RBNZ Preview: A 25bp Hike But Peak Rate Of 5.50% Looks Hard To Reach

We expect the Reserve Bank of New Zealand to hike by 25bp to 5.0% this week and to maintain a hawkish tone, which can support NZD. The slower pace of tightening is warranted by external and domestic downside risks to the economy and a lower inflation outlook. These same factors make us doubt that the 5.50% peak rate (projected by the RBNZ) will be reached.

Growth and housing outlook is grim

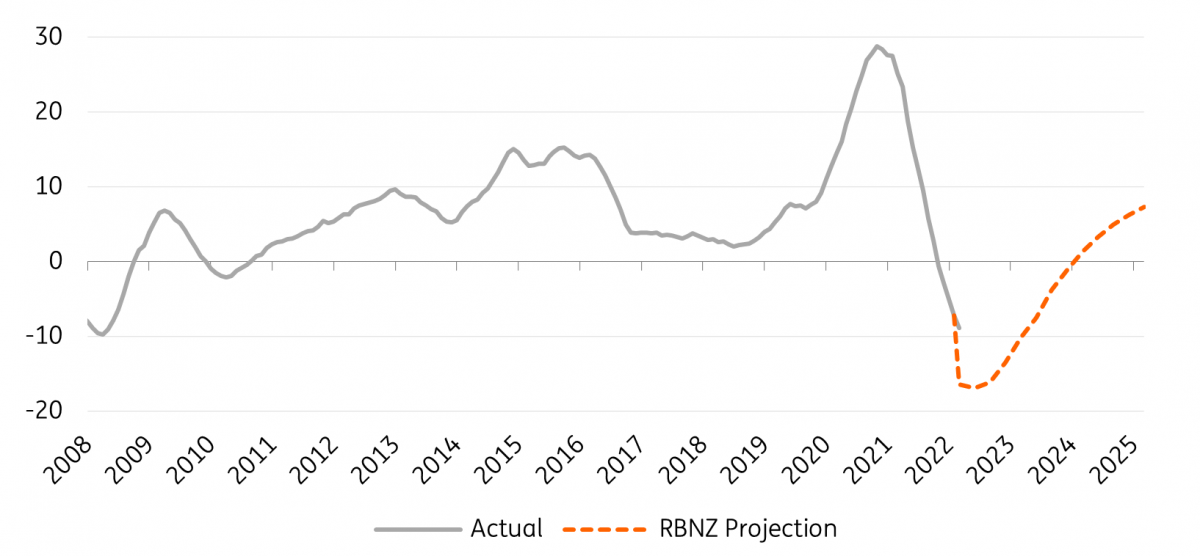

New Zealand’s GDP dropped by 0.6% in the last quarter of 2022, greater than what the RBNZ had projected in its latest statement. Additionally, with disruptions from the North Island storms, we expect GDP growth and inflation to be negatively impacted in the first half of 2023.

The housing market has also continued to deteriorate. Prices fell by 1% in February, a much greater decline compared to previous months, and the Reserve Bank expects prices to decline even further. When looking at CoreLogic’s latest sales volumes, we see transactions in the past 12 months (as of February 2023) are at their lowest levels in over 40 years due to tightening lending conditions and the cost of living squeeze.

New Zealand house price index (% year-on-year)

Source: RBNZ, CoreLogic, ING

In conjunction with the housing market slump, 50% of the existing fixed mortgage loans are due to be repriced within the next 12 months – the RBNZ will need to tread carefully given the substantial rise in mortgage rates. With the increasing risk of households facing difficulty in servicing their debts, and the labour market expected to soften over time, we believe there’s only so much room left for the RBNZ to continue hiking.

25bp look likely this week, but 5.50% peak rate is hard to achieve

No inflation or jobs figures have been released since the February meeting. But considering near-term risks are on the downside - both due to the recent financial turmoil and the impact of weather events in NZ – and that recession is looming over New Zealand, we think the RBNZ will slow the pace of tightening and hike the policy rate by 25bp, to 5.0%.

The NZD OIS curve is pricing in exactly 25bp this week, another 25bp hike by the July meeting (5.25% peak rate), followed by around 30bp of cuts by February 2024. The latest RBNZ projections (released in February) signal a 5.50% peak rate, and we have long highlighted how the deteriorating domestic picture and the strong chance of a faster-than-expected drop in inflation suggest the RBNZ may not reach that level at all.

While waiting for more evidence on the inflation, jobs and economic fronts, the RBNZ may continue to hold a hawkish stance. The Bank will only issue a statement this time, without new rate or economic projections, so a reiteration that policy rates still need to rise would be enough to keep rate expectations supported. We think this may be the preferred course of action for now for the RBNZ, and this may ultimately support the Kiwi dollar.

However, a dovish tilt looks to us as a matter of 'when' rather than 'if'. We think that rates will peak at 5.25% and we cannot exclude that a sharp drop in inflation and economic activity will force a pause and make this the last hike of the cycle for the RBNZ.

More By This Author:

Turkey: Inflation Falls To 50.5% On Large Base Effects

China’s PMIs Show Growing Risk From Slowing External Demand

OPEC+ Shocks Market With Supply Cuts

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more