Key Events In EMEA For The Week Of May 1

Image Source: Pexels

Expect the Czech National Bank to keep rates on hold, while activity data in Hungary points to an ongoing technical recession.

Czech Republic: CNB to keep rates unchanged

The Czech National Bank will likely keep its interest rate unchanged at 7%. The future development of wages and the government's strategy for fiscal consolidation will play a crucial role in any decision to ease monetary policy. We expect the CNB's statement to remain hawkish, stressing the risks associated with the tight labor market, wage growth increases, and deteriorating public finances. On the one hand, CNB can feel more comfortable with the gradual decline of both headline and core inflation. Core inflation has declined gradually from 14.7% in September to 11.5% in March. However, we've still seen hefty growth in industry wages at the beginning of the year, exceeding 10% YoY. The lingering tightness of the labor market was also confirmed by a decline in the unemployment rate of 0.2bp to 3.7% in March.

The other issue is the adverse development of the country's fiscal stance. In March the state budget reached a deficit of CZK166.2bn, which was historically the worst March result, jeopardizing the government's plan for this year of a deficit of CZK295bn. Therefore, we expect the CNB to stay vigilant and follow those trends before looking at rate cuts.

Hungary: Painful retail sales points to continued technical recession

The highlight day in Hungary is Friday when the Statistical Office will release the March industrial production and retail sales data. We expect the industry to remain divided. On one hand, with easing supply chain concerns, we expect a further improvement in the production numbers in car and electronic products, and also in electrical equipment (EV batteries). On the other hand, with domestic demand shrinking at a significant pace, the domestically-focused industrial sectors will continue to suffer. In total, we're expecting 1.3% MoM growth, but on a yearly basis, this will still mark a 3% drop in industrial production volumes.

The really painful story however comes from retail sales. Given the high base in fuel retailing, we're expecting total retail sales volumes to drop by almost 15% on a yearly basis. But even if we exclude fuel sales, we still think we could get a double-digit dip in retailing turnover due to the evaporating purchasing power of households. With that in mind, we can be sure that the technical recession has continued in Hungary during the first quarter of 2023.

Turkey: Inflation to slip further to 46%

Annual inflation continued its downtrend to 50.5% in March, and will likely do the same in April, slipping to 46% (or 4.0% on a monthly basis). This is attributable to large base effects. While the outlook is quite uncertain for the rest of 2023, a Lira adjustment post-election and potential adjustments in wages and administered prices will likely weigh on inflation momentum.

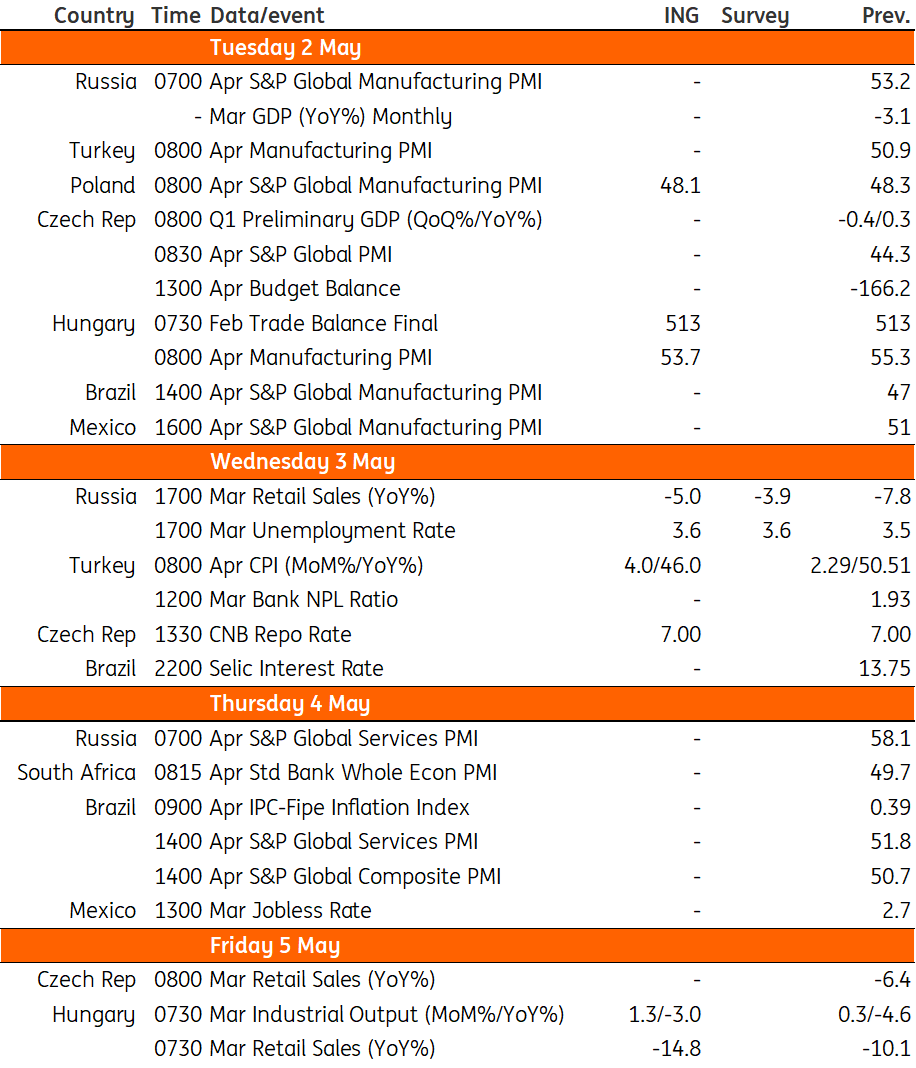

Key events next week

Image Source: Refinitiv, ING

More By This Author:

FX Daily: BoJ Asks Markets For Patience

Turkish Central Bank Keeps Rates On Hold

US GDP Growth Disappoints As Corporate America Comes Under Pressure

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more