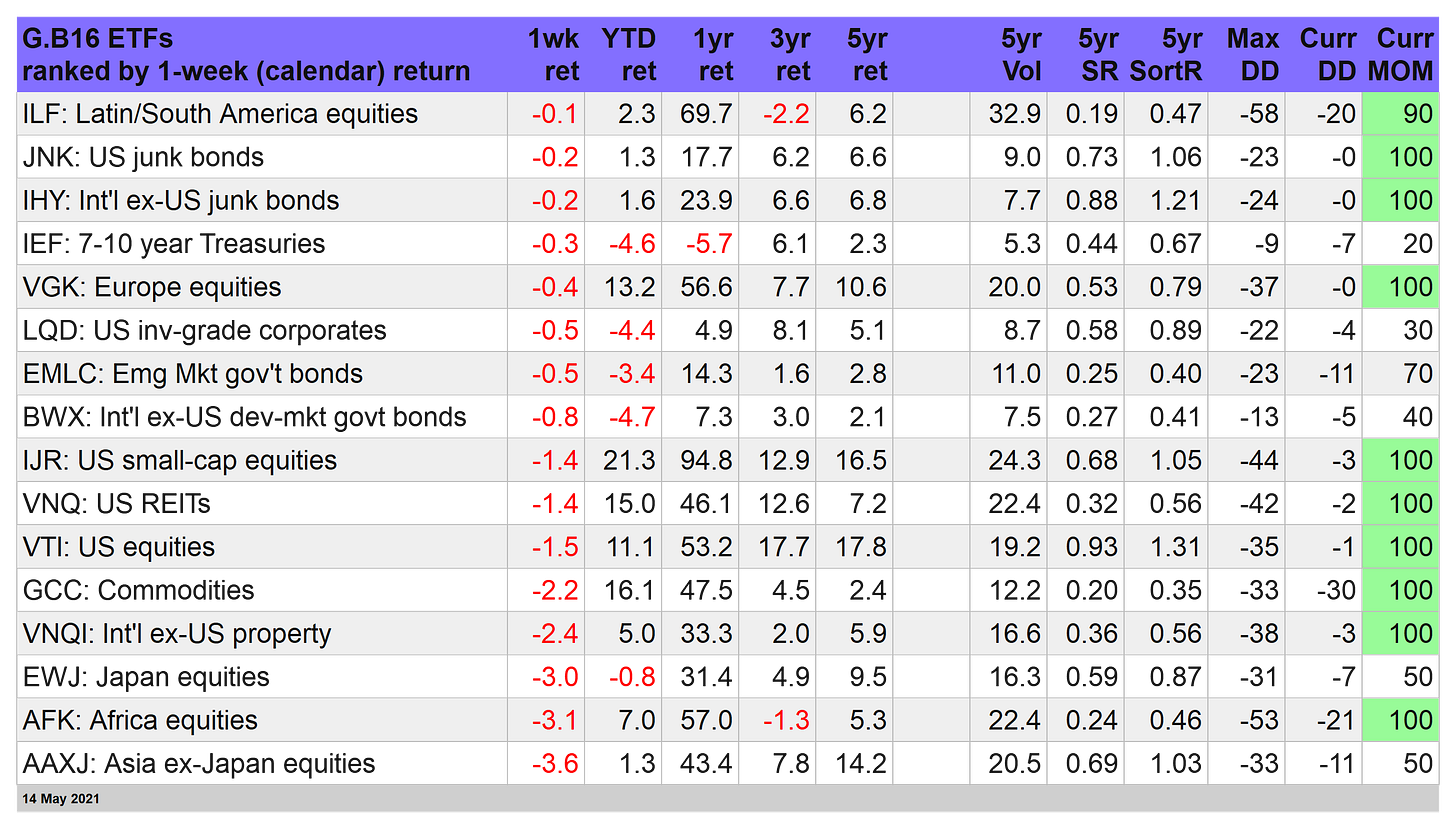

Our trio of proprietary strategies outperformed their common benchmark last week. Alas, the outperformance was in the form of lesser declines, but that still beats underperformance.

