Stocks: It's Always About Earnings, Always

Image Source: Unsplash

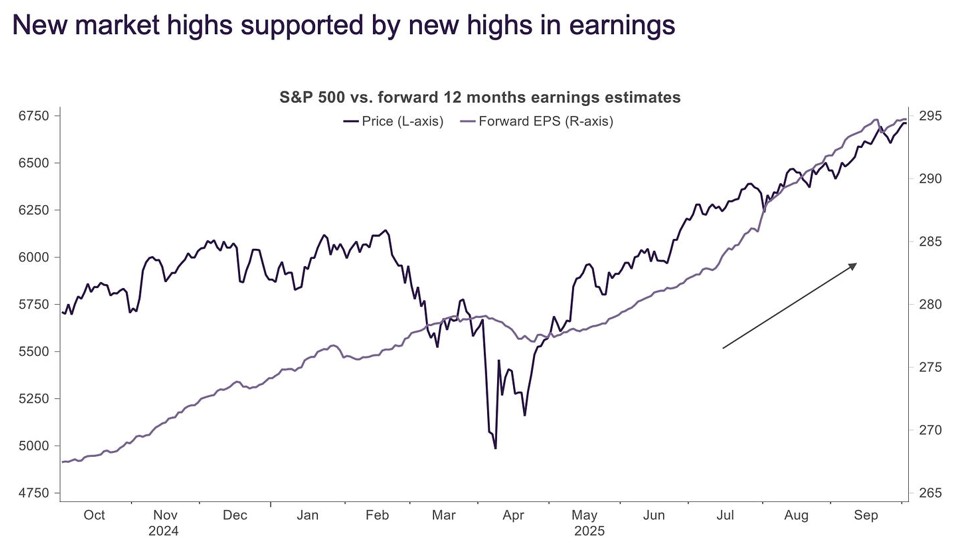

Time and time again over the past year, I found myself falling back on TKer Stock Market Truth No. 5: Earnings drive stock prices. Any long-term move in a stock can ultimately be explained by the underlying company’s earnings, and estimates for future earnings have been moving higher, notes Sam Ro, editor of Tker.co.

News about the economy or policy moves markets to the degree they are expected to impact earnings. Earnings (a.k.a. profits) are why you invest in companies. They are literally the bottom line. Earnings explain why the stock market has decoupled from the economy. They also explain why the US stock market has been outperforming the world for years.

For stock market investors, all of the challenges I’ve flagged previously have only mattered to the degree that they have affected earnings and the prospect for earnings growth. And throughout the year, companies continued to signal that their earnings were in good shape, despite the new challenges. This is reflected in analysts’ next-12-month earnings estimates, which have mostly trended higher as the year unfolded.

Source: Truist

As we have learned again and again, all else is never equal, especially in the business world, where companies constantly adapt and adjust to risks in their relentless pursuit of earnings growth. But efforts to mitigate risks have been so effective that profit margins have remained high, bolstering earnings growth. And those margins are expected to expand through at least 2026 and 2027, years during which earnings are forecast to grow at a double-digit pace.

To be clear: This doesn’t mean everything will work out as expected. It’s certainly possible that earnings fail to meet or beat estimates. It’s also possible that earnings do great, but stock prices fall anyway.

For now, the market dynamics appear to make sense. Earnings have been going up and are expected to keep going up. And stock prices have followed. That’s been the story for years.

About the Author

Sam Ro is the founder and editor of TKer, the award-winning newsletter curating news, data, and insights on the markets and the economy for long-term investors. He previously wrote the Axios Markets newsletter. Before that, he was the managing editor at Yahoo Finance and the deputy editor of markets at Business Insider. He is a CFA charterholder.

More By This Author:

Solana: The Fastest Blockchain You’ve Never Fully UnderstoodEarnings: Will Financials, Techs Deliver On Q3 Profit Front?

Are Chip Megadeals Proof Of A Boom Or Bubble?