Oil, Risk, And Price Pressures Before Putin/Ukraine

A reader, critiquing the argument that the expanded Russian invasion of Ukraine could not explain accelerating inflation before February 2022, observes “The surge of inflation happened well before the war.” I don’t think this characterization is entirely accurate, but in any case, oil prices rose before the so-called “Special Military Operation”, and price pressures showed up concurrently.

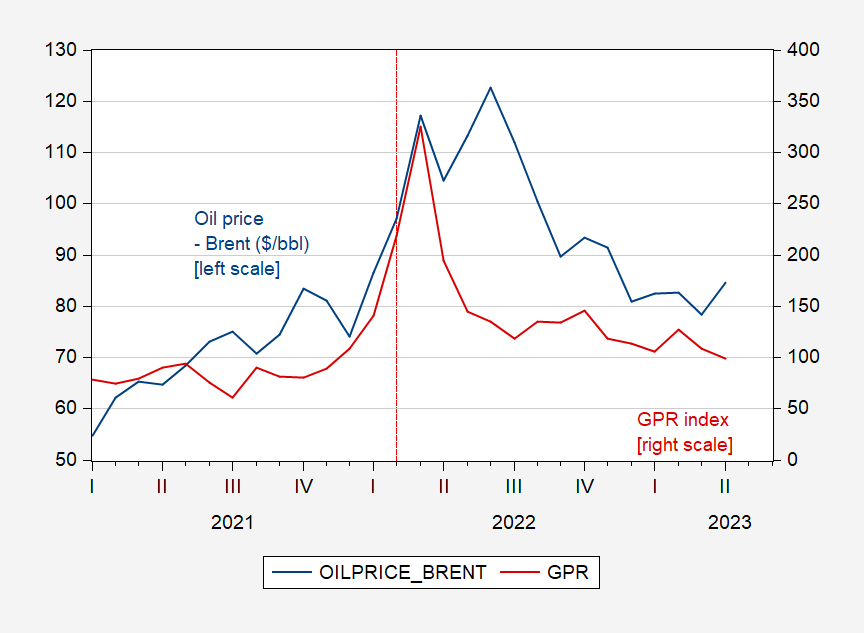

First, consider oil prices (Brent) and Geopolitical Risk as measured by Caldara-Iacoviello GPR index.

Figure 1: Oil price (Brent), $/bbl (blue, left scale), GeoPolitical Risk index (red, right scale). Red dashed line at 2022M02, Russian invasion. Source: EIA via FRED, Caldara-Iacoviello.

Notice that oil prices started rising even before the invasion; anxieties about Russian actions were rife as of November, so this is unsurprising. In other words, cost-push pressures rose before Russian tanks actually moved further into Ukraine.

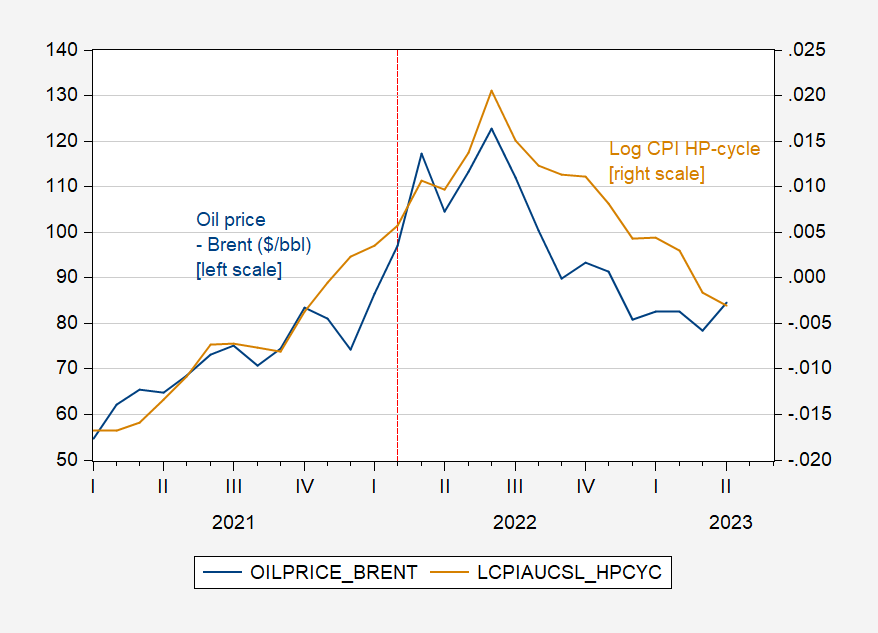

Figure 2: Oil price (Brent), $/bbl (blue, left scale), HP cyclical component of log CPI (tan, right scale). Red dashed line at 2022M02, Russian invasion. Source: EIA via FRED, CPI, and author’s calculations.

The graph indicates that the CPI was 2% above HP trend by June 2022.

More By This Author:

Real Median And Average Earnings, Normalized To NBER Peak

Timely Data On Median Wages

Real Wages, 2007-2023M04