Market Briefing For Wednesday, Nov. 30

A 'neutrality' stance isn't a cop-out avoiding decision-making, but currently is actually an appropriate strategy.

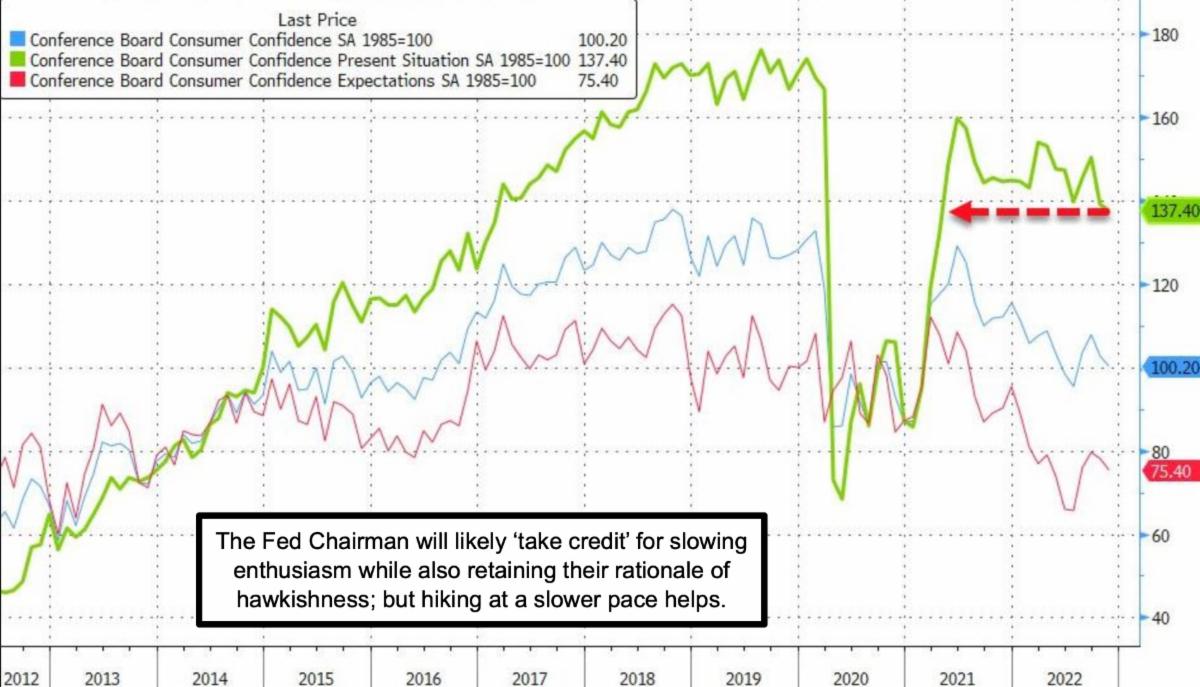

Why? Because we've had both the Fall's heavy decline (mostly in mega-caps) and the ensuing forecast evolving rally all the way up to key resistance. Yes S&P can go down if it doesn't go up. So obvious with a market near resistance and a Fed Chairman 'next up' to 'talk'. Also S&P can go down, then show 'relief' that Powell's speech is behind.

It's hard to get much more optimistic, given the effects of the tightening cycle, as well as the reality of many suppressed stocks likely to revive somewhat. At the same time there's a story of resilience because the majority of stocks had topped as outlined 'last' year (troops in the trenches), with just the generals in exposed forward positions taking fire and retrenching to join the rest. Thus it's hard to crash what's already crashed, with was the case for all but a very few.

Call for late 2022 and early 2023 behavior is tough indeed, although we have suggested a possible migration amid the crosscurrents of year-end tax selling versus accumulation and preparation for a new year, even if most everyone is lukewarm at best about prospects. In a sense the lukewarm attitude helps, as it tells you there are few excessive commitment made, and likely more shorts.

