Negative Yields Are No Longer Spanning The Globe

When commenting on the bond market, the tendency is to focus just on U.S. Treasury (UST) securities. This is not a critique, as the UST market is arguably the most closely followed bond arena in the world. However, sometimes investors can lose sight of developments in other sovereign debt arenas. Against this backdrop, I thought it would be prudent to provide an early 2022 update from a global perspective, although the results probably won’t surprise you too much.

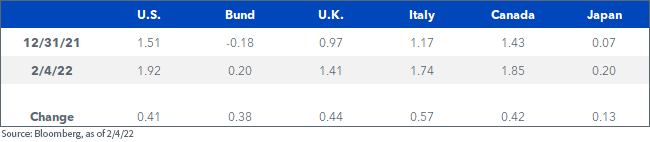

The trend here in the U.S. is one that is also occurring all around the globe—higher yields. As you can see in the table, 10-year sovereign debt yields have moved higher year-to-date in just about every key bond market. Interestingly, the increases have also been somewhat uniform in places such as the U.S., Germany, the U.K., and Canada, at around 40 basis points (bps) each. Italian 10-year BTP yields have risen the most thus far, by just under 60 bps. Even in Japan, yields have moved up by almost 15 bps in the Japanese Government Bond market.

Year-to-Date Changes in 10-Year Sovereign Debt Yields (%)

Perhaps the most noteworthy global development has been the return of sovereign debt yields into positive territory. Indeed, remember all those stories about negative yields abroad? Well, don’t look now, but as of this writing, negative rates are no longer evident in the 10-year sector, or even for essentially any of the five-year part of the curve either. Looking at German bunds as the benchmark government bond market outside the U.S., 10-year yields are now in positive territory for the first time since 2019. In fact, following last week’s ECB meeting, the markets seem to be betting that rate hikes will also occur in the eurozone later this year, which could bring the key deposit rate back to zero from its current level of -0.50%.

Conclusion

Let’s bring it back to any potential ramifications for the U.S. bond market. What sticks out to me is the narrative of recent years that negative rates overseas would serve as a cap on yield levels here at home. Well, what happens when negative rates abroad no longer exist? While spread comparisons would seem to still benefit Treasuries on an absolute basis, it seems reasonable to expect UST yields could potentially lose some support from overseas buying going forward. So, let’s harken back to my blog post from last week and ask the question: could the UST market lose support from both the Fed and global investors later this year? A fair question to ask and a compelling reason to consider rate hedging for a bond portfolio.

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more