Russia: Defensive Current Account Should Limit Ruble Downside

In 2Q, the current account was strong at US$20bn thanks to non-fuel exports, while net capital outflows decelerated to US$10bn on a lower preference for foreign assets. The non-fuel BoP should enhance the ruble's resilience to global risk-off in 3Q. But an appreciation in 4Q remains uncertain and subject to local investment out of the sovereign fund.

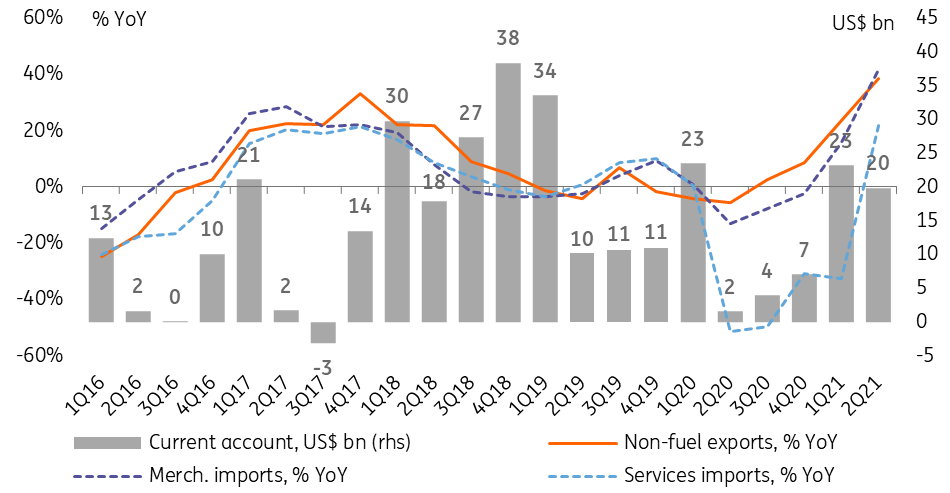

The current account remained strong in 2Q21

The first estimate of the Russian balance of payments for 2Q21 is painting a relatively benign picture. The current account surplus was reported at US$19.9bn, which is close to the market consensus, and near the upper border of our forecast range of US$15-20bn. Even though the 2Q21 result is lower than 1Q21's US$23.2bn, this is still much better than suggested by the seasonality, as normally in the second quarter it is close to zero on higher imports of goods and services and dividend payments. Looking deeper into the details it is evident that the reasons for the strength go beyond the Urals price, which indeed increased from US$60/bbl in 1Q21 to US$67/bbl in 2Q21.

- The key positive from the current account data is growth in quarterly non-fuel exports by 39% YoY (despite the lack of a low base effect) to US$57bn, equal to the historical high seen in 4Q20. The detailed structure of quarterly exports is not available yet, but based on the April-May data from the federal customs, the key contributors to the growth include metals, non-fuel chemicals (mainly fertilizers), machinery&equipment, and lumber, all showing c.60% year-on-year growth on a combination of a stronger price environment and higher physical volumes. Even assuming some moderation in the growth for 2H21, this year's non-fuel exports growth can reach a four-year high of 20% after staying flat in 2020.

- Imports of goods and services also picked up, but more or less in line with expectations and from a low base of 2020 (Figure 1). Imports of goods are the bigger concern, as they showed 42% YoY growth in 2Q21 to an 8-year quarterly high of US$76bn, suggesting that the strengthening local activity is creating strong demand for imports. Imports of services also showed a recovery – by 22% YoY to US$15bn, which however is still significantly below the pre-Covid high of US$25bn seen in 2Q19. The recent reopening of popular tourist destinations, including Turkey (with estimated quarterly spending US$1.5-3.0bn), and Egypt (relevant mostly for 4Q21), the imports of services should continue gaining momentum to 30-35% YoY in 2H21, but in absolute terms annual imports of services in 2021 should still be around US$30bn lower than the 2019 peak of US$99bn.

