OPEC+ Shocks Market With Supply Cuts

A handful of OPEC+ members surprised the market over the weekend by announcing further voluntary cuts amounting to around 1.66m b/d from May to December 2023. These surprise cuts mean a tighter market this year. As a result, we have had to revise higher our oil forecasts for the remainder of 2023.

What has been announced?

A number of OPEC+ members shocked the market over the weekend by announcing further voluntary supply cuts. These cuts were announced ahead of the Joint Ministerial Monitoring Committee (JMMC) meeting scheduled for 3 April, where the expectation was that the committee would recommend keeping the output policy unchanged.

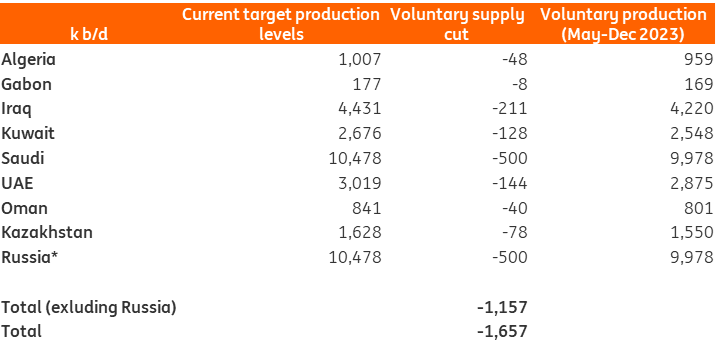

Nine members of the OPEC+ group announced further voluntary cuts, amounting to around 1.66m b/d.

However, 500k b/d of this is from Russia, which will be extending existing output cuts from the end of June until the end of this year. The reduction in Russian supply was already factored into our balance.

Additional cuts from other members total around 1.16m b/d. These cuts will start in May and run until the end of 2023. The bulk of the cuts will come from Saudi Arabia, which will reduce supply by 500k b/d, while cuts will also be seen from Algeria, Gabon, Iraq, Kuwait, the UAE, Oman and Kazakhstan.

Given that most of these members are producing at or near their current quota levels suggests that actual supply reductions will not be too dissimilar to the paper cuts announced.

Voluntary supply cuts announced by OPEC+ members

Source: OPEC, reports, ING Research

* Russian supply cuts are an extension of recently announced cuts

Why reduce output?

The move to reduce supply is fairly odd. Oil prices have partly recovered from the turmoil seen in financial markets following developments in the banking sector. Meanwhile, oil fundamentals are expected to tighten as we move through the year. Prior to these cuts, we were already expecting the oil market to see a fairly sizeable deficit over the second half of the year. Clearly, this will be even larger now.

The cuts suggest that OPEC+ was not content with Brent trading in the US$70-80/bbl range. It would appear it wants the floor for the market at even higher levels. Although, Saudi Arabia stated that the cut is a “precautionary measure aimed at supporting the stability of the oil market”. This might make sense in the near term, however, the tightness in the latter part of the year, suggests that this could in fact lead to further volatility in the market.

OPEC+ members can also cut without the worry that they will lose significant market share to non-OPEC members. In previous years, OPEC+ would have been hesitant to push prices too high, with the fear that it would lead to a strong supply response from US producers. However, it is clear that US output growth is much more modest these days, with a change in mentality from US producers. Gone are the days of pumping as much as possible. Instead, capital discipline and shareholder returns appear to be the key focus now. Therefore, OPEC+ members can look to maximize revenues without the fear of losing significant market share.

While the cut is clearly bullish from a fundamental point of view, the group will also need to be aware of how the cut is perceived. The fact that we are seeing a sizeable supply reduction may suggest to some that OPEC+ is worried about the demand outlook in the current economic environment.

Tighter balance, higher prices

Prior to these latest cuts we were expecting the global market to be in deficit by around 1.3m b/d between the second quarter of 2023 and the fourth quarter. However, these cuts would push the deficit to in excess of 2m b/d.

We have not made any changes to our Russian supply number given we were already assuming a significant decline in output this year.

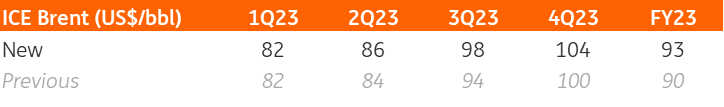

A tighter market means that we now expect higher oil prices. Prior to these announced cuts we were forecasting Brent to average US$97/bbl over the second half of the year. However, we now expect the market to average US$101/bbl over this period.

There are clear risks to this view. The most important being the demand outlook. At the moment, global oil demand is forecast to grow by around 2m b/d in 2023. A significant amount of this growth is concentrated in China (close to 50%), so naturally this is a risk, given a substantial amount of demand growth hinges on one country. Meanwhile, we will need to keep an eye on whether the aggressive tightening from central banks around the world leads to a stronger-than-expected slowdown later in the year. For now, we are still expecting marginal demand growth from OECD countries.

The US has already voiced its concerns over these latest cuts. Clearly, if prices push higher, we will likely see growing pressure on OPEC to increase output. Although, as seen over much of last year, it could very well choose to ignore this. This leaves the US possibly tapping the Strategic Petroleum Reserve (SPR) once again if needed, but given that the SPR is at its lowest levels since the early 1980s, it may be reluctant to do so.

ING oil forecasts

Source: ING Research

More By This Author:

FX Daily: OPEC+ Output Cut Gives Dollar A LifelineConstructive On Credit

Asia Week Ahead: Policy Rate Decisions From Australia And India

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more