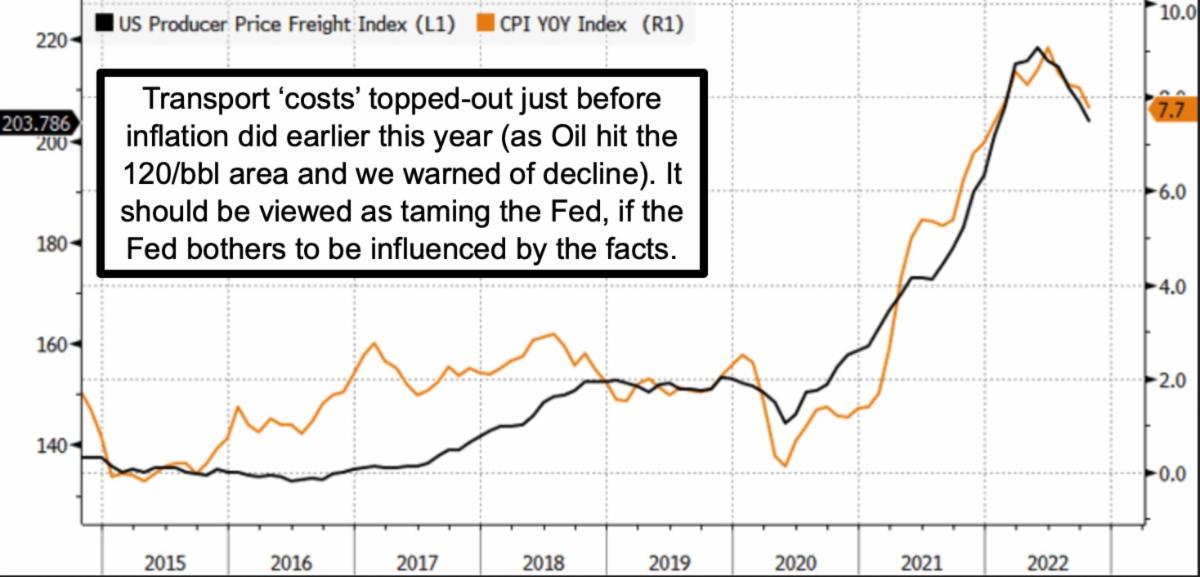

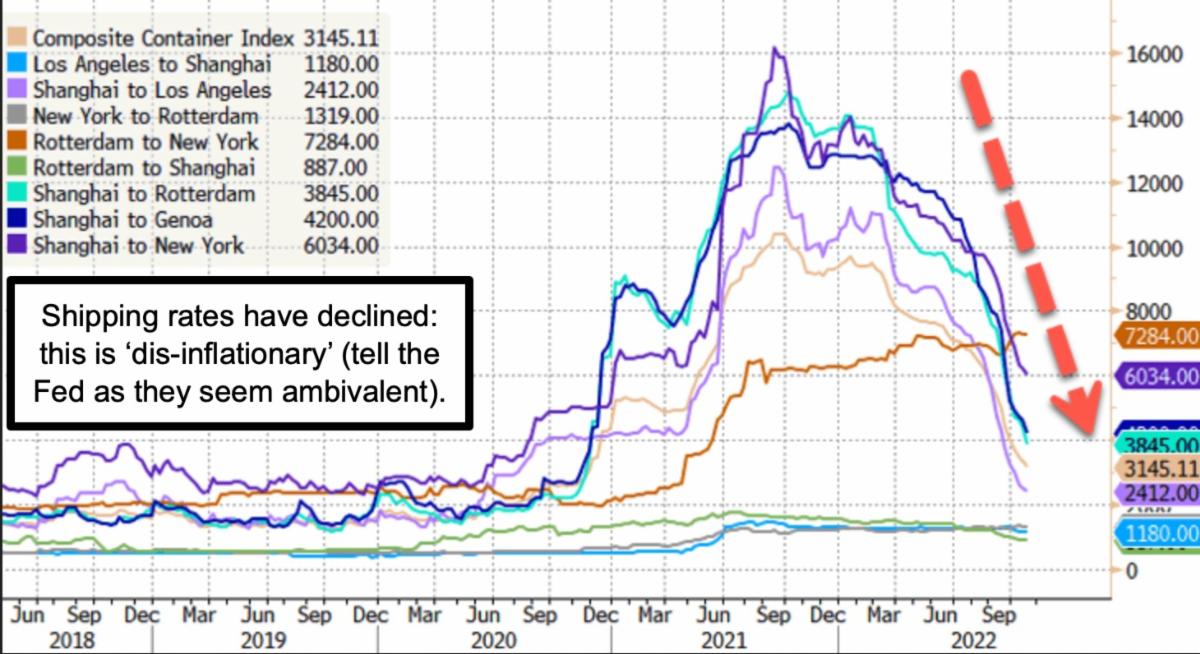

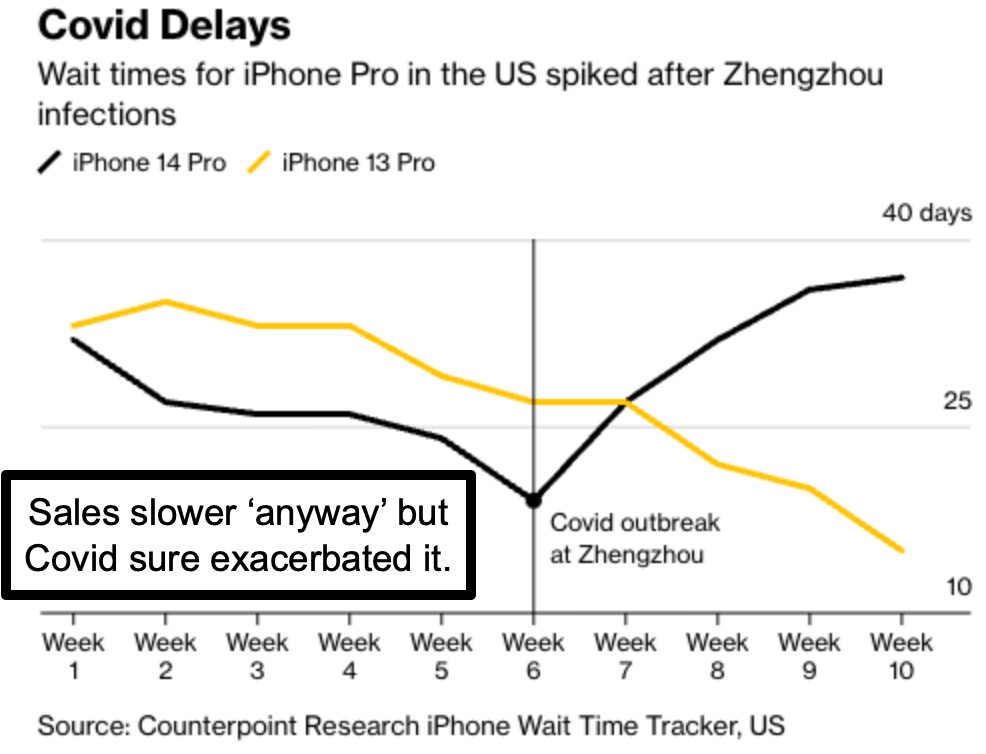

So yes we discussed this as a 'high-level trading range' and it is. Not exciting, but analytically correct. Current action is tricky for sure, especially when your future market outcome is in the hands of 'others', in this case the Fed as well as implications of what happens in China (where hopefully things stabilize a bit as relates to the supply-chain issues and hence the shortage/glut issue).

Aside the obvious challenge with an oblivious Fed (so far ignoring importance of external factors interest rates can't influence), and an in-the-corner Chinese President Xi, not to mention whether or not the Ukraine-Russian war persists through the Winter, we ponder whether the 'active' market will indeed excel.

Normally it's necessary to focus on disruptive technology to achieve superior results in a more-or-less neutral market environment. We'd tried to do that by 'sprinkling' a few bucks in a handful of small stocks trying to bottom. We did a bit more with our 'pick of the year', because it was truly unique if not disruptive in it's field, that being AEHR Test Systems. Now we're focused a bit on SKYT and SkyWater Technologies is not completely unique like AEHR, but we like it as a totally domestic semiconductor play with reasonably good prospects (for the most part tied to military relationships with the DoD).

In-sum:

The market's chopping around shy of key overhead resistance. The majority of pundits are bearish, but that same segment missed the rally from our predicted October washout lows. That matters not because we called that right (though glad we did), but rather because the money managers actually do 'fear' a rally into year-end, since they'd be compelled to buy into strength.

Of course that might not happen, so I suspect 'secretly' Wall Street influenced or hopes to get a hawkish 'tone' from Chairman Powell on Wednesday. They actually 'need' the market to decline, so they can get 'in', not for an exodus.

Considerable time is spent by the financial press and pundits debating if we're in another 2001 (we called for a 'crash' in the Spring of 2000, not after serious damage was done), similarly if we do get a serious shakeout it's a buy not sell for most S&P players. It would also be coincident with post-tax-selling trough.

Bottom-line:

Most eyes are focused.. maybe cross-eyed.. between China's COVID lock-downs and protests (versus resolution), and Chairman Powell's talk which I think Wall Street 'hopes' is hawkish so they can get a decline 'to buy in rather than sell for' in the couple weeks ahead.

More By This Author:

Market Briefing For Tuesday, Nov. 29

Market Briefing For Monday, Nov. 28

Market Briefing For Wednesday, Nov. 23