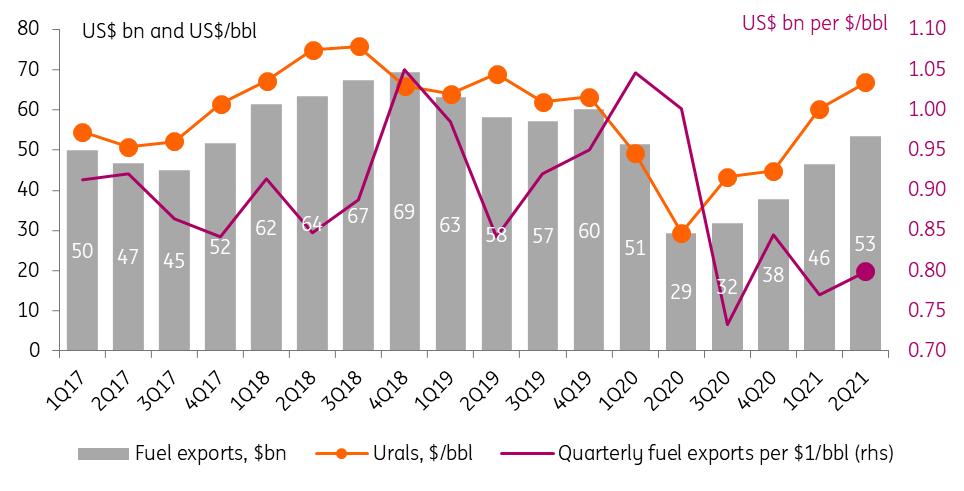

- Finally, the fuel revenues, which reached a two-year high of US$53bn in 2Q21, benefited not only from the higher oil price but also apparently from higher volumes leading to fuel exports recovering to US$0.8bn per 1/bbl (Figure 2). This is still below the pre-OPEC+ US$0.85-1.00, but assuming some easing in the restrictions scheduled for 2H21, further recovery should be expected.

Based on US$43bn current account surplus in 1H21 and given the structure of 2Q21, our US$65bn forecast for the full year is becoming a bit pessimistic, assuming Urals remains in the US$70-75 range. We expect the 3Q21 current account to remain at US$20bn, as higher imports of goods and services are likely to be offset by stronger exports. Meanwhile, in 4Q21 the surplus may shrink to single-digit US$5-9bn. At the same time, the oil price, which has recently become more volatile, is a significant factor of uncertainty, as each US$1/bbl assures around US$3bn of annual fuel exports.

Figure 1: Current account in 2Q21 was supported by non-fuel exports

Source: Bank of Russia, ING

Figure 2: Fuel exports per $1/bbl are recovering

Source: Bank of Russia, Refinitiv, ING

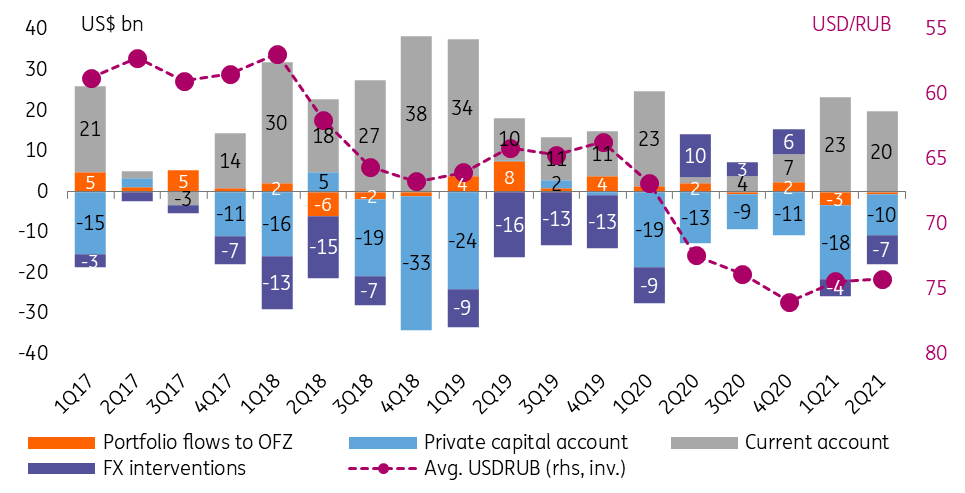

The overall balance of payments looks stable

The broader balance of payments also looks relatively strong, as the current account surplus appears high enough (and likely will be that way in 3Q21) to withstand the possible outflows via the capital account (Figure 3).

- The key positive is that the net private capital outflow narrowed from US$18.3bn in 1Q21 to US$10.0bn in 2Q21 amid the relatively unchanged current account surplus. While the foreign debt statistics, to be released on 13 July, will give a deeper insight into the structure of the capital outflow, we can make a preliminary conclusion that unlike the situation of 1Q21, when the capital outflow was driven purely by the accumulation of the international assets, the 2Q21 outflow seems to reflect higher private sector's preference to reduce foreign liabilities. The 1H21 net private capital outflow of US$28.3bn makes us comfortable with a full-year expectations of US$45bn.

