Market Briefing For Thursday, Feb. 24

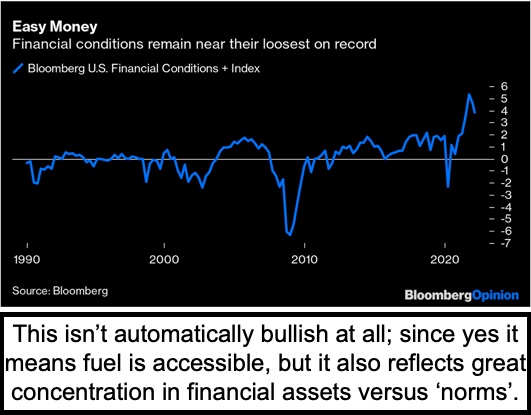

A double-edge sword dominates the slashing going on in the stock market. It is not merely Fed monetary policy, or even the geopolitical uncertainty, but a combination of ramifications from both, and that includes slow growth with the continued contraction of absurdly extended multiples in many mega-caps.

For traders, and in interesting small-caps that have the prospect of surviving a tough time (that normally means they have liquidity, cash on hand, and not at all high debt situations that might require financing at higher rates), gradually a nibbling approach can be suggested, or already has, with most efforts so far proving to be premature, which is why one has to be careful speculating.

