Earnings: Will Financials, Techs Deliver On Q3 Profit Front?

Image Source: Unsplash

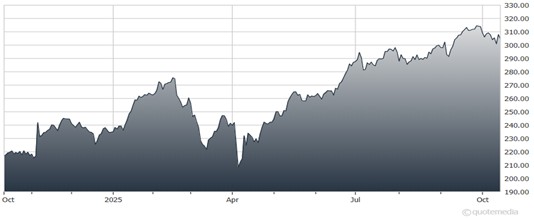

Earnings season has begun, with major banks like JPMorgan Chase & Co. (JPM) and Wells Fargo & Co. (WFC) leading the way. The previous quarter, expected to be an earnings trough for the S&P 500 Index (SPX), instead delivered 8.7% growth.

Can we get a repeat, with notably better earnings growth this quarter, too? Markets have a history of beating consensus expectations, so if that’s the case this time around, it could bring some much-needed reassurance at a time where volatility has resurfaced.

JPMorgan Chase & Co. (JPM)

Financials are up first, with consensus expectations calling for more than 10% growth. Investors will be paying close attention to this group — and not just because they have a chance to set the tone early. It’s also because this group will provide a read on the state of US consumers, which comes at a critical time with many key economic releases delayed due to the government shutdown.

Earnings helped steady the ship in early April amid heavy volatility, with financials telling a reassuring story about the consumer. Management teams grew even more confident over the summer and investors are now hoping for another positive update.

Beyond the banks, investors will be keeping a close eye on tech — specifically mega-cap tech and Artificial Intelligence (AI)-related names. They’ll want to know if large tech firms are still spending gobs of money on AI infrastructure, and if recent headlines are any indication, the spending cycle is still firing on all cylinders.

Still, with worries of an AI bubble permeating throughout social media, investors want some reassurance that these big capital investments into AI will pay off. Tech carries the highest earnings growth expectations for the quarter at 23.5%, along with the highest expectations for 2026 at about 21%. Investors will want to see this group deliver.

More By This Author:

Are Chip Megadeals Proof Of A Boom Or Bubble?Fifth Third Bancorp: A "Super Regional" Bank In The Making After Comerica Buy

AI: No, This Is Not A Replay Of The Dot-Com Bubble