Pandemic Hits Europe Hard

“Growth in Germany and Spain and a smaller-than-expected contraction in France pointed to resilience in the euro zone economy in the final three months of last year, but the bright spot belies a more troubled outlook for the bloc….The IMF said this week the euro area is likely to slip behind the United States in its recovery” (Reuters, Jan 29, 2021)

The pandemic recession has been very hard on European countries.

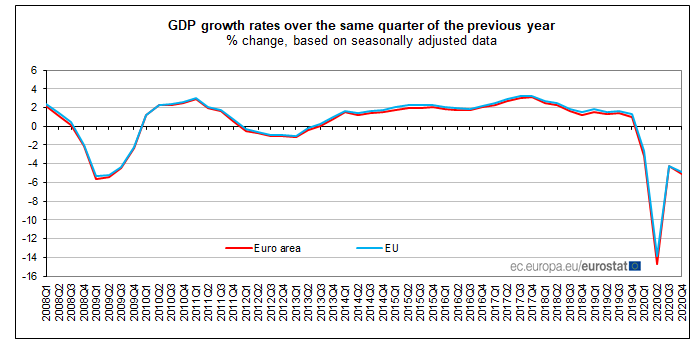

The Euro Area and the entire European Union (the EU) slipped back into recession in the fourth quarter of last year, following a somewhat similar pattern seen in the US.

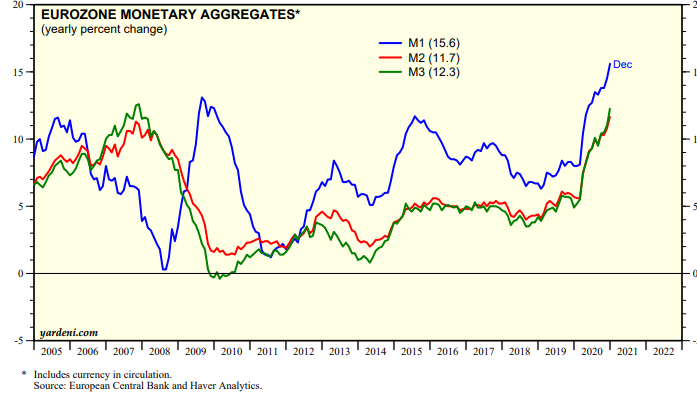

And as the following charts underscore, the money supply in the Euro Area expanded at an accelerated pace in 2020 because of the pandemic hit their economies extremely hard.

The European Central Bank (ECB) has provided a massive pandemic emergency program (PEPP) amounting to a total sum of €1,850 billion. As well, ECB monetary easing has already resulted in a very rapid growth in the money supply,

The ECB indicated on Jan 21, that it would continue the same course it has followed since the Covid-19 pandemic began in early 2020. In other words, interest rates would stay at record lows as would other policies introduced during the pandemic.

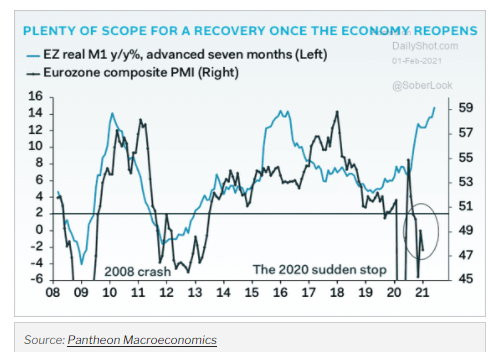

Reviewing the recent GDP data, the eurozone economy contracted less than expected in the fourth quarter of 2020 because of pandemic-induced lockdowns. However, the Zone is still likely heading for a steeper decline in the first quarter of 2021 due to the disappointing pace of the vaccine roll-out and the extension of restrictions in many countries.

As in the US, economists are now expecting a European recovery to begin in the second quarter, and essentially pick-up steam later in the year, assuming the vaccine rollout is successful

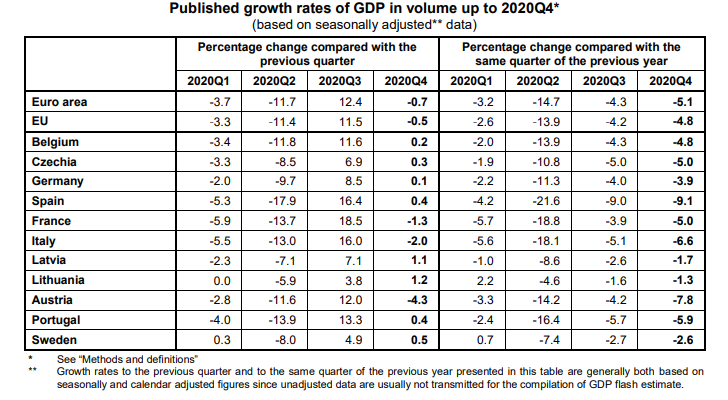

Based on preliminary data, real GDP in the Euro Area (19 countries) and the European Union (27 countries) declined in the fourth quarter of 2020.

As the following table and chart indicate, Euro Area real GDP dropped in the first and second quarters of 2020 as Covid-19 containment measures were implemented, and then rebounded strongly in the third quarter.

Compared with the same quarter in the previous year, fourth-quarter real GDP decreased by 5.1% in the euro area and by 4.8% in the EU.

Among the larger economies, France, the euro zone’s second-largest economy, shrank 1.3% in the final three months of 2020, while Italy recorded a2% decline.

In Germany, robust exports helped Europe's largest economy eke out 0.1% growth in Q4, despite a second wave of the new coronavirus and new lockdowns.

Recent data indicate that lending to Euro Zone companies picked up in December, even though the Euro Zone has slipped back in recession. European banks have indicated that they were tightening access to credit amid fear of defaults amid a fresh wave of lockdowns.

The ECB is unlikely to cut its already-record-low interest rate policy because that would do little to revive the pandemic-hit eurozone economy.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

The presumption of a rapid robust recovery is certainly what many are hoping for. The unfortunate bad news is that wishing and hoping do not make things happen. Even a lot of serious effort and real hard work do not assure that huge time of sunshine in the near future.

What may happen is that if any nation does recover much more rapidly there may be a big change in who is the world power. If it is China or India it will be "interesting" indeed.