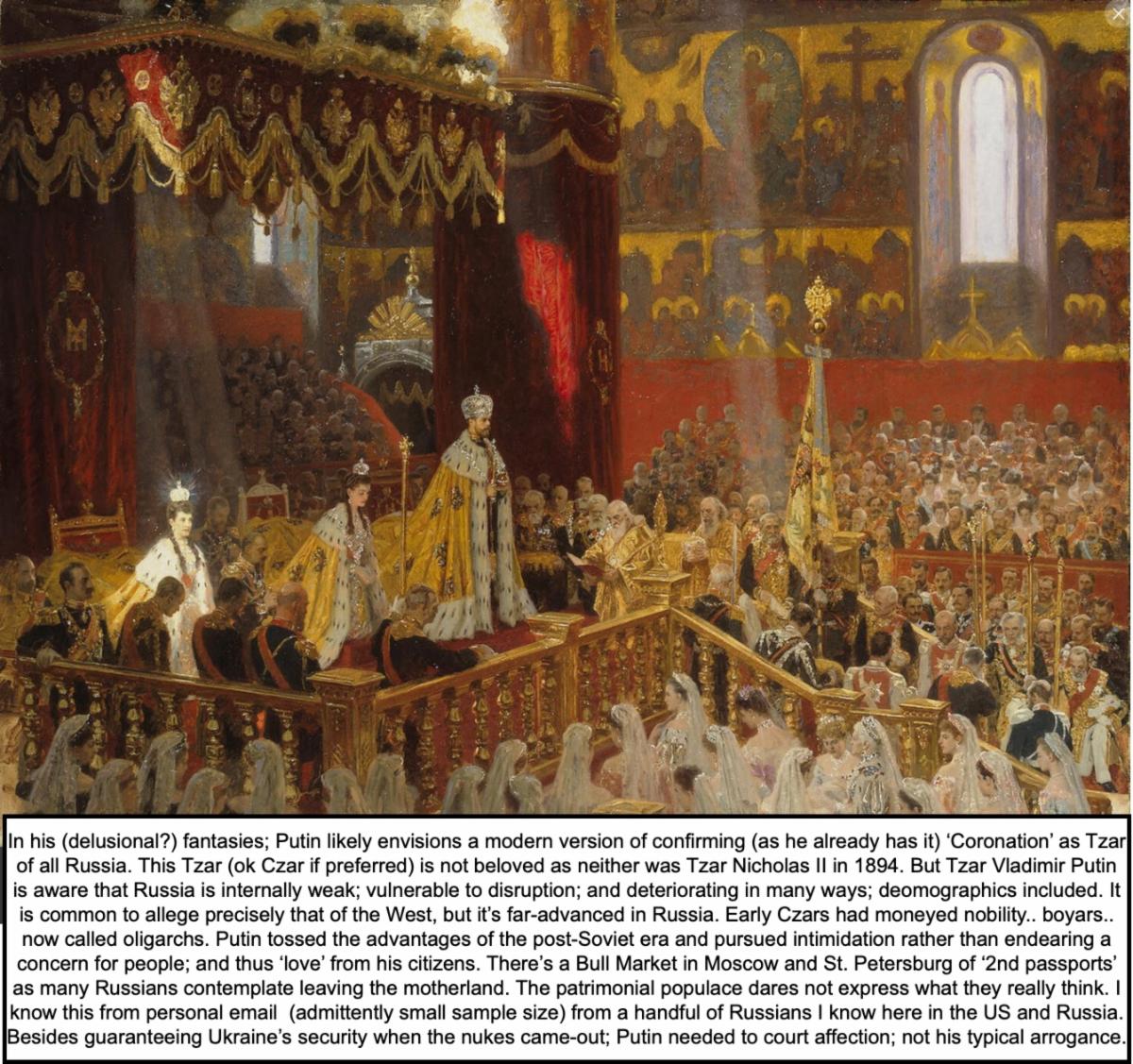

It may be inflation more than Ukraine, but that market's focus on war. I realize some will say the S&P will soar if it's only a 'regional war' (defined as Russia's absorption of Ukraine or installing a puppet-government in Kiev). That's more a recollection of what happened after we 'took' (most) of Iraq (Desert Storm). But in this case it's Russia pressing Ukraine to the wall, and that's a difference of course. However the market might be relieved if it stopped then.

The basic thinking has been that the U.S. won't 'really' care about Ukraine (a fact, but in a way it emboldens Putin), and Europe doesn't have the power to really take on Russia, and Putin knows that too. However if for any reason we get a 'chill' out of Europe, and Oil drops, market pops big-time. Otherwise not, and the focus remains on inflation, which the Fed alone can't 'whip' (to recall the old days of 'WIN' buttons, Whip Inflation Now). More rocky days ahead.

A couple weeks ago my thinking was not just continuation of a bearish overall structure, but that traders or investors might make sure to have buying power (basically cash available as of course margin is insane in such markets), and realize that a traditional 'crash' is so difficult because so many smaller stocks had already crashed last year, with further 'grinding into the ground' recently.

Interestingly, the downside moves have occurred whether fundamental stories were pretty decent or not. And that may be a reflection of the 'concentration' I long noted, in ETF's or Indexes, so any stock that belongs in one of these is subject to moving with the Index, ironic because executives often cheered as they had previously matured enough to be included in an index (like Russell).

In-sum:

This becomes a fairly persisted and almost protracted intermediate decline for the big-caps, including the S&P, NDX and even SOX, while it's a devastating situation for small-caps that might need to dilute for funding, thus a reason to be careful. If they're structured to make it through this period then that's fine, but if not operating cash problems (or the need to merge) surface.

COVID is still a factor, even as so many 'behave' as if it's not. That contributes to inflation, and as Hong Kong 'today' has the highest level of cases 'ever' as China masks what must be similar mainland conditions, the restrictions that in a sense contribute to supply-chain issues, and higher prices, persists.

It seems fairly certain that the overall higher price levels are going to persist, it is probable that the Fed will still hike, but modulate their statement to conform to the new reality globally (and hopefully grasp the impact of COVID, high Oil as a result of inflation 'and' geopolitics, not just demand which may cool a bit), continuing 'hot' CPI numbers and so on. A multiplicity of challenges.

BTW, the sanctions basically won't work, Putin will still get money from energy, and just like the military mantra of what what 'Russia does not what they say', it's about the same financially. Follow the money, counter-sanctions and Oil. Also, while this is not Putin's bluff, he'll fall over the bluff if he takes all Ukraine, then finds an insurgency with safe-haven support in neighboring EU / NATO countries, with prospect of wider war and impossibility for Russia to prevail.

And oh yes, before any cognitive dissonance, recall it's a U.S. Election year.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more