Shocking German PPI Data Unable To Deter EUR Upside

EURO Fundamental Backdrop

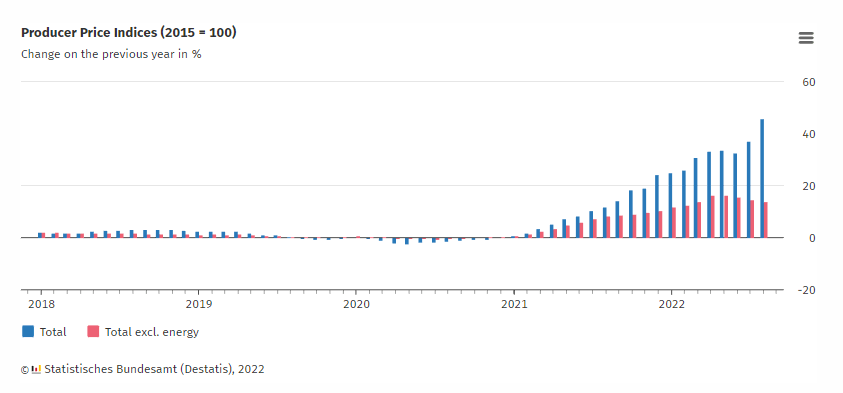

The euro has managed to pull itself above parity once more against the greenback despite quite shocking German PPI data for August (see economic calendar below).

EUR/USD Economic Calendar

Source: DailyFX economic calendar

Looking at the PPI comparison with and excluding energy, we can see that most of the price appreciation on the headline figure can be attributed to higher energy costs and underlines the energy crisis within the eurozone.

Looking ahead, markets are anticipating the Federal Reserve’s interest rate decision tomorrow which is currently expected at 75bps with 83% probability, according to money market pricing – see table below. The post-announcement address by Fed Chair Jerome Powell will be key as to what’s next considering many analysts expect inflation to have peaked. Forward guidance will dictate the short-term directional bias on EUR/USD but fundamental headwinds facing the eurozone are mounting and may be aggravated by the upcoming winter months. This leaves the euro exposed to the downside although the ECB’s hawkish narrative of recent has helped relieve some EUR weakness.

Fed Interest Rate Probabilities

Source: Refinitiv

Technical Analysis

EUR/USD Daily Chart

Chart prepared by Warren Venketas, IG

EUR/USD price action of recent reflects the current fundamental backdrop with markets uncertain ahead of a key central bank week. Daily candles are riddled with doji formations without much directional bias leaving the pair vulnerable to whatever the Fed may throw at us. Yesterday’s close above the 20-day EMA (purple) has generated an immediate level of support as we await the details around tomorrow’s FOMC meet.

Resistance levels:

Support levels:

- 1.0000

- 0.9854

More By This Author:

US Dollar Price Action Setups: EUR/USD, GBP/USD, CAD/USD, USD/JPYEUR/USD Dips Below Parity With Dollar Index Leading The Way

Gold Price Softens Ahead Of A Busy Week With Fed, BoE, SNB And BoJ Meetings

Disclosure: See the full disclosure for DailyFX here.