- The volume of FX purchases conducted in accordance with the fiscal rule naturally increased from US$4bn in 1Q21 to US$7bn along with the higher oil price, remaining small enough for the overall current account to absorb. To remind, for 2H21, we expect FX purchases of US$22bn, including US$12bn in 3Q21 and US$10bn in 4Q21. This will not be an issue in 3Q21 given the expected US$20bn current account surplus, but in the 4Q21 may create some uncertainties amid shrinking non-fuel current account. At the same time, the FX purchases could be lowered if the government manages to finalize the plans to invest US$3-5bn per year out of the National Wealth Fund into local infrastructure projects in 2021-2023.

- Net portfolio flows related to the local public debt market (OFZ) remained negative in 2Q21 but improved to -US$0.6bn vs. -US$3.3bn. The prospects for further flows remain uncertain: on the one hand, the persisting risk of widening in the sanctions to the secondary market (since mid-June, offshore investors no longer can purchase OFZ at the placement auctions, but still can enter via the secondary market) and global risk-off mood, that appeared recently is a factor limiting the inflows. On the other hand, Russia's strengthening fiscal position acknowledged by the rating agencies and relatively hawkish monetary policy outlook could make Russian assets attractive vs. peers. In any case, looking at the scale of flows, they appear less significant relative to other components of the balance of payments.

Improvement in the private and state capital account amid stable current account was the key reason why ruble exchange rate managed to stabilize in 2Q21 despite rather volatile external newsflow on foreign affairs and monetary policy.

Figure 3: Current account is large enough to withstand negative capital flows

Source: Bank of Russia, Refinitiv, ING

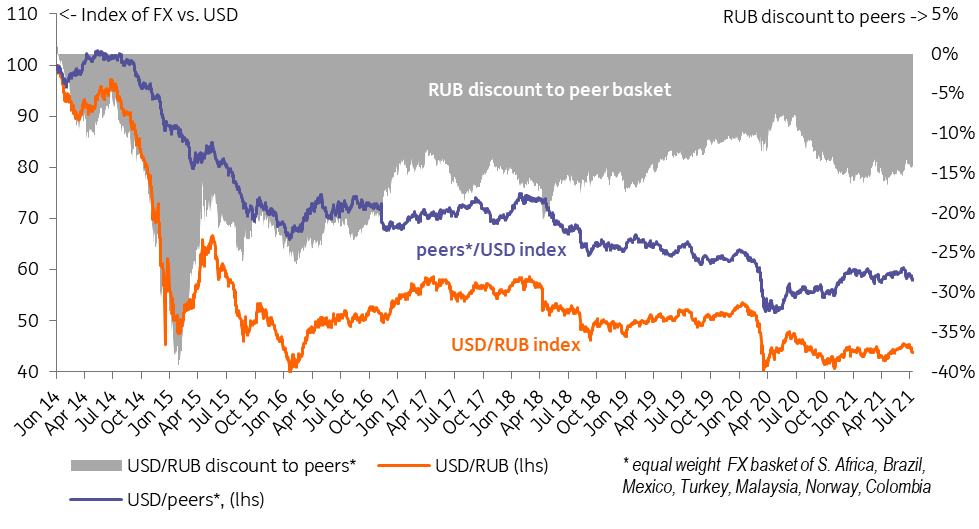

RUB's downside in the current risk-off should be limited

The 2Q21 balance of payments data somewhat lowers our concerns regarding the non-fuel current account and private capital outflow, at least for the near term. Our take is that in 3Q21, the current account should be large enough to absorb the private capital outflow and growing FX purchases. The recent ruble depreciation to the USDRUB74-75 range was driven by the deterioration in the EM risk appetite (stronger dollar) and was not Russia-specific. In fact, some improvement in the non-portfolio balance of payments assured USDRUB's stabilization vs. peers in 2Q21 and even outperformance in the beginning of 3Q (Figure 4). This makes us comfortable with our USDRUB75.0 expectations for the end of 3Q21, but the near-term volatility cannot be excluded, with the market testing the upper border of the wide 70-75 range given during shallow summer trading and the continuing dividend period in Russia.

The prospects of USDRUB recovery to 73.0 by the year-end are now less clear, as the eventual narrowing in the non-fuel current account amid elevated FX interventions could leave the local FX markets exposed to external risks, especially given the less bearish global outlook on USD till the year-end. At the same time, a potential US$3-5 bn cut in the FX interventions on local investments out of the local sovereign fund could offer some minor support, remaining a watch factor.

Figure 4: USDRUB stabilized vs. peers in 2Q21

Source: Refinitiv, ING

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more