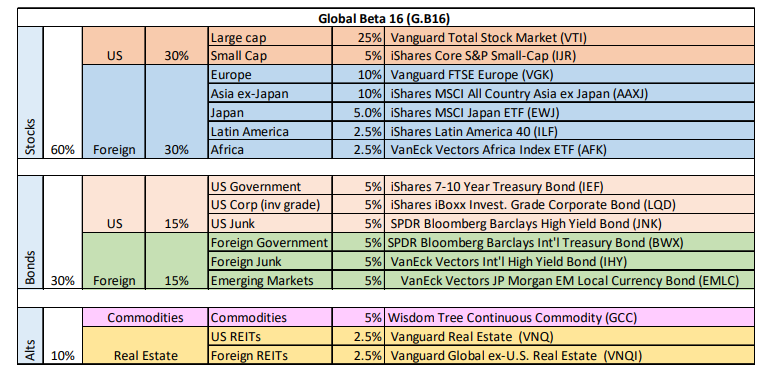

The softer losses helped close the year-to-date gap that the benchmark – G.B16 – still enjoys over the proprietary strategies. For two of the prop strategies, the 2021 gains are within shouting distance of G.B16, which is ahead by 7.0% for the year through Friday’s close (May 14).

Global Momentum (G.B16.MOM) has gained 6.2% year-to-date, and is currently the closest to matching G.B16’s advance in 2021. By contrast, Global Managed Drawdown (G.B16.MDD) is nursing the biggest lag at the moment via a relatively weak 2.3% year-to-date rise.

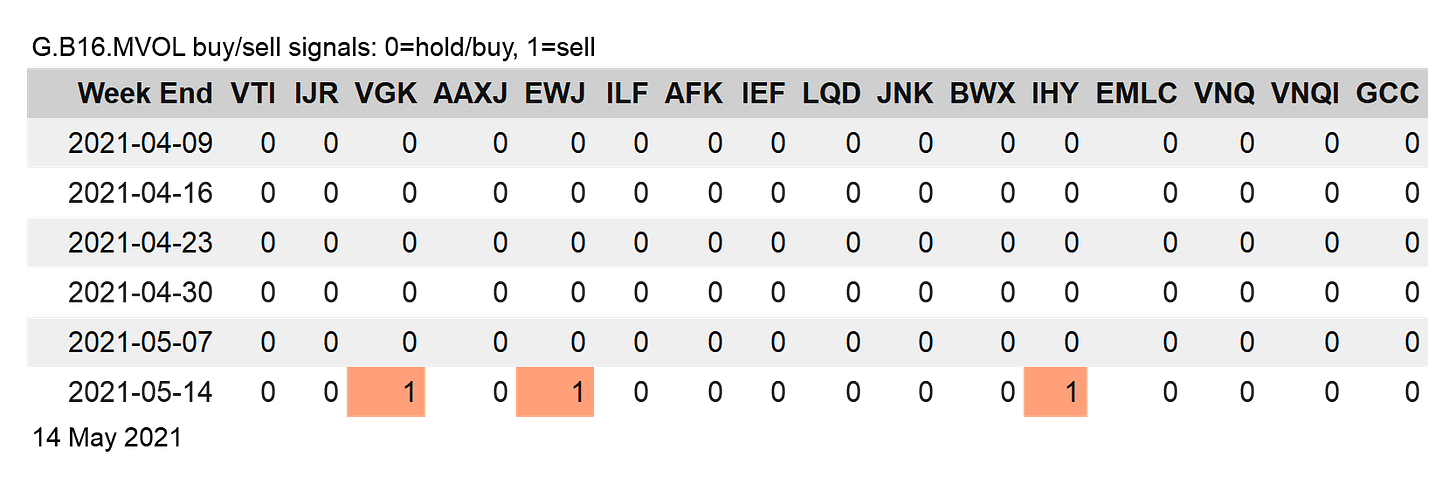

G.B16.MVOL became moderately more defensive at last week’s close as three of its 16 funds shifted to risk-off. That’s the first time in seven weeks that the strategy moved away from a full-on risk-on profile. The trio of risk-off positions: foreign developed-market stocks (VGK), Japan stocks (EWJ), and foreign high-yield bonds (IHY).

