Lloyds Banking Group: A Top-Performing British Bank With Big Growth Plans

Image Source: Unsplash

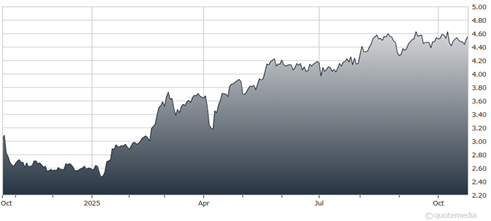

Lloyds Banking Group Plc (LYG) extended its share price gains after a sharp rally earlier in the year. It was recently up 68% in 2025. Not bad for an old, stodgy British bank, observes Philip MacKellar, editor of Contra the Heard.

The institution got a boost in August when the UK Supreme Court ruled in the financial industry’s favor regarding a motor vehicle financing case. The decision gave UK lenders a lift, as investors welcomed the removal of some worst-case compensation scenarios. While regulatory risks linger, Lloyds said its existing 1.15 billion British pound provision should be sufficient, and that any future adjustments are unlikely to be material.

Lloyds Banking Group (LYG) Stock Chart

First-half 2025 earnings reinforced the bank’s stable footing. Underlying net interest income rose 5% year-on-year to 6.7 billion pounds, supported by a healthy net interest margin of 3%, up 0.1% from the first half of 2024. Net income climbed 6% to 8.9 billion pounds, while operating costs increased in the low single digits, bringing the cost-to-income ratio to 55.1%.

On the capital front, Lloyds remains well-fortified. The CET1 ratio stood at 13.8% and the total capital ratio at 19%, both comfortably above regulatory requirements. Strong cash generation continues to fuel shareholder returns, including an ongoing buyback program that has retired a billion shares for 733 million pounds since February.

Looking ahead, the executive team reaffirmed full-year 2025 guidance and doubled down on more ambitious goals for 2026. Management pointed to digital investment, deeper customer relationships, and productivity gains as the main levers of growth.

My recommended action would be to consider holding shares of Lloyds Banking Group Plc.

Recommended Action: Hold LYG.

More By This Author:

Stocks: It's Always About Earnings, Always

Solana: The Fastest Blockchain You’ve Never Fully Understood

Earnings: Will Financials, Techs Deliver On Q3 Profit Front?