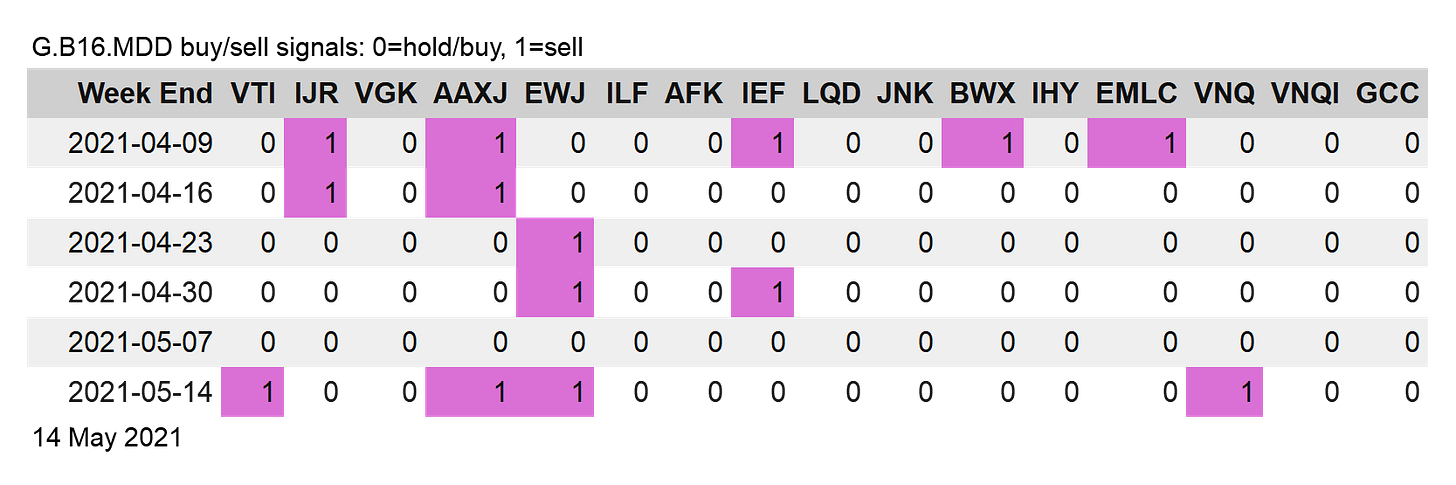

Meanwhile, G.B16.MDD reversed its complete risk-off profile (a rare event for the strategy) and shifted to risk-off for four funds last week, including US stocks (VTI):

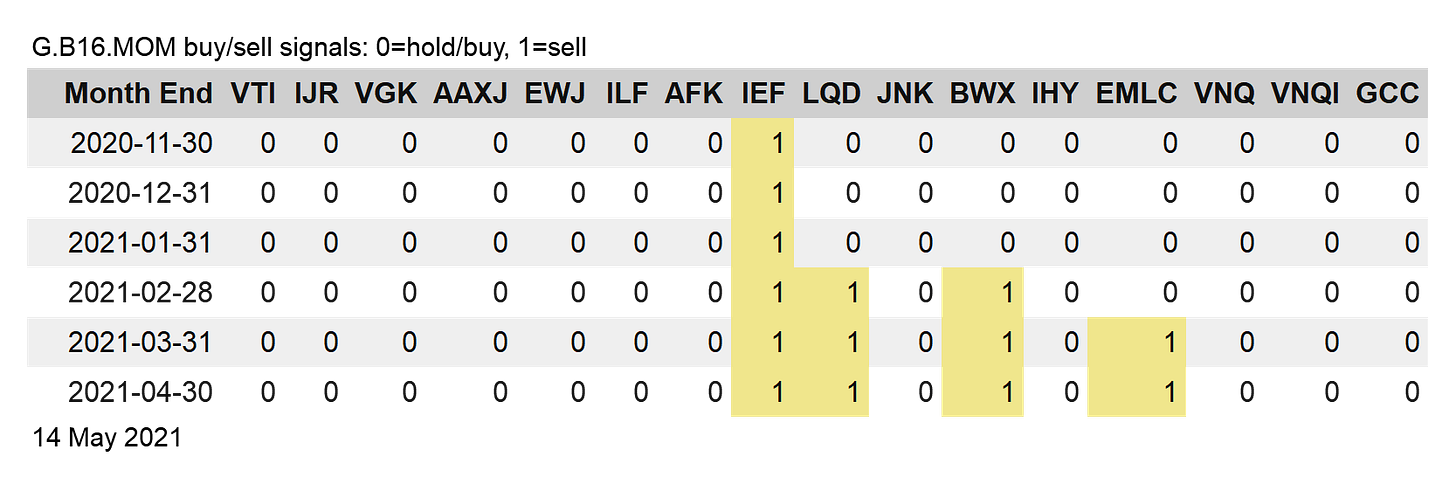

G.B16.MOM, by design, had no changes — any rebalancing events are limited to month-end changes. That said, the strategy continues to reflect four risk-off positions for its 16-fund opportunity set